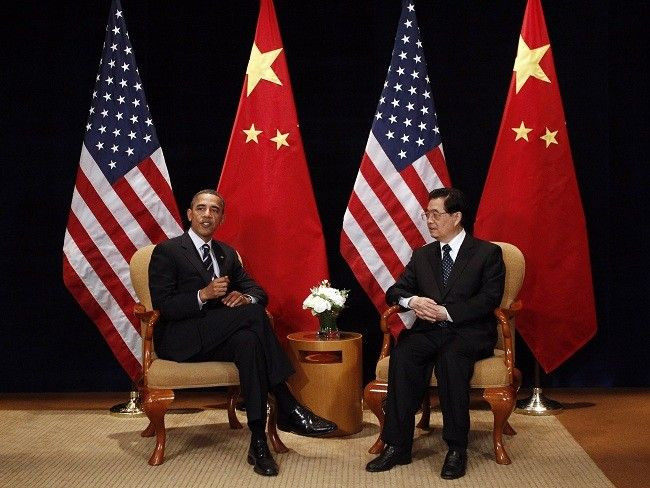

Congressional panel advises tougher stance against China

A congressional advisory panel has recommended that politicians in Washington D.C. pressure the Obama administration into more forceful action against China for keeping its currency artificially undervalued and, thereby, worsening the trade deficit of the U.S.

The U.S.-China Economic and Security Review Commission said that the Chinese are responsible for global trade imbalances and are employing “market access-limiting practices” and “exclusionary” trade practices.

China's currency manipulation continues to harm U.S. manufacturing and employment, said the commission's chairman, Ohio businessman Dan Slane.

There appears to be no real motivation by the Chinese to adopt market-based approaches with regard to its currency.

The trade deficit with China reached a monthly record high of $28-billion in August and is 21 percent higher than in 2009.

The Commission also said that China's ability to sell to the U. S. four times as many goods as it imports is a major drag on the U.S. economy.

The Commission advises the U.S. government to encourage China to help correct global imbalances and to shift its economy to more consumption-driven growth.

While China announced in June that it would allow its yuan currency to fluctuate within a narrow range according to market forces, the Commission says the measure has been insufficient. The yuan has appreciated only about 2.3 percent so far this year.

“The Chinese government quite simply intends to wall off a majority of its economy from international competition, added Slane.

The Commission said that China’s unwillingness to revalue its currency for fear of undermining its export-driven economy has increased tensions between the United States and China, while China has nonetheless continued purchasing U.S. debt and become the largest individual foreign buyer of Treasuries.

Although the size of China's holdings has raised concerns about the degree of influence China has on the U.S. economy, the lack of alternatives and the potential detrimental impacts on China's economy make it unlikely that China would stop buying U.S. debt or liquidate its holdings altogether, the Commission’s report said.

The resultant unbalanced nature of the trade and economic relationship between the United States and China has helped give China the financial resources and new technological capabilities that have enabled it to strengthen and grow its economic, military and political power, the report stated.

On the whole, the Commission supports a tougher stance against China than either Obama or George W. Bush had adopted.

The Commission’s report also discussed China’s green technology sector, which it described as a well-developed, long-term strategy for investment,” and which has provided it with a competitive advantage.

As a result of China's comprehensive programs of subsidies and domestic market protections, many U.S. companies are at a strategic disadvantage in the global alternative and renewable energy markets, the commission said.

The Commission, which was established by Congress in 2000 to advise and report on affairs between the U.S. and China, is comprised of 12 experts in trade and defense issues.

© Copyright IBTimes 2024. All rights reserved.