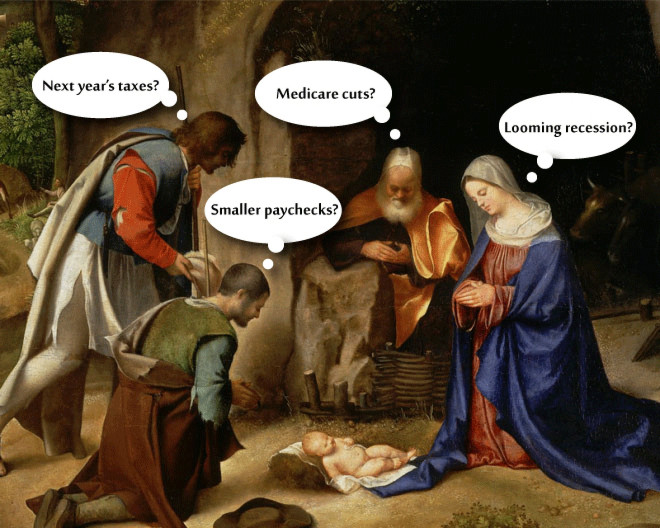

Capitol Hill's Christmas Gift To America: Incompetence In Timely Solving The Fiscal Cliff Crisis

Concern over taxes and spending cuts has been simmering for months.

Members of Congress can enjoy their Christmas break with the certainty that they will be securely employed through next year (except for the handful who got fired in the election). The same cannot be said for the millions of their constituents eagerly waiting, as they have for weeks if not months, for Washington to defuse the time bomb of across-the-board spending cuts and tax increases that they set last year.

“We’re nervous,” David French, a lobbyist for the National Retail Federation, the largest merchant advocacy group in the U.S., told The Hill after House Republicans last week forced their nominal leader, Speaker John Boehner, to drop his "Plan B" that would have prevented tax hikes on all but an estimated 22,000 households that earn more than $1 million a year.

Another source who represents the business community told The Hill there is “incredible frustration” over a “virtually wasted” month of negotiations.

Federal Reserve Chairman Ben Bernanke has already warned Congress of the effects of this lingering uncertainty on the economy. The Congressional Budget Office predicts that failing to reach a deal would send the country back into a recession as it still struggles to climb out from the last one caused by the subprime mortgage meltdown in 2008. The so-called fiscal cliff is the result of last year's Budget Control Act of 2011 that was part of an 11th-hour deal to avert a national default by lifting the debt ceiling crisis. That put off a much-needed reckoning until now.

Rep. Mick Mulvaney, R-S.C., said on CNN Sunday that he opposed Plan B because it wouldn’t have passed anyway. “You cannot negotiate with someone who does not want to negotiate,” he said, referring to President Barack Obama.

Sen. Joseph Lieberman, the independent from Connecticut who is retiring, didn’t help allay concerns when he went on CNN to say he felt like “it’s more likely that we will go off the cliff.”

Lawmakers will reconvene on Capitol Hill on Thursday to try to hammer out a deal in the five remaining days of the year. If they fail, they could still orchestrate a so-called soft-landing off the fiscal cliff, but the uncertainties would linger into the first weeks of the year.

For his part, Senate Budget Committee Chairman Kent Conrad, D-N.D., who is also leaving the Senate in a week, said the two sides are so close that he feels a deal would be reached in days.

“What we ought to do is take Speaker Boehner’s last offer, the president’s last offer, split the difference,” Conrad said Sunday on Fox News.

For months the business community has been preparing contingency measures, which could include layoffs and hiring freezes. Washington’s inability to do its job in a timely manner may have put downward pressure on holiday spending during the most important time of the year for large and small retailers.

The rich, the middle class and the poor are all waiting to see how their incomes will be affected by the possibility of $536 billion in tax increases coupled with $110 billion in spending cuts divided between military and domestic spending in the discretionary budget — the part of the U.S. budget that Congress decides on that excludes Social Security, Medicare and Medicaid.

For example, the 2 percent payroll tax cut set to expire could mean the difference between hourly workers being able to afford the monthly premium deductions to their paychecks for a company health plan. A person earning $30,000 a year, for example, would begin to earn about $50 a month less if Congress does nothing.

For people with income from investments, doing nothing would more than double the capital gains tax as capital gains would be treated like regular income, taxing people differently for the same revenue based on their total wealth.

And, perhaps most important, employers, who – unlike lawmakers – have to plan months in advance to secure their own incomes, are eager to know how to plan for next fiscal year.

© Copyright IBTimes 2024. All rights reserved.