Cuba Gripped In Dollar Frenzy, Peso Under Pressure

The US dollar, nigh impossible to obtain legally in communist-run Cuba, has become a coveted commodity raking in double the state-determined exchange rate on the black market as the peso falters.

Since a new currency structure came into force on January 1, the Cuban Peso or CUP -- its value artificially set by the government at 24 to the dollar -- is Cuba's only legal tender.

But economists say the CUP is massively overvalued.

This, combined with a simultaneous government drive to amass foreign currency with which to buy much-needed imports, has seen Cubans pay as many as 50 CUP on the black market for one dollar -- the only money that can buy many basic goods on the island.

"I don't think that there are many countries in the world that have that level of overvaluation of their currency (the CUP)," according to Pedro Monreal, a Cuban economist.

And as the CUP continues weakening on the black market, pressure could be building "for a new official devaluation," he added.

The previous devaluation on January 1 saw the government scrap a preferential rate of one CUP to the dollar reserved for state-owned enterprises, which account for 85 percent of Cuba's economy.

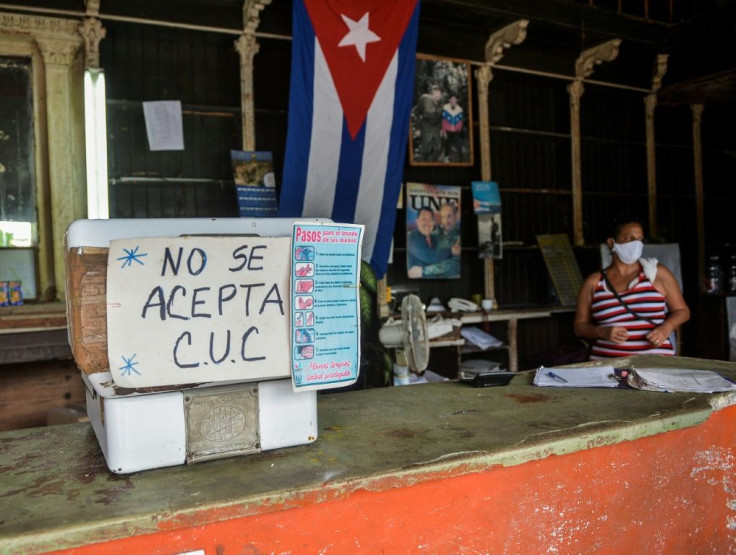

Long-awaited economic reforms which entered into force on New Year's Day saw the start of a six-month period of phasing out the convertible peso or CUC, which was pegged to the dollar and was introduced in 1994 to replace the US currency.

The move sought to make the Cuban economy more accessible to foreign investors, and came at a time the country is reeling from the impact of US sanctions and a steep drop in tourism and remittances from abroad due to the coronavirus pandemic.

The reform ended a near three-decade system of the two currencies existing side-by-side, and would leave the CUP as the only legal tender by mid-2021, though many stores already refuse to accept the CUC.

Complicating matters, the government decided in late 2019 to partially reintroduce the greenback as its foreign reserves started running low.

Caribbean beach tourism is Cuba's largest source of hard currency, but has been hard hit by US restrictions on travel to the island, then by the global health crisis.

Import restrictions due to foreign exchange shortages aggravate scarcity and queues outside supermarkets. Eighty percent of all goods consumed on the island are imported.

So the government decided last year to allow about 100 state-owned stores, which sell everything from food to electronic goods and car parts, to accept payment exclusively in dollars.

These stores sell goods that are hard to come by elsewhere, some of them basic necessities.

The problem is, few people in Cuba, apart from those who receive payments from family or friends abroad, can legally access the greenback, never mind afford it.

Only people leaving the country are allowed to purchase dollars, and up to a maximum of $300.

Trapped between a rock and a hard place, desperate Cubans are left with no choice but to acquire black market dollars.

Soaring demand has caused the US currency's black market worth to soar -- its highest level so far was 108.3 percent of the official rate.

Economist Mauricio De Miranda of the Xaveriana University in Cali, Colombia, said true currency reform was not possible "when the Central Bank of the country cannot offer the foreign currency at the officially-established exchange rate. I

"It's a carte blanche for the black market."

Added Ricardo Torres of the University of Havana, Cuban consumers are being dealt a double-whammy.

Not only do they pay high rates for dollars with which to buy goods, but so do traders who, in turn, "have to incorporate the difference into their prices."

During the economic crisis of the 1990s that was caused by the fall of the USSR, a dollar cost 150 Cuban pesos.

It is hard to forecast how high it will go this time, said De Miranda.

"It depends on how quickly and at what level the country's foreign exchange earnings level recover."

Last year, the Cuban economy shrank 11 percent, its worse decline in 27 years.

© Copyright AFP 2024. All rights reserved.