Connection Between US Interest Rates And Gold Prices Is Looser, Less Important Than Investors Think: World Gold Council

Real interest rates in the United States may lose some of their traditionally strong influence over gold prices in the coming decade or so, as inflation rates and physical demand in emerging markets take more prominence, according to a World Gold Council investor analysis released Wednesday.

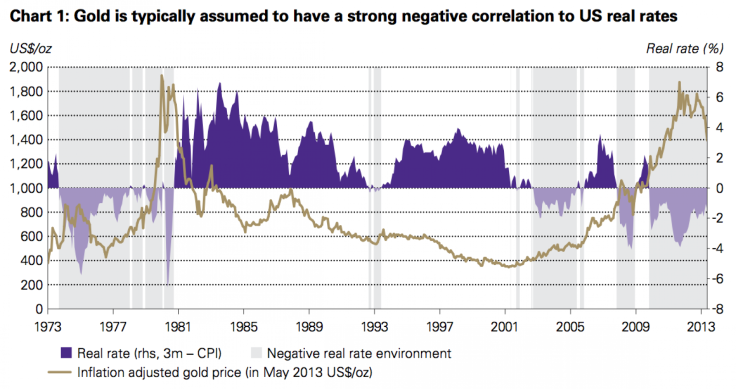

The traditional view is that U.S. gold prices and interest rates move inversely, so that high real interest rates lead to lower gold prices, as investors seek better returns in markets outside gold.

Gold investors have recently faced sharp declines in gold prices, since April, in an end to the metal’s years-long bull run.

The decline, especially visible in outflows from exchange traded funds (ETFs), was driven partly by fears that the Federal Reserve will taper back its bond purchases and eventually raise interest rates within the next two to three years.

But “the influence of the U.S. real rate on gold has receded over the last couple of decades,” reads the council report. “Gold’s portfolio attributes are not compromised by a return to a normal interest rate environment.”

The council maintains that moderate real interest rates of 0 to 4 percent won’t adversely impact gold. Nominal interest rates on benchmark 10-year U.S. treasuries have risen to more than 2 percent in recent weeks.

“The gold market in general has a myriad of influences on it,” HSBC Holdings PLC (LON:HSBA) gold analyst James Steel told the International Business Times. “Some are monetary, and others are macro, more related to physical supply and demand balances.”

Still, said Steel, the market lately has been dominated by expectations about tapering. He cited gold market movements ahead of Wednesday’s Federal Open Market committee meeting as one example.

“The gold market particularly, along with the foreign exchange market, is sensitive to what’s going to come out today,” said Steel. “We’ve weakened running into it, that’s for sure.”

Steel’s latest forecast is that gold prices could rebound back to about $1400/oz by the end of 2013. Gold prices opened at $1,326/oz on Wednesday morning.

Other gold experts see a split between two contrasting markets for gold. One market primarily involves U.S. and European investors who focus on futures and ETFs, while the other consists of physical gold customers from countries like China and India.

“It’s been a tale of two markets, it seems,” said Anthem Blanchard, CEO of Anthem Vault, which sells physical gold and silver to U.S. consumers and holds $2 billion in assets.

Blanchard points out that even if physical gold demand is robust, gold consumers in emerging markets are still indirectly affected by U.S. interest rates, since foreign currencies like the Chinese yuan are still linked to U.S. dollar debt instruments.

Central banks, who have bulked up on gold reserves in recent years, are particularly affected by U.S. interest rates, said Blanchard.

“So long as the current international financial structure is in place, U.S. real interest rates should still be a driving factor longer term,” he said.

Physical demand for gold among U.S. consumers continues to be relatively weak and has been in a lull recently, said Blanchard.

The council estimates that the U.S. only accounted for 10 percent of global physical gold demand in 2012, compared to 70 percent from emerging markets.

© Copyright IBTimes 2024. All rights reserved.