Column-Fed's Inflation Target Ambiguity Risks Market Misstep: McGeever

It may just boil down to semantics, and in good times when inflation is low it's not an issue at all. But the Fed has a communication problem.

Inflation's surge to the highest level in 40 years has shone a light on what exactly the Federal Reserve's inflation goal is, how policymakers go about achieving it, and how they get their message across to the public and financial markets.

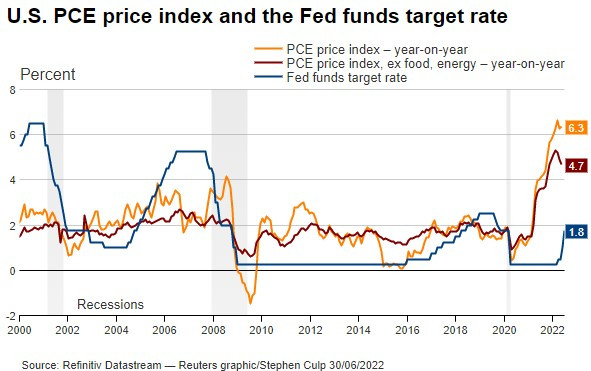

Figures on Thursday showed that U.S. inflation, as measured by the annual rate of increase in the personal consumption expenditures (PCE) index, held steady in May at 6.3%. Excluding food and energy prices, the 'core' PCE rate of inflation fell to 4.7%.

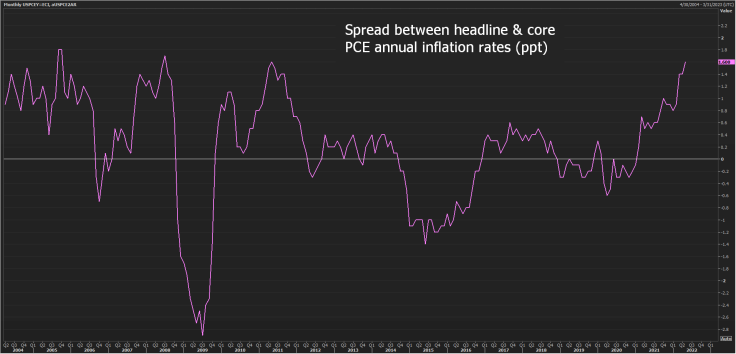

The headline rate of PCE inflation, including food and energy prices, is now 1.6 percentage points higher than core, which strips out these more volatile inputs.

That's the widest spread in 11 years, a result of soaring energy, food and commodity prices. The spread between the two mattered less after the financial crisis when the Fed's battle was against deflation and headline often undershot core.

U.S. PCE inflation - core v headline

But with headline now so much higher than core, it does matter. The Fed's inflation target is 2% headline PCE, but policymakers also look very closely at the behavior of core.

Apart from the pain on Main Street and potential political problems ahead of the mid-term elections, the divergence makes it more difficult for the Fed to effectively communicate its thinking and strategy to the public and markets alike.

For investors, this raises the risk of misreading the Fed and mispricing its reaction function, potentially triggering a wave of distortion and volatility across markets.

"It's a concern, because the market may be underestimating the likelihood of further, more aggressive rate moves by the Fed," said Willem Buiter, a former Bank of England rate-setter.

Before 2012, it was accepted that the Fed focused on core inflation. The 2% goal was unscientifically chosen by the Alan Greenspan Fed in the mid-1990s, and core PCE quickly became the favored measure.

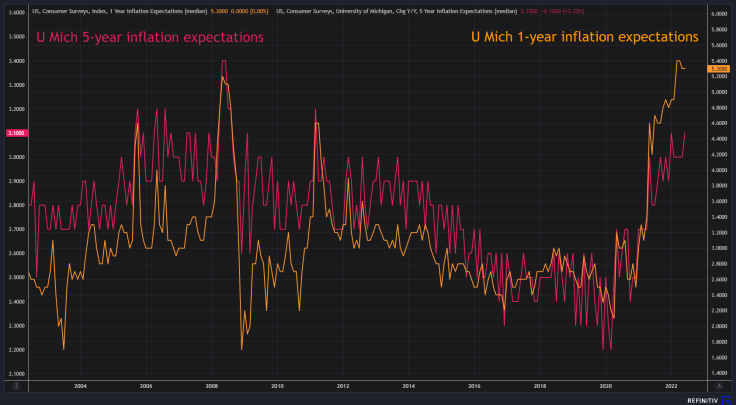

There are good reasons to target core inflation: monetary policy has little influence over food or energy prices; core is often seen as a good guide for where headline is headed; and it makes more sense in the event of energy or supply shocks, assuming inflation expectations remain anchored.

The Bureau of Economic Analysis says on its website that core PCE "is closely watched by the Federal Reserve as it conducts monetary policy." Former Fed Chair Ben Bernanke said in an interview with Marketplace in May that core "is the inflation rate that they (policymakers) target at 2%."

The reasoning here is that any pass-through to core inflation from energy or supply shocks is usually short-lived, and core is generally seen as the best predictor of the medium-term trend. In this sense, the Fed can simultaneously target headline while focus on core.

U.S. PCE inflation & fed funds rate

"I CAN'T EAT AN I-PAD"

Since January 2012, the Fed's policy-setting Federal Open Market Committee's explicit longer-run annual inflation goal has been 2% "as measured by the annual change in the price index for personal consumption expenditures."

The inflation environment in 2012 was very different. Core and headline rates were more closely aligned - indeed, headline was to fall significantly below core for much of 2015 and 2016.

Headline PCE is also clearly shown as the Fed's long-run inflation goal in its Summary of Economic Projections tables.

This makes sense, too. Headline inflation is what most people experience and focus on, particularly the poorer in society, who spend a greater share of their income on food and energy. And prices are sharply higher across the board now.

Policymakers will be keen to avoid the criticism directed toward then-New York Fed President William Dudley in 2011, when he told an audience in New York that while food and energy prices were rising, the cost of other goods, such as iPads, was falling.

"I can't eat an iPad," shot back one audience member.

David Wessel at the Brookings Institution says that as long as both headline and core inflation are too high and moving in the wrong direction, the public and markets should expect the Fed to tighten policy further.

"It will get interesting when one of them is falling back towards target and one isn't. They will have to make a judgment," he said.

The Fed has raised its federal funds target range by 150 basis points so far this year to 1.50%-1.75%. Futures markets are pricing in further increases to around 3.50% by early next year, and Cleveland Fed President Loretta Mester on Wednesday said rates could ultimately top 4%.

Although U.S. recession risks are rising rapidly - 88% of respondents in a Deutsche Bank client poll said there will be one within 18 months - the Fed seems squarely focused on bringing inflation down. Ideally, both core and headline.

U.S. inflation expectations - U Mich surveys

Related columns:

- Rate blitz a reminder the Fed doesn't target GDP (June 21)

- Fed shredding 'forward guidance' - for good or ill (June 15)

- Fed may face yield curve, recession 'mea culpa' (June 2)

(The opinions expressed here are those of the author, a columnist for Reuters.)

(By Jamie McGeever)

© Copyright Thomson Reuters 2024. All rights reserved.