China’s Yuan Internationalization: Africa Eyeing Dim Sum Bond Market

China’s currency -- the yuan or renminbi (RMB) -- hit a 19-year high against the U.S. dollar last week. An appreciating currency should breathe new life into China’s offshore “dim sum” bond market after a surprisingly subdued 2012. Africa, among other countries, is developing an appetite for the CNY-denominated securities nicknamed after Hong Kong’s favorite dining pastime.

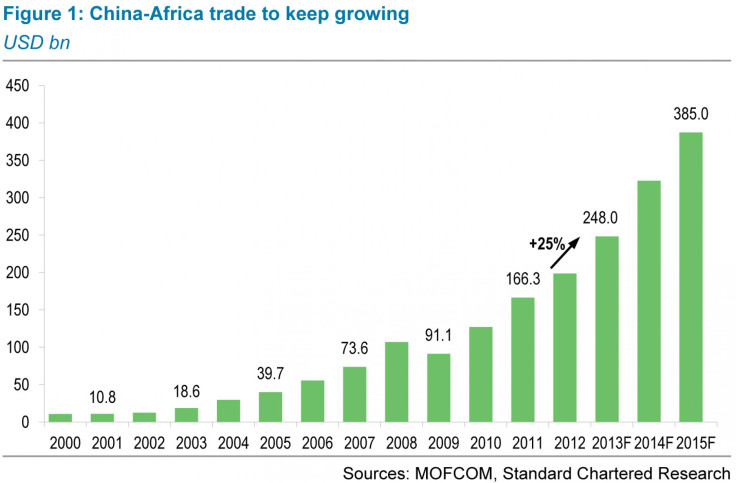

Trade between China and Africa reached another new high last year of $198.5 billion, a 19.8 percent increase on trade of $166.3 billion recorded in 2011, according to the Ministry of Commerce. Standard Chartered expects China-Africa bilateral trade volume to hit $325 billion by 2015, which provides a strong foundation for growth in yuan trade settlement.

Over the past 15 years, growth in trade between China and Africa has increased faster than China’s trade with the rest of the world. China is Africa’s largest trading partner, so it makes sense for African governments and companies to hold assets denominated in yuan.

According to Standard Chartered analyst Sarah Baynton-Glen, African demand for Chinese capital goods and manufactured exports will be driven by investment in infrastructure, oil and gas exploration, and growing consumption demand. Meanwhile, Chinese policy banks’ ongoing investment in Africa, with numerous infrastructure- and resource-related projects already under way or in the pipeline, will provide underlying momentum for further bilateral trade growth.

“Given these trade trends, ever-closer diplomatic and financial links with China, and a drive by Chinese policy banks to increase use of the yuan in Africa, we believe that yuan trade settlement will likely increase significantly from current levels,” Baynton-Glen said in a note to clients.

Yuan Trade Settlement

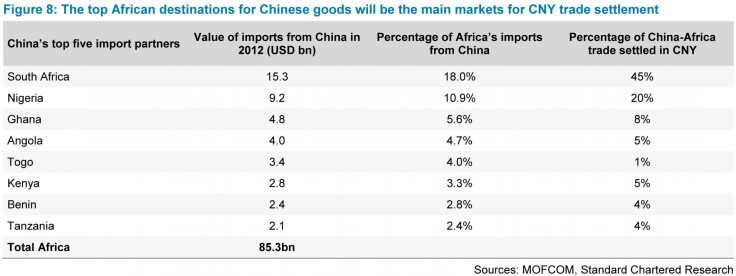

In 2010, only 3 percent of China's foreign trade was settled in yuan. By last year that had risen to more than 15 percent. The Chinese currency was ranked 13th among all global currencies in terms of popularity. However, the use of yuan in Africa is still small. Last year, yuan settlements accounted for just 0.5 percent, or $1 billion, of trade transactions between China and Africa. But with the huge trade base, yuan settlement can be easily boosted. Standard Chartered forecast that yuan trade settlement volume in Africa will reach $38.5 billion by 2015 -- or 10 percent of projected China-Africa trade in 2015.

According to Standard Chartered, the geographical scope of the use of the yuan offshore in Africa is expanding gradually. Data from SWIFT in January on the value of yuan payments between Africa and China and Hong Kong shows that yuan-denominated SWIFT payments were made between China and 18 African countries. In 2012, this stood at 16 countries, up from just five in 2010. Nonetheless, South Africa remains the main market.

Dim Sum Bond

As the use of the yuan as a trade-settlement currency becomes more widespread, more African central banks are likely to look to diversify their foreign exchange reserves to include the yuan.

Nigeria said in 2011 it would start to hold yuan in its central bank reserves, and Standard Chartered analysts said that Nigeria and Tanzania’s central banks each bought 500 million yuan of a 3.5 billion yuan dim sum bond launched by China Development Bank last July.

Angola has also invested in dim sum bonds, while Kenya and Ghana have shown an interest in holding yuan in their reserves. Then there’s South Africa. The country’s central bank will be able to invest up to $1.5 billion in dim sum bonds, following an announcement at the BRICS summit in Durban last month. China is South Africa’s biggest buyer of raw materials and its largest trading partner, purchasing 13 percent of the country’s exports.

Li Dongrong, vice governor of the People's Bank of China, optimistically suggested in 2012 that in five years 20 percent of African central banks’ foreign reserve portfolios would be in yuan.

The offering of yuan-denominated debt, first by South Africa and potentially Nigeria, and then other higher-rated African sovereigns, could be the next development in the yuan market in Africa, according to Standard Chartered. Appetite for bonds issued by smaller, less-liquid African economies is likely to be lower.

“For African issuers looking to finance capital expenditure plans, issuing bonds denominated in the yuan provides access to a new investor base, enables expansion of existing financing channels, and offers a lower cost of financing than do bonds available from other international capital markets,” Baynton-Glen said.

© Copyright IBTimes 2024. All rights reserved.