Cardano Technical Analysis: Bears In Control As ADA Makes History By Hitting 1M Staking Wallets

KEY POINTS

- Cardano reached 1 million staking wallets

- In all, the platform has reached 2 million total ADA wallets

- Technical analysis points to sluggish price action for ADA

Cardano, the sixth biggest cryptocurrency in the market, has hit 1 million staking wallets, a historical moment for the smart contracts platform.

The surge in the number of staking wallets has stayed in step with the bearishness that has descended on Cardano, something that investors weren't prepared for as ADA, the utility token of the platform, had steadily risen in the first half of the year. Cardano works on Proof of Stake, unlike Ethereum, which is known for its high gas fees. And Cardano, alongside its rival Solana, supports scalability and is energy efficient, holding out a promise to make blockchain transactions easier and less costly.

But now, an increase in staking wallets could indicate that investors are holding on to their ADA and staking them for returns as they wait out for the bulls to return.

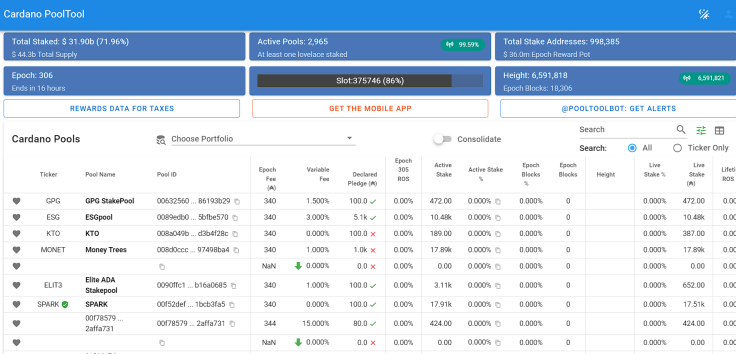

The data from PoolTool.io shows that currently 998,300 wallets are staking their Cardano tokens. This comes at a time when the Cardano Foundation is celebrating hitting the milestone of 2 million ADA wallets.

🎉OVER 2 MILLION ADA WALLETS🥳️

— Cardano Community (@Cardano) November 1, 2021

It wasn't long ago that we were celebrating hitting our 1 million mark and now we hit a whopping 2 million #ada wallets!#Cardano #CardanoCommunity@F_Gregaard @IOHK_Charles @IOHKMedia @InputOutputHK pic.twitter.com/x40pri9tjN

ADA had added an additional 333,726 wallets, up from 608,391 since June when Cardano surpassed 600,000, data from Finbold shows.

Data from CoinMarketCap suggests that as of 12:10 a.m. ET, the market capitalization of Cardano had dropped 1.46% to $45.6 billion. The token had hit an all-time high market cap of above $90 billion in August but is now valued at nearly half that number.

Cardano’s performance in 2021

The monthly chart below shows that Cardano has remained bullish since February. In August, its price jumped — mostly due to the hype over the launch of the Alonzo Testnet. The testnet has three phases through which developers can engage with smart contracts on Cardano for more expanded blockchain functionalities.

The token went parabolic as it made an all-time high at $3.10 in August, following the actual launch of the testnet. It had started that rise from $1.31.

But by September, the price had fallen 23.56%, hitting a monthly low of $1.9. October and November have seen the bears making a stand over Cardano, with the price currently at $1.35. The popularity of the token in the early part of the year and the the launch of the Alonzo testnet have failed to translate into a sustained price rally, which investors were hoping for.

Analyst believes that 2022 will be parabolic

In a recent Medium blog, Lukas Moore, a crypto analyst, forecast Cardano will go parabolic next year. He says Cardano released its smart contracts only in September and it is too soon to expect extremely positive results.

Moore cited Sundaeswap, one of the first DEX platforms on the Cardano blockchain, which is attracting a lot of attention. He said that the problem with these applications is they're "not very user friendly to interact with these projects."

"Because of the hate towards Cardano that it's a ghost chain, I feel like it's one of those things that Cardano is going to bounce back and prove everything wrong," he said. A ghost chain is a blockchain platform worth billions but with limited utility.

Technical analysis: Bears guiding ADA price down

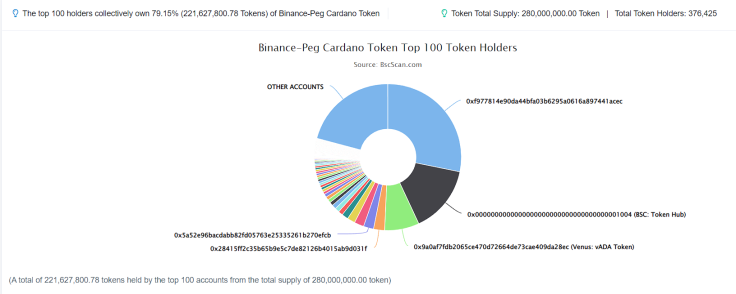

An analysis of the ADA wallets showed that a single whale owns around 28.12% of the tokens in circulation, while another owns nearly 14.8%. A deeper dive into the biggest whale's holding showed that the owner transferred around 1,906,957 ADA from their wallet to the Binance hot wallet. While that could just have been a move to stake those tokens and make money while ADA remains depressed, it could also be a psychological ploy to induce bearishness and selling pressure among other traders and investors.

The daily chart for ADA/USDT (below) shows that the accumulation of ADA is has stayed high since July — an indication possibly that investors expect the price to bounce back. Meanwhile, ADA has seen a downwards trajectory with consecutive red daily candles. While Bitcoin recovered from $42,000 to $48,800 Sunday, Cardano prices continued to fall. In the past 24 hours, Cardano fell from over $1.41 to $1.29 but the token found some support at this level.

The MACD (moving average convergence divergence) indicator is bearish too. The MACD line (blue) continues to progress below the signal line (orange) after a failed attempt to break above the latter few days ago. The histogram shows bright red bars, indicating the sellers are in control. The volumes for ADA have continued to drop, possibly as investors wait out.

The RSI (relative strength index), too, is dropping into the oversold region. The gradient of the RSI line is negative as levels fall below 30. Huge selling pressure is indicated as buyers are unable to overcome the pressure from the sellers — the bears have the bulls subdued.

The 50-day and 100-day Moving Averages continue to trend below the price fractal. These key Moving Averages act as major supports for price movement when they are below the price fractal. But here it seems the opposite is happening with the averages now acting as resistance zones.

Further, the price action broke out from the lower end of the Bollinger Band, which also supports a bearish price analysis for ADA. The continuous procession of bearish candles suggests that a retracement towards lower levels is certainly probable.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Parth Dubey holds Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Cardano (ADA) and Polygon (MATIC).

© Copyright IBTimes 2024. All rights reserved.