Chevron Shareholders Ask SEC To Investigate Company Disclosures On $18B Ecuador Judgment

A group of Chevron Corp. shareholders is asking the Securities and Exchange Commission to investigate claims the oil major is not fully disclosing the effects of a multibillion-dollar environmental case in Ecuador on the company and its numerous stakeholders.

Led by a religious group, the Unitarian Universalist Association of Congregations, the letter filed last week contends Chevron is violating SEC disclosure laws in what appears to be an extensive coverup of the risks faced by the company regarding this litigation, read the letter.

Timothy Brennan, the treasurer and chief financial officer for the Unitarian association, signed two letters, one to J. Bradley Bennet, the executive vice president of enforcement with the Financial Industry Regulatory Authority, and another to Mary Schapiro, chairwoman of the SEC.

Both letters cite a report by Graham Erion, a securities lawyer licensed in Ontario and New York, comissioned by the Ecuadorean plaintiffs, that suggests Chevron is not disclosing the material impact the Ecuador judgement would have on the company throughout the world.

Chevron said its filings have been thorough and appropriate.

The report suggests Chevron is deliberately not disclosing the range of possible financial losses it could sustain, is selectively releasing court rulings and repeatedly misrepresents the merits of the case against the company. It characterizes the decade-long seesaw court battle as fraud.

It's important to see this report in a context -- Chevron has been repeating the same things in the past three years, stuck to the same disclosure based on their legal theory of the case, said Erion. You can't do that. Investors need to get much more unbiased information on what is happening.

Erion said he suspects the company's stock price does not reflect risks, because its shareholders and investors are as yet unaware of how badly it could get hit if the judgement is ruled enforceable internationally.

It's unfortunate that the Unitarian Universalist Association has fallen victim to the deceit of the plaintiffs' lawyers, said Chevron spokesman Justin Higgs. The biased report that is the basis for this unfounded request was prepared by one of the plaintiffs' lawyers himself as part of yet another baseless attempt to target stockholders and regulators to apply pressure on Chevron and extort a settlement from the company.

In a separate court proceeding, the Southern District of New York, presided over by Judge Lewis Kaplan, upheld on Monday Chevron's racketeering complaint against Ecuadorean defendants, opening the possibility that Chevron and its lawyer may win civil damages.

The order upholds Chevron's long-held stance that the Ecuadorean defendants are executing a multifaceted, extortionate scheme, as the company said in a statement late Monday. The judge's order also denied Chevron's request that its assets be attached to the court, a move the company hoped would insulate it from enforcement of the $18 billion judgment against it in Ecuador.

The SEC, which typically does not comment on requests for investigations, would neither confirm nor deny that a letter was received or that the commission is following through with an investigation.

Erion said the SEC could take several months to make a determination.

Bruce Herbert, chief executive of Newground Social Investment, a Seattle investment house and one of those requesting the SEC action on behalf of a handful of shareholders, said he is unsure if the regulator will take up the case.

Larry Dohrs, Newground's vice president, said he would like to see Chevron's management change their behavior and uphold the legal obligation to reveal the company's liabilities.

If this appeal can focus more on the facts of the situation, shareholders could be on the hook for a substantial sum of money, Dohrs said.

Herbert said Chevron could be liable for additional fines if found in violation of SEC rules, but any sum would be minor when compared to the $18 billion at stake in Ecuador.

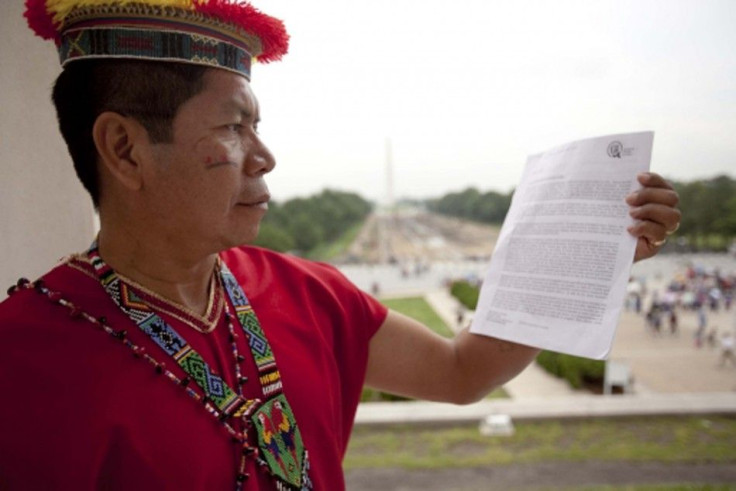

In February of 2011, an Ecuadorean judge ruled Chevron was guilty of polluting tracts of the country's Amazon jungle to the detriment of thousands of aboriginal villagers.

As repayment, Chevron was faced with an $18 billion fine, which the company calls illegitimate, and the product of malicious intent.

Ecuadorean prosecutors have said they intend to enforce the judgement by seizing Chevron assets including tanker ships throughout the world. Chevron has been fighting the accusations for the greater part of a decade following Texaco's -- now owned by Chevron -- operations in the country.

In Monday trading, Chevron shares fell 75 cents to $101.95 a share.

© Copyright IBTimes 2024. All rights reserved.