CRUDE OIL- Strategy more fundamental than technical

Performance of the US dollar, Europe's periphery issues, inflation in developing world, consumption by developed ones, and of late, tensions in Korean peninsula- a lot of things are weighing on oil. The net result in recent weeks was positive for the greenback, which has risen to a 2-month high versus majors, and therefore negative for oil. Still, the commodity is set to end this week with a positive note despite losing more than a dollar from its intra-week high by Friday. So, what is the trend? Where is oil heading?

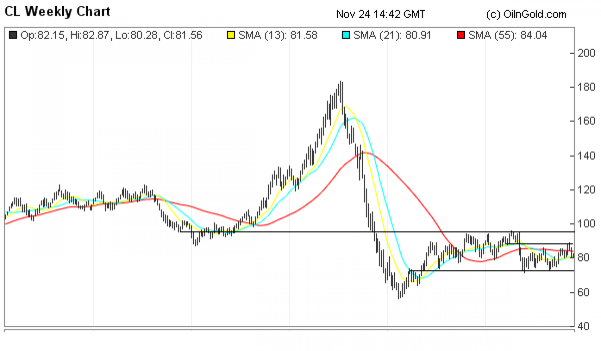

Charts show that US crude for December delivery has been broadly supported just under $80 a barrel since early last year, and some analysts believe that the commodity is now set to break above an intermediate range of $80-$85 and march towards $90. (See image-1) They are also hopeful to see many parts of the world maintaining good growth despite the cooling efforts by authorities and developed world continuing their accommodative policy stance for quite some time, and concludes oil reaching $100 level by next year is not impossible.

Yes, oil's reluctance to fall freely matching gains by the dollar in the forex market point to investor's concerns over the fundamentals of the US economy. But it is also difficult to predict good time for the commodity only based on continued stimuli in many major developed countries, as most of them are also preparing grounds for more aggressive anti-inflation action, especially China.

How long can Europe and Korea help dollar rally?

This question is more important because the dollar's perceived safe-haven status is being questioned more than ever. The relative gains greenback is making against the single currency are based on the conviction that many of the Union's members are losing fiscal strength day by day.

As long as there is no clarity as to how big a burden the European Union is bearing, the buck will stay supported. If China allows its currency to appreciate, you can hope the US exporters will earn some extra dollars for the economy and help narrow the nation's trade gap, providing the currency with some fundamental support as well.

Dollar was buying 6.6400 Chinese yuan in the 6-month non-deliverable forwards (NDF) market at about 12:50 GMT on Friday, 0.4 percent more than the spot quote. A Reuters story from Hong Kong said the NDF market is more liquid with more players entering it with a bullish outlook for the Chinese currency.

That said, everyone is also aware that the dollar will easily lose its ground once a weak economic data or some dovish comments by a policy maker brings the QE3 talk back to table.

Fed's growth view

A group of US policymakers have shared a growth outlook for the world's largest economy this week- a view likely to remain relevant for a longer period and prevent sharper gains in the dollar.

The Fed said on Tuesday that it sees 2011 GDP growth at a more pessimistic 3-3.6 percent, versus prior estimate of 3.5-4.2 percent released in June. Unemployment is projected to be at around 9 percent by end of 2011, up from earlier forecast of 8.5 percent. Inflation is expected to stay below the informal target of 2 percent through 2013.

Yes, it looks like oil investors have a reason to rejoice for weak fundamentals of the greenback. But then you have to discount for a matching fall in demand for the commodity is the economic growth lacks adequate momentum. You should also factor in a rate hike by China in the near future and most likely more of that, going forward. It is no good for the commodity.

Negative oil signals from EMU, Asia

Wednesday's German IFO data showed better business climate in the country but it could not help the single currency recover from 2-month lows against the greenback on worries the business earnings could well be eaten up by the region's debt-laden members. The euro, in fact, slipped to fresh 2-month lows against the buck by Friday.

Sovereign bonds of the developed and 'matured' European economies are now sold at lowest ever prices and those of the so-called peripheral ones are finding it really difficult to get buyers without burdening the exchequers with sharply higher interest liability.

As Europeans are advised to follow unforeseen austerity practices to help their cash-strapped nations recover from the crisis no one is expecting them to burn more fuel and drive their cars those extra miles to a more comfortable holidaying spot.

Moving on to Asia, investors are looking forward to a second round of policy rate hike by China with the uncertainty only seen about its timing. There are market talks about the nation providing the investor community with false signals regarding its consumption, but until we get clearer data on it policy signals from the world's second largest economy will guide pricing of all the commodities.

What will move oil then?

Tuesday's Korean strike had triggered safety seeking rally towards commodities like gold and the US dollar as usual but investors were visibly cautious on the currency this time, with negatives weighing on it like never before.

But at the same time, oil as a commodity was nowhere near most metals, especially the precious ones, in taking advantage of the concerns over dollar. Instead, the commodity mostly followed its own fundamentals; maybe because of the hangover of the big leap and a subsequent steep fall it had just two years ago.

And over the long-term, oil will continue to follow the demand-supply matrix than depend upon relative gains with respect to the dollar, analysts say. The EIA series of inventory data will therefore remain important, just as the health of the global economic recovery is.

The dollar movement, however, will also impact the commodity, but for short-to-medium term. See image-2 for Nymex WTI futures performance versus USD index - OPEC data.

Wednesday's data showed an unexpected uptick in oil storage in the US last week but oil extended gains after the news as market acted upon the fact that strong demand for the commodity lead to higher imports, increasing its stock. It clearly shows that oil investors will closely follow the pace and scale at which the economy is growing.

OPEC Projection

The Organization of Petroleum Exporting Countries (OECD) has revised up the world oil demand for 2010 by 190 tb/d (thousand barrels per day) to 1.3 mb/d (million barrels per day). They revised it for the OECD nations where various stimulus plans helped consumption outpace expectations. But the forecast for world oil demand growth in 2011 has been revised up by a lesser 120 tb/d to 1.2 mb/d.

See Image-3 for OPEC projection for world oil demand. It shows that the demand is matching the refinery capacity, pushing the difference between the two sharply higher.

Now, for a fact that a big chunk of growth in the developing world so far is also funded through various stimulus programs, monetary or fiscal, what applies for OECD must be true for them as well. Analysts have a view that India, China and Brazil - all are 'behind the curve' in responding to the price rises there.

While India has already raised its key rates five times this year the fiscal freebies announced at the height of the crisis more or less remain. Similarly, analysts believe that the measures China has so far taken to tighten credit and liquidity in the banking system is not enough to cool down the 'dragon' that reels under inflation fire. Latest inflation data from Brazil has also become a matter of concern.

The fact that both the countries have not yet normalized their policy rates and liquidity levels counters the argument that the region's oil consumption will continue to rise at the current pace.

Finally, what to expect?

Despite the latest Fed remarks that echoed concerns over dollar's recent losses, there is a strong view that the US has no other way but to let its currency further weaken in order to shore up the economy. Also, many parts of the world may continue to have easy monetary and fiscal conditions for a considerable period, helping the physical demand for the commodity.

But they are not deemed strong enough reasons to believe that the commodity will break above a 'comfortable' range of $70 to $90 it has settled into settled into early last year.

Saudi Arabia's Oil Minister, Ali Al-Naimi, said earlier this month that a range of $70 to $90 a barrel should be satisfactory for consumers. The upper limit he has put is $5 above the current 'intermediate range', but it falls within the broad range since 2009.

If you can believe analysts like Francisco Blanch of Bank of America Merrill Lynch, Al-Naimi could even go for a production regulation to see that his prediction realizes. Blanch is, however, not going ahead and predicting a $100 price tag for the commodity.

So, in whatever circumstances, crude oil rising above the psychologically important $100 level, even in 2011, could really be difficult as suppliers may not find adequate demand at very high prices when the whole world is struggling to see the recovery really happening. They have a reason to remain 'satisfied' under $90 and need more reasons to dream $100 mark, obviously.

Oil producers and consumers are comfortable at current prices according OPEC's general secretary Abdulla al-Badri as well. He said on Wednesday that it is all likely that next month's group meeting in Ecuador's Quito will be smooth.

The producer group has kept its output target unchanged for two years and analysts do not see any chance of reviewing the same at its December meeting, giving a reason from their end for oil to rise sharply.

© Copyright IBTimes 2024. All rights reserved.