Merrill Lynch Stories

China sees growth risk, not inflation, in oil surge

Soaring oil prices will have little impact on Chinese consumer inflation, but will place considerable cost pressure on the country's manufacturers, a government adviser and ministry official said on Thursday.

Analysis: Glimmer of G20 hope as China adjustment takes shape

It's too early to be sure, but signs that China's current account surplus will keep shrinking as a share of national output could draw some of the venom from the debate on global economic imbalances preoccupying the G20.

BofA Merill hires top guns to represent its legal interests

Bank of America (BofA) has selected a battery of top-end law firms to represent their legal interests but being on the legal panel comes at a price.

China inflation data adds to tightening case

Chinese inflation hit a lower-than-forecast 4.9 percent in January, but price pressures excluding food were their strongest in at least a decade and will force the central bank to keep tightening monetary policy.

Australia's Newcrest H1 profit jumps, appoints new chief

Newcrest Mining , Australia's top gold miner, almost doubled underlying first-half profits on Friday due to higher gold production, beating some forecasts, and appointed a new chief executive.

Rising Gold Beaten by Silver Prices Again as Wheat Jumps, Bond Investors Fear Inflation

Gold rose back towards yesterday's 3-week peaks in London on Wednesday, pushing higher against all major currencies as world stock markets slipped.

China Raises Interest Rates, Very Loose Policy Risks Exponential Food Inflation

This is a world obsessed with demand...[and] many central banks' policy settings are very, very loose...making for serious inflationary pressures, UBS said. The outlook for food prices is that they could rise exponentially from here if we were to see another shock. There's no buffer right now.

Consumer spending rises 0.7 percent in Dec

U.S. consumer spending rose more than expected in December to post the sixth straight month of gains as households drew down on their savings to fund purchases, government data showed on Monday.

Merill Lynch settles prop trading charges for $10 mln

Bank of America Corp's Merrill Lynch unit has agreed to pay $10 million as part of a settlement with the U.S. Securities and Exchange Commission (SEC) that has accused it of fraudulently misusing customer orders so it could trade for its own benefit.

Gold steadies ahead of Fed as haven buying wanes

The main gold exchange-traded fund, the SPDR Gold Trust, recorded its biggest ever one-day outflow on Tuesday. The precious metal is taking some support from physical demand after its slide to its lowest since October 28, but buying interest remains lackluster.

Inquiry board cites usual suspects as culprits behind 2008 financial collapse

Both Bush and Clinton Adminstrations were at fault, as well as former Fed Chairman Alan Greenspan and current Treasury Secretary Timothy Geithner, as well as former Treasury chief Henry Paulson, says inquiry

Russia’s central bank will increase gold reserves by over 100 tons every year

The Gold reserves of the Russian central bank grew by 280 tons over the last 2 years. And the bank will continue with a similar speed by buying at least 100 tons every year, deputy chairman Georgy Luntovsky told reporters now.

Analysis: Be careful what you wish for: the China Price starts

Call it the price of success. China is starting to pass on the rising cost of labor and other manufacturing inputs as it restructures its economy, creating a potential new inflation headache for Western countries already grappling with surging commodity prices.

IFR-Evergrande's massive offshore yuan bond pushes boundaries

PRC property developer Evergrande Real Estate Group made history last week with a Rmb9.25bn (US$1.4bn) synthetic renminbi bond - the biggest to date in the fast-growing market.

HK stocks seen higher after HSBC-led breakout

Hong Kong stocks are likely to rise further on Thursday with traders expecting momentum to continue after the benchmark convincingly broke through short-term chart resistance on high volumes.

Sizing up the economic impact of Australian floods

The devastating floods that have inundated Queensland may significantly reduce Australia’s overall economic growth this year, according to an array of economists and analysts.

Interview: Baird CEO Paul Purcell on running a private financial services firm

Robert W. Baird & Co. CEO Paul Purcell speaks to IBTimes about his firm's performance during the financial crisis, navigating the financial services industry after the crisis, and the advantages of being a privately-held financial services firm.

Rising demand should push up crude oil prices in 2011

Many investment banks and commodity analysts have taken a highly bullish stance on crude oil prices for 2011, based largely on economic recovery in the U.S., continued money-printing by the Federal Reserve (thereby, weakening U.S. dollar) and persistent high demand from the emerging markets, particularly China and India.

Top Ten Predictions for U.S. Economy/Markets in 2011

Top Ten Predictions for U.S. Economy/Markets in 2011. These predictions come from Michael Yoshikami, president and chief investment strategist of YCMNET Advisors Inc. in Walnut Creek, Cal.

Allstate sues BofA, Countrywide for $700 mln over toxic securities

Allstate Corp., the largest publicly traded U.S. home and auto insurer, has accused Bank of America (BofA) and its lending unit, Countrywide Financial, of misrepresenting the risk associated with mortgage-backed securities it bought from them beginning 2005, and is suing them for more than $700 million.

Germany running out of patience with weaker euro nations

Although some progress appears to be being made in the euro zone sovereign debt crisis – including the passage of an austerity budget by the Greek Parliament today and a capital injection into Allied Irish Bank (NYSE: AIB) – the most important member of the euro currency bloc, Germany, is unlikely to foot the total bill that will be required to truly resolve this issue.

Investors moving to U.S. stocks as European woes grow: BoAML survey

Investors are increasingly attracted to U.S. stocks as the fiscal/sovereign debt crisis in the euro zone deepens, according to a fund manager survey by Bank of America-Merrill Lynch (BoAML)

Bush tax cut extensions likely to help small businesses; impact on stocks unclear

Longer-term, the potential impact of the tax cuts upon the stock market and economy remain rather fuzzy, given the multitude of other issues facing investors, including perpetually high unemployment in the U.S., a seemingly never-ending sovereign debt crisis in Europe and constant friction with China over trade and currency.

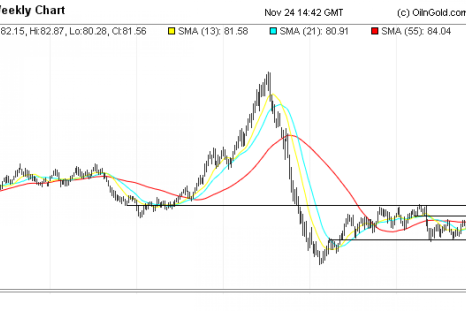

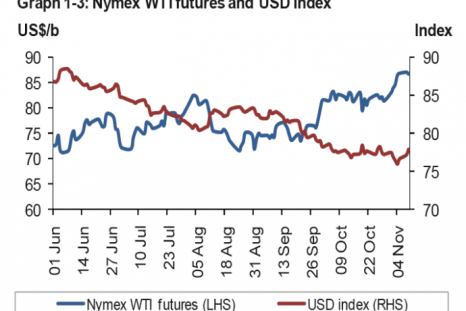

CRUDE OIL- Strategy more fundamental than technical

Performance of the US dollar, Europe's periphery issues, inflation in developing world, consumption by developed ones, and of late, tensions in Korean peninsula- a lot of things are weighing on oil. The net result in recent weeks was positive for the greenback and therefore negative for oil. Still, the commodity is set to end this week with a positive note despite losing more than a dollar from its intra-week high by Friday. So, what is the trend? Where is oil heading?

OIL OUTLOOK: How long will it stay ranged? Will it rise above $100?

Dollar, Korea, Ireland, Asian demand, inventories and technicals - a lot of things are weighing on oil now. But market participants find the question if the commodity has reached its bottom technically and on robust demand in some regions, or will a dollar rally or geopolitical developments force it break below the current range, tough to answer.

ECM deals total $23.3 billion last week: Dealogic

Equity capital market transactions totaled $23.3 billion last week, with 59 deals in the Asia Pacific region in the last week, a report by Dealogic said.

Copper rallies to fresh highs on buoyant China, drop in supplies

Copper hit record highs in London and jumped to a 30-month high in New York on Thursday as strong Chinese data suggested higher demand for the metal by the world's biggest consumer.

Continous money printing will drive gold ever higher: An Interview with Mr. Rose, CEO of Capital Gold Group

With our debt coming to maturity in the next ten years, which we cannot afford to pay, printing money seems to be our only option, which we feel is going to spur inflation, if not hyperinflation. We also feel if we adjusted gold for the inflationary highs of the 80's, gold bullion should already be at $2,200 an ounce, so we feel very strongly about a further drive up in gold over the next five years.

Europe banks say stress tests positive

Over one-third of investors expect Europe's banks to raise significant capital in the next six months following a health check that forced little fundraising but showed up some weak spots, according to a survey.

Europe banks seen raising significant capital: survey

Almost two-thirds of investors expect Europe's banks to raise significant capital in the next year following a health check that forced little fundraising but showed up some weak spots, according to a survey.