Chevron's Shale Drilling Keeps Driving Its Bottom Line

Typically, keeping track of all the major capital projects an integrated oil and gas company has going all at once is close to impossible. That has been less and less the case at Chevron (NYSE:CVX), as its development portfolio has become more and more concentrated on shale drilling in the Permian Basin. So far, it's been a rather successful strategy, as it has significantly increased the company's earnings and cash flow, even though fourth-quarter oil prices were on the decline throughout the quarter.

Let's look at what happened at Chevron this past quarter and what investors should make of this seemingly all-in-on-shale strategy.

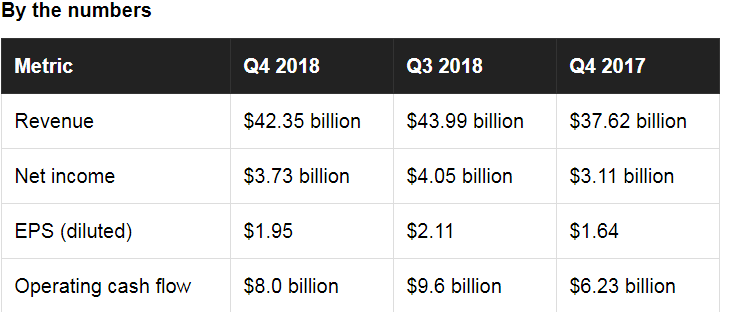

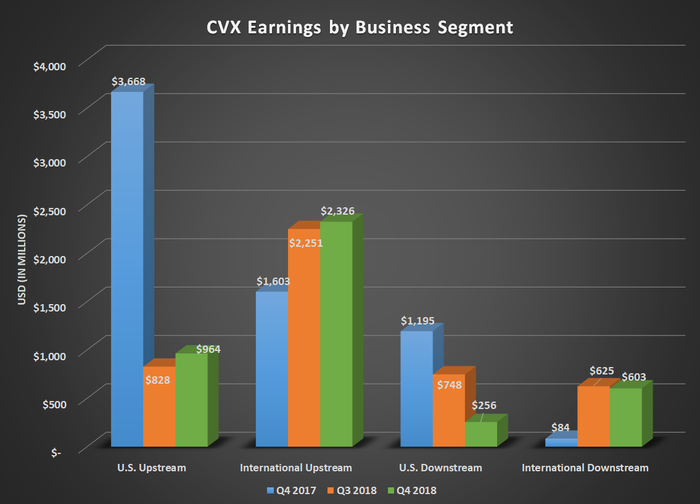

There's no other way to describe Chevron's recent earnings than solid and consistent. The company has been doing a lot of the same things over the past year to grow production and earnings at a steady rate. This past quarter, it was able to grow earnings from its upstream production largely from higher natural gas prices, especially in its international upstream business.

It's also worth pointing out that Chevron realized some large one-time tax benefits this time last year related to changes in corporate tax rates. Those gains of $3.33 billion and $1.16 billion for U.S. upstream and U.S. downstream, respectively, make the year-over-year comparisons look off.

The highlights

- Chevron's production for the quarter was 3.08 million barrels per day, which was 12.4% higher than this time last year and led to full-year production growth of 7%. For a company as large as Chevron, that's a remarkable result. Management noted that the largest drivers of those gains were continued ramp at its Wheatstone liquefied natural gas facility and growth in Permian shale.

- As has been the case every quarter for several years, Chevron's growth in the Permian Basin continues to exceed management's expectations. Fourth-quarter production was up 84% from last year and stands at 377,000 barrels of oil equivalent per day. The company is now more than one year ahead of guidance it gave earlier this year.

- Chevron announced days before its earnings announcement that it has acquired Petrobras' refinery in Pasadena, Texas, for $350 million. The 110,000 barrel-per-day refinery will help the company process more of its bountiful supply of crude coming out of the Permian Basin and allow it to extract more value from each molecule.

- Management also issued early guidance for 2019. It expects to grow production by 4%-7%, not including any potential asset sales, and anticipates spending $20 billion. More than a quarter of that spending will go toward shale development.

What management had to say

One of the issues Chevron ran into from 2014 to 2017 was that it had several large-scale projects under development that took several years to become productive assets. There was a time when it had tens of billions tied up in working capital for its Gorgon and Wheatstone LNG facilities.

Since then, management has focused more of its spending on shorter development cycle projects, like shale. According to CEO Michael Wirth, the company is dedicating the lion's share of its capital spending to these shorter cycle projects:

Total C&E [capital & exploration] in 2018 was $20.1 billion. This included approximately $600 million of inorganic spend for which we don't budget, primarily related to bonus payments for offshore leases in Brazil and the Gulf of Mexico. The stacked bar depicts our organic C&E budget for 2019 of $20 billion.

Within this budget, the cash component is $13.7 billion, while the remaining $6.3 billion is expenditures by affiliates, primarily TCO [the Tengizchevroil oil field in Kazakhstan] and CPChem [ChevronPhillips Chemical].

In the 2019 budget, $3.6 billion was allocated to the Permian and another $1.6 billion is allocated to other shale and tight assets. We expect approximately 70% of our total 2019 spend to deliver cash within two years. Our current spend profile has significantly lower execution risk relative to the past.

You can read a full transcript of Chevron's conference call.

More of the same

Chevron's earnings reports and business plans have been incredibly straightforward lately. The primary focus has been to maintain its dividend by cutting costs and getting the most out of its smaller suite of development projects. So far, it's been working, as management has been able to generate enough cash to cover its dividend obligations, pay down debt, and even buy back shares.

Based on the company's suite of major capital projects in the wings, it looks as if investors can expect more of the same in 2019. Growth will probably come from its shale drilling in the Permian, getting Wheatstone LNG up to full capacity, and getting first oil from its Big Foot offshore platform. Beyond that, the next major capital project isn't slated to have first oil until 2021.

Overall, Chevron has reported solid earnings and a plan that's generating cash to do what it wants right now. The question is how much longer it can sustain itself on this current track without investing in other growth projects. The answer to that is likely to come during its next security analyst meeting in March.

This article originally appeared in the Motley Fool.

Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.