Day After the Dollar Crashes Says U.S. Is Running on Borrowed Cash, Borrowed Time

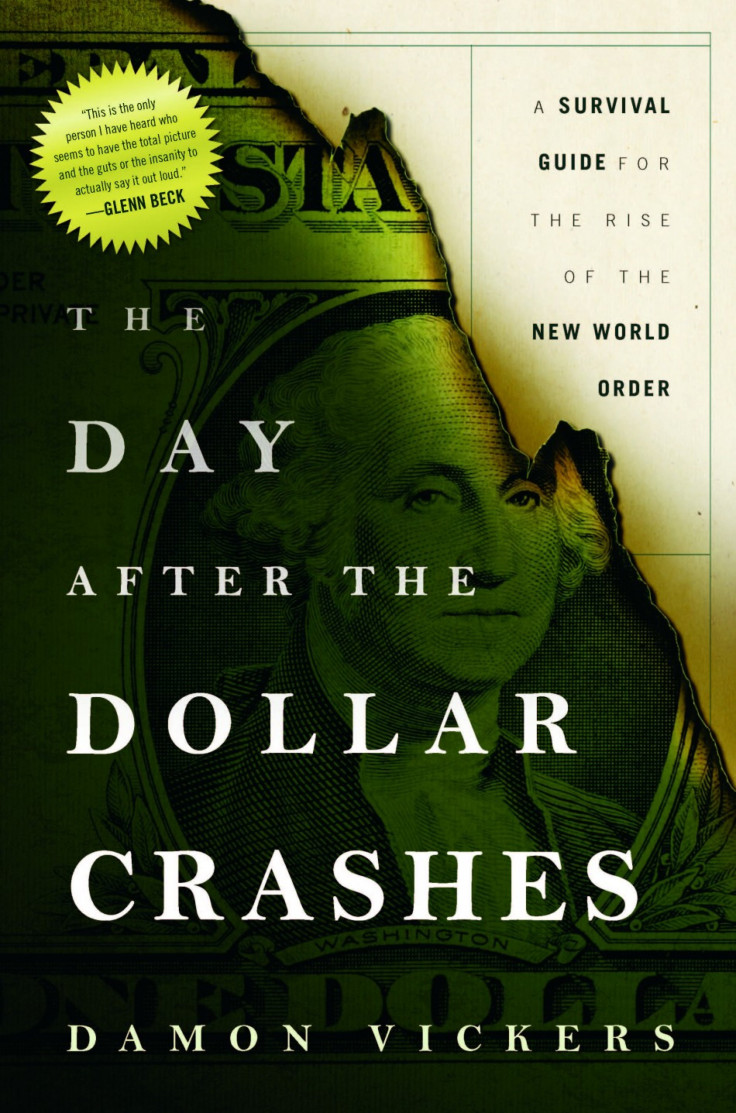

The book: The Day After the Dollar Crashes: A Survival Guide for the Rise of the New World Order

Author: Damon Vickers

Wiley, January 2011

190 pages, $29.95

Just pages into his book, Damon Vickers gets going at warp speed, declaring that the United States is not a going concern.

We don't fuel our cars. We don't keep ourselves healthy. We don't feed our bellies. We don't make anything anymore! We don't make real things, real goods, or real services and earn real capital, he says, yet the U.S. government trots out statistics that try to tell a different story, so that the next bond auction gets completed.

He presents an alternative, lower version of our GDP over the past two and a half decades, while making the case that the GDP numbers don't show real exports but instead reflect self-dealing among U.S. companies. He says the only real gauge of our worth is our exports, but the main thing the United States exports is debt and its hollow promises in the form of derivatives and Treasury notes.

Section by section, he explains why he thinks the U.S. is in deep trouble: we depend on entitlements, our population is aging, we've lost our advantage in technological manufacturing, we can no longer feed ourselves fully (and the food we do make is full of toxins and hormones), we are sick despite all the piles of money spent on health care, we are ruining the environment. But the biggest problem is debt. Vickers' estimate of the U.S.' true obligations is much higher than the $14.3 trillion debt ceiling that Congress is haggling about -- he claims the country has a net worth of negative $65 trillion.

A New World Order is coming, he says, and Americans, as part of a global community, have a moral obligation to do everything we can to reclaim America and this earth for ourselves and the generations of all life to come.

The U.S. has been running on borrowed cash and borrowed time, Vickers says, but the levels of insolvency among Westernized nations as a whole are unsustainable. In part because of entropy and the instability and complexity of the current economic system, We will see a reset that dissolves the rules currently governing international economics and forces a complete economic and social restructuring on the planet, he writes.

This is strong stuff -- and Vickers certainly calls it like he sees it. He provides an extraordinarily detailed, minute-by-minute imagined accounting of the day the dollar crashes and how the resulting collapse would play out, beginning with an auction of U.S. Treasury notes that no one buys. This is when the book reaches its climax, as markets freeze and freefall, traders on the floor of the New York Stock Exchange watch on CNN as bodies fall out of exchange headquarters around the world, and everyone scrambles. Out of all this, he predicts, will emerge a single shared currency and a new Central Government (or CG), but nations and cultures would retain their identities.

Given the nature of this book, there is a lot of conjecture, but Vickers has financial acumen to back him up: the managing director of an investment firm in Seattle, he points out how he called market tops in 2000 and 2007/2008.

It's a quick-moving and sometimes surreal book, such as when Vickers recounts how he saw visions of riots a few days before they happened in Greece in 2010 while riding in a limo to be interviewed on Glenn Beck's show, where he and Beck agreed that Revolution was on the horizon.

The book is strongest and most intriguing in its first half, as Vickers calls for an end to our dependent lifestyle, equates environmental demise with economic demise, and makes the case that the Western model of consuming everything in sight for profit and comfort is bringing significantly diminishing returns.

The Day After the Dollar Crashes is also somewhat repetitive, and Vickers does not stay with any narrative through line for all that long. Some points he makes are weak, particularly his criticism of the government's takeover of General Motors and Chrysler. He says the U.S. auto industry is not viable and that the Obama administration should have allowed the companies to go into bankruptcy and use the time to retool and retrain the workforce to manufacture something the planet does want -- but they did go into bankruptcy, and recent months have confirmed their return to profitability, particularly GM's. And toward the end of the book Vickers runs out of steam, especially the last few chapters, which are full of bite-sized rants on numerous issues.

But you don't read this book for the writing. You read it for the provocative ideas, and Vickers provides plenty of those. He also provides many sensible suggestions for crafting a more sustainable future, from voting by character and not by party in our democracy, to learning how to make more of our own food, to shifting toward more healthful living rather than focusing on all the diseases we can get.

I don't believe people truly need be afraid of the future, Vickers writes. But I do think people have to be smart and start thinking for themselves.

Edward B. Colby is the Books editor of the International Business Times. He can be reached at e.colby@ibtimes.com.

© Copyright IBTimes 2024. All rights reserved.