Will The Chinese Yuan Replace The US Dollar As The Global Reserve Currency?

As China moves up the economic pecking order, it has been trying to promote the yuan as an alternative to the U.S. dollar, which has been the dominant global reserve currency since the 1944 Bretton Woods conference.

Currently, China represents around 11 percent of global gross domestic product, more than 10 percent of world trade and nearly 9 percent of total foreign direct investment.

It is interesting to note that, of the currencies of the world’s six largest economies, China’s yuan is the only one that is not a reserve currency.

China's economy is also on the path of surpassing that of the U.S. in less than two decades, according to projections made in a recent report issued by the U.S. National Intelligence Council.

“The Chinese yuan is clearly on the path towards becoming a global trade currency, but the country's closed capital account prevents it from becoming a reserve currency,” said Karl Schamotta, a senior market strategist at Western Union Business Solutions based in Calgary, Canada.

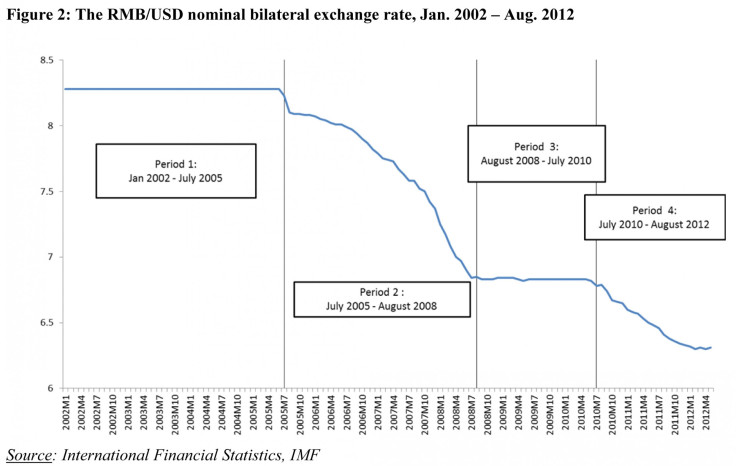

Despite criticisms of Beijing's interventions in currency markets, it is clear that China is laying foundations for wider acceptance of the yuan.

The numbers tell the story. Today, more than 10,000 financial institutions are doing business in Chinese yuan, up from 900 in June 2011. The pool of offshore yuan, non-existent three years ago, is now near 900 billion ($143 billion). And the proportion of China’s exports and imports settled in yuan has increased nearly sixfold in three years to nearly 12 percent.

It is clear that more and more foreign enterprises that import goods from China choose to pay in yuan, especially those in the emerging markets.

The G3 – the EU, U.S. and Japan – have been China’s top trade partners for the past decade. But the emerging market share of China’s trade flows is rising steadily in line with changes in the global economic landscape.

China is the main driver of intra-Asian trade; its imports and exports with ASEAN countries expanded 10.2 percent year-over-year in 2012, outpacing the 6.2 percent growth in China’s overall trade. As a result the ASEAN economies overtook Japan to become China’s No. 3 trade partner in 2012.

The yuan has surpassed the Russian ruble and Danish krone to become the world's 13th most-used currency for international payments, the Society for Worldwide Interbank Financial Telecommunication said last month.

According to Eswar Prasad and Lei (Sandy) Ye, authors of “The Yuan’s Role in the Global Monetary System,” there are three degrees of yuan internationalization.

First, China and its major trading partners transact in yuan; this has been happening since 2009.

According to HSBC, a third of China’s total trade will be settled in yuan by 2015, making it one of the top-three global trade settlement currencies by volume.

The next step is for parties undertaking transactions unrelated to China to use the yuan regularly.

Outward yuan foreign direct investment surged 50 percent last year, implying that international acceptance of the currency has already started to extend from trade settlement to investment.

Analysts say they expect the use of yuan in cross-border trade settlement and investment payments to accelerate following Beijing’s recent moves, including the appointment of banks in Singapore and Taiwan to clear yuan-denominated trades, and allowing companies registered in the Qianhai Bay economic zone in Shenzhen to borrow yuan from Hong Kong banks.

In mainland China, the yuan is tightly controlled and can only trade 1 percent above or below the guidance set by the central bank every day. By contrast, Hong Kong is the leading offshore center where the yuan is traded freely.

Meanwhile, Standard Chartered said an index it has created to gauge global offshore use of the yuan in January recorded an 8.2 percent rise from December -- the fastest monthly gain since the end of 2011.

“To become a global currency requires full convertibility,” HSBC economists Qu Hongbin, Sun Junwei, Paul Mackel and Wang Ju wrote in a research report. “Although this will be done gradually, Beijing policy makers are now more confident than ever about speeding up the process.”

HSBC economists forecast that China’s yuan will become fully convertible within five years as the authorities seek to promote global use of the currency.

For the currency to take the final step and become a global reserve currency, central banks around the world would have to maintain sizable holdings of yuan as protection against balance of payments crises. In other words, the yuan would become a so-called safe-haven currency.

Empirical research has suggested that each 1 percentage point increase of GDP as a share of the world total (measured at actual exchange rate) leads to a 0.55 percentage point rise in central bank reserve holdings in the corresponding currency. Assuming the share of Chinese GDP to world GDP (at current prices and actual exchange rates) rises by 10 percent (taking into account the likely appreciation of the yuan) over the next 10 years, this would suggest at least a 5.5 percentage point increase in central banks’ yuan holdings.

Hence, as long as China’s GDP growth stays above global growth, central bank reserves should increase their share of yuan holdings, eventually making it an important reserve currency.

That said, that day is still “a long way off,” Schamotta said.

© Copyright IBTimes 2024. All rights reserved.