China Bans Some New Coal Power Plants, Spelling More Bad News For A Troubled Industry

The long-suffering global coal industry just got another dose of bad news. China’s government this week said it is banning construction of new coal-fired power plants in areas with surplus power supplies.

Declining domestic demand for Chinese coal could lead to higher exports of coal from the country, further expanding the glut of global coal supplies and weighing on already depressed prices. The downturn has battered major U.S. coal-mining companies such as Peabody Energy Corp. and Arch Coal Inc., which both recently filed for bankruptcy protection.

“If China tightens coal-fired thermal power plants then this will significantly lead to a decline in coal-demand growth,” Miao Tian, an energy analyst at North Square Blue Oak investment bank in Beijing, told The Wall Street Journal.

China’s National Development and Reform Commission, the country’s top economic planner, issued the partial coal plant ban Monday. The central government has previously said it aimed to curb excess power capacity — part of a broader effort to address oversupply in the Chinese economy, which has widened as China’s industrial demand has weakened. But the NRDC communiqué is the clearest signal yet that Beijing won’t accept new coal capacity in areas with an overabundance of supplies, the Journal noted.

The commission also said that in regions that face a shortage of electricity supplies, the government will prioritize renewable energy projects such as solar and wind farms, and develop energy transmission networks across provincial borders. Chinese officials last week vowed to lead the world on green energy development during a signing ceremony for the Paris climate change agreement in New York.

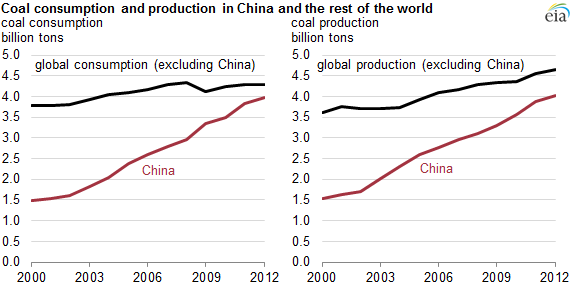

In China, the world’s biggest coal consumer and producer, coal-fired power plants still account for about two-thirds of the country's primary energy consumption. But the shift away from new plants offers further proof that Asia’s largest economy is no longer the boon that U.S. and global coal companies once sought.

As China’s economy has ramped up in recent years, mining companies have invested heavily to acquire mines and build new operations to supply power plants and steel mills in China. Peabody, Arch and their competitors had bet that China’s growing appetite for coal could offset the sluggish U.S. market, where tougher pollution limits, concerns about climate change and more-efficient, cleaner energy supplies have dampened demand for high-carbon coal.

But the influx of coal supplies served only to weigh down prices, making it harder for miners to get the cash to cover their multibillion-dollar debt obligations. Peabody Energy filed for Chapter 11 bankruptcy protection two weeks ago as it struggled to service debt worth $10.1 billion, marking a critical new low for the U.S. coal industry.

In China, coal demand is on track to grow about 2 percent annually over the next five years and reach about 4.3 billion metric tons by 2020, according to China National Coal Association data cited by the Journal. By contrast, annual coal demand grew about 9 percent on average from 2000 to 2010. During that decade, China began to consume nearly as much coal as the rest of the world combined, U.S. energy data show.

© Copyright IBTimes 2024. All rights reserved.