Merrill Lynch Stories

Asia Eyes ‘yo-yo’ Economy in 2012

Asia's economic growth looks set to stumble over the next few months, prompting a flurry of interest rate cuts and a spike in stimulus spending that may ultimately pave the way for a strong recovery in the second half of 2012. The catch-phrase for 2012 is the Asia yo-yo.

Bank of America Agrees to $315 Million Merrill Lynch Mortgage Settlement

Bank of America agreed on Tuesday to pay $315 million to settle claims involving mortgage securities issued by Merrill Lynch.

New York Landlords: 2011 Office Leasing Strong

Officials from major New York property owners said 2011 office leasing activity was strong, despite broader economic concerns, in a panel at the Goldman Sachs Commercial Real Estate Symposium in Lower Manhattan on Thursday.

Exclusive: Zynga aims for $10 billion valuation in IPO

NEW YORK, Nov 30 - Facebook games developer Zynga Inc is seeking a lower-than-expected $10 billion valuation for its initial public offering, which is to be priced on December 15, two people close to the process said on Wednesday.

It's Game on for Zynga Initial Public Offering

Zynga is expected to price its shares on December 15 in one of the most highly anticipated IPOs of the year.

Bank of Canada seen on hold rates until Q4, 2012: Reuters poll

The Bank of Canada will not raise interest rates again until the fourth quarter of next year as Europe's worsening debt crisis dims the outlook for the global economy, according to a Reuters survey.

Melrose 2 fund suing Paramount for film profits

The investor group Melrose 2 is suing Paramount Pictures, claiming it put up $375 million to finance the Transformers movies and other projects, but hasn't received any of the profits.

India’s GDP Growth Falls to 6.9 Percent; Weakest in 2 Years

India's Gross domestic product growth fell to 6.9 percent in the second quarter of the financial year. The GDP growth figure is the weakest pace in more than two years.

Even Warren Buffett Can’t Stop Bank of America’s Stock From Plunging

So far, it has been a tough week for the troubled Bank of America Corp. (BAC). The firm's stock hit a new 52-week low Tuesday, dropping more than 3 percent to $5.03 a share, the lowest level since March 12, 2009. After the market closed, more bad news came as Standard & Poor's downgraded the bank's long-term credit rating by a notch to A- from A.

AT&T, T-Mobile Merger: Effects on Small Carriers Unclear

Small wireless carriers, such as U.S. Cellular and MetroPCS, provide low-cost alternatives to companies such as AT&T and Verizon. However, companies and industry experts are split on how the AT&T/T-Mobile merger will affect the smaller companies.

Greenberg Sues U.S. for $25 billion over AIG Takeover

A company run by former American International Group Inc Chief Executive Maurice Hank Greenberg sued the U.S. government for $25 billion, calling the 2008 federal takeover of the insurer unconstitutional.

Gilead to Buy Biotech Firm Pharmasset for $11 Billion

Gilead Sciences Inc struck a deal to buy Pharmasset Inc for about $11 billion in a huge bet on hepatitis C treatments to diversify its portfolio.

Ex-UBS star shakes and stirs at BofA Asia

When some bankers arrived late for work at Bank of America-Merrill Lynch's Asia headquarters in Hong Kong earlier this year, they found a Post-It note on their computer screens.

Newsmaker: Ex-UBS Star Shakes and Stirs at BofA Asia

When some bankers arrived late for work at Bank of America-Merrill Lynch's Asia headquarters in Hong Kong earlier this year, they found a Post-It note on their computer screens.

Merrill Lynch Reportedly Agrees to Pay $315 Million in Mortgage-Backed Securities Settlement

Merrill Lynch has agreed to pay $315 million to settle a class action filed against it on behalf of investors in 18 mortgage-backed securities trusts, according to Reuters.

Panic Selling Sends Jefferies Into Tailspin as Company Tries to Fend Off Rumors

Negative rumors have turned Jefferies Group Inc. into the latest financial whipping boy. A controversial report from ratings agency Egan-Jones, which the firm has stood by, has spooked the markets. Jefferies is insistent that it remains solid. Who will investors believe?

UBS Shares Rise on Pledge to Restart Dividends

Shares in Swiss bank UBS rose on Friday as investors welcomed its pledge to start paying dividends again, though its plans to trim its scandal-hit investment bank failed to go as far as some had hoped.

Angie's List soars on debut, but concerns linger

Shares of consumer review website Angie's List surged as much as 44 percent on their market debut Thursday as investors continued to lap up internet offerings, but concerns about the company's profitability could loom on the stock.

Spanish Borrowing Costs Soar to 14-Year High

The Madrid government 3.56 billion euros of new bonds, short of the maximum target of four billion euros.

BofA Learned a Lesson from Debit Card Fury - CEO

Bank of America Corp. learned a lesson from its abandoned debit card fee and will work to provide transparency and fair pricing to customers while producing a return for shareholders, Chief Executive Brian Moynihan said on Tuesday.

UniCredit to cut 5,000 jobs in dire quarter

Profits at Italian bank UniCredit have all but evaporated and capital has shrunk to dangerous levels, results due on Monday will show as the bank prepares a $10 billion rights issue and 5,000 job cuts to get back on track.

China Bank Loans Rebound in October, More Policy Easing

Chinese banks wrote 587 billion yuan ($92.5 billion) of new loans in October, much more than expected and a sharp jump from September, evidence of "selective" policy easing by the government to keep the world's second-largest economy on an even keel.

Global Equities Plunge, Dollar Soars on Fears of Italian Default

Global markets stampeded Wednesday after the bond market signaled that Europe's third-largest economy can no longer survive without a rescue.

China Inflation Cools in October; More Policy Shifts Seen

China's annual inflation rate fell sharply in October to 5.5 percent in a further pullback from July's three-year peak, giving Beijing more room to fine tune policy to help an economy feeling the chill of a global slowdown.

HP Weighing Sale of WebOS Unit

Hewlett-Packard Co is looking to sell Palm's webOS mobile software platform, a deal that could fetch hundreds of millions of dollars but less than the $1.2 billion that HP paid last year, four sources close to the matter said.

Brookfield Reports Record Leasing Activity, Raises Forecast

Brookfield Office Properties, the landlord with holdings in America, Canada and Australia, including the now infamous Zuccotti Park, reported 8.2 million square feet of leasing activity following the third quarter, surpassing its record leasing levels in pre-recession 2007.

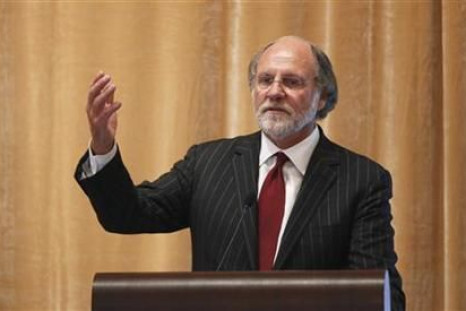

MF Global CEO Jon Corzine Resigns Under Fire

Jon Corzine has resigned as MF Global Holdings Ltd's chairman and chief executive officer four days after the futures brokerage filed for bankruptcy protection, culminating a rapid downfall for one of Wall Street's best-known executives.

Analysis: Beijing Risks Public Backlash if it Rescues Europe

China's people have a clear message for their government -- don't even think of saving Europe.

Credit Unions Capitalize on Bank Fee Displeasure

With customers angry about new bank fees, credit unions have been trying to use the displeasure to gain more customers.

White House to Review Energy Loans in the Wake of Solyndra

The White House said Friday it would conduct an independent review of the U.S. Energy Department's loan portfolio following the collapse of Solyndra, the solar-panel maker that went bankrupt last month after receiving a hefty federal loan guarantee.