The world entered 2011 with cautious optimism that things would improve over the gloom of 2009 and 2010. However, the past year has proven to be quite turbulent. The global economy was faced with a myriad of challenges including the European debt crisis, while the overall economic performance in the industrialized world left much to be desired.

The United States warned the Iranian government that the closure of the Strait of Hormuz will not be tolerated after Iran threatened to do so if sanctions were put in place.

The pipeline will carry Russian gas under the Black Sea into Europe.

Stocks fell about 1 percent on Wednesday on concerns about the economy in early 2012 while the euro hit a fresh 11-month low against the dollar before a key auction of long-dated Italian debt on Thursday.

Samsung Electronics Co, Sharp Corp and five other makers of liquid crystal displays agreed to pay more than $553 million to settle consumer and state regulatory claims that they conspired to fix prices for LCD panels in televisions, notebook computers and monitors.

Deutsche Boerse and NYSE Euronext have extended the deadline for completion of their planned merger to March 31 next year as they seek to convince European regulators to back the $9 billion deal.

Samsung Electronics Co, Sharp Corp and five other makers of liquid crystal displays agreed to pay $553 million to settle consumer and state regulatory claims that they conspired to fix prices for LCD panels in televisions, notebook computers and monitors.

Samsung Electronics Co, Sharp Corp and five other makers of liquid crystal displays agreed to pay $539 million to settle claims they conspired to fix prices and stifle competition for LCD panels in televisions, notebook computers and monitors, according to a court filing.

Europe faces another year of dismal economic performance in 2012 that will weigh on global growth, but emerging markets and the United States should at least keep the world economy moving in the right direction.

Must Watch Christmas Images, Traditions From all Round the World; What is Santa Called in Other Countries [PHOTOS]

European Central Bank Governing Council Member Ignazio Visco said in a newspaper interview on Saturday that the bank will be attentive to the economic cycle when setting monetary policy, suggesting rates could fall more if the euro zone economy worsens.

he bill moves to France's senate next year. If it passes the upper house, it will become law.

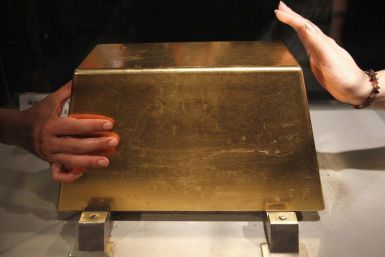

Gold extended its record bull run in 2011 for an 11th year as confidence in the world's financial leaders and their stewardship of fiat currencies plummeted.

U.S. Rep. Ron Paul, R-Texas, has predicted rising inflation and a collapse of the dollar due to the U.S.’s fiscal and monetary policies, but roughly three years into the economic recovery, inflation remains moderate. And the dollar? It’s holding its own and may strengthen in 2012.

Chen denied he was guilty and allegedly told the court that “Dictatorship will fail, democracy will prevail.

Former Ukrainian Prime Minister Yulia Tymoshenko's guilty verdict and seven-year jail sentence was upheld Friday by a Ukrainian appeals court.

The half a trillion euros the European Central Bank pumped into the financial system buys hard-hit banks valuable time but will not in itself protect them from threatened rating downgrades, one of Standard and Poor's top executives said.

The half a trillion euros the European Central Bank pumped into the financial system buys hard-hit banks valuable time but will not in itself protect them from threatened rating downgrades, one of Standard and Poor's top executives said.

European stocks rose to their highest in two weeks on Friday, tracking Wall Street gains as the U.S., the world's biggest economy, showed further signs of recovery, especially in the labor market.

Japan has cut its forecast regrading economic growth for 2012 as a cumulative effect of a rising yen, natural disasters and the eurozone debt crisis.

The bill proposes a 45,000 euro fine and jail sentence of up to one year for those who violate the law.

European shares rose on Thursday, helped by mostly upbeat U.S. economic data, and with banks gaining after taking advantage of cheap finance offered by the European Central Bank.