Deere & Company (DE) Earnings Preview: Q4 Sales Hit By Lower Corn Prices

Deere & Company (NYSE:DE), the world's largest manufacturer of farm equipment by sales, is expected to report a decline in revenue Wednesday morning as farmers buy fewer tractors and harvesting combines amid a sharp drop in agricultural commodity prices. But the company’s margin on farm machinery probably strengthened, resulting in an increase in profit.

The company commonly known as John Deere is likely to book a profit of $727.94 million, or $1.89 per share, on revenue of $8.68 billion in the fourth quarter of fiscal year 2013, according to the consensus estimate of analysts polled by Thomson Reuters. In the year-earlier period, Deere earned $687.60 million, or $1.75 a share, on revenue of $9.05 billion. Excluding one-time items, the company gained $1.89 a share in the fourth quarter, compared with $1.75 a share same time last year.

For the fiscal year, analysts expect Deere to earn $3.47 billion, or $8.75 a share, on revenue of $35.26 billion. That’s higher than the $7.63 a share recorded in the prior fiscal year. Sales were also lower in the prior year, at $33.50 billion.

In a slide presentation accompanying the company’s fiscal third-quarter results in August, Deere forecast a drop in U.S. farm cash receipts, a key indicator of agricultural-equipment sales.

U.S. farm revenue will drop to $389.8 billion this year and $379.7 billion in 2014 from a record $402.1 billion last year. Deere’s forecast for two straight years of lower crop cash suggested future softness in farm equipment demand.

For the full 2013 fiscal year, Deere kept to its guidance of a 5 percent increase in revenue, but for the fiscal fourth quarter the company said it expects a 5 percent drop in revenue to $8.59 billion. That’s below Wall Street projections. Deere said net profit will be about $3.45 billion in the fiscal year through October.

The End Of The Tractor Boom

Deere’s annual sales have gained 50 percent since fiscal 2007 as farmers’ revenue was bolstered by a rally in agricultural commodities. But the bull market in farm machinery that began about seven years ago is coming to a halt.

Sales of farm equipment wilted during October, according to unit sales figures released by the Milwaukee-based Association of Equipment Manufacturers. Retail sales of farm tractors in the U.S. and Canada slipped 1.5 percent last month from a year ago.

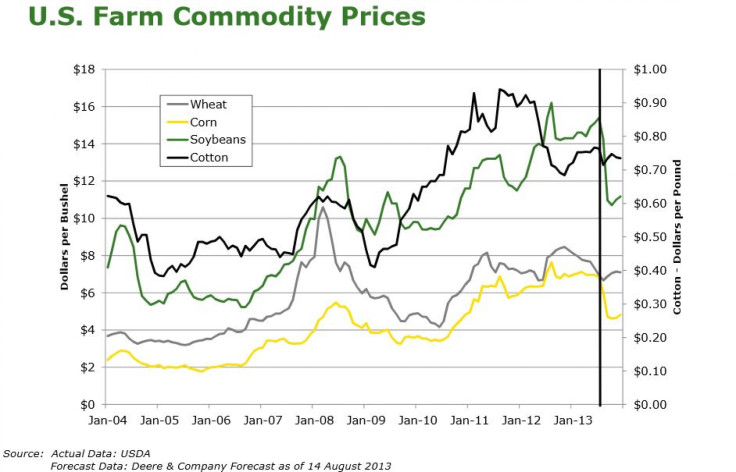

Demand for equipment has been correlated to prices for corn, soybeans and other farm commodities.

For decades, corn prices hovered between $2 and $3 a bushel, but they surged to an all-time high last summer at $8.31 a bushel as the worst U.S. drought in decades battered the Farm Belt. That provided farmers with more money to spend and drove quarterly equipment sales for Deere.

The high price also prompted farmers to plant the most corn acreage in 77 years this spring, and weather has been mostly favorable for growing the yellow kernels. The U.S. Department of Agriculture estimated that world corn, rice, soybean and wheat production would break records this year.

Analysts fear that farmers will cut back on equipment upgrading because a record harvest would weigh on prices and lead them to plant fewer acres next year. On the other hand, even if prices plateau at moderate levels, farmers could take an extended break from buying after presumably upgrading their all their equipment in recent years.

On Monday, corn for December delivery fell to $4.13 a bushel on the Chicago Board of Trade.

“These price falls have been driven by the realization that the U.S. harvests would be better than many had feared earlier in the summer,” said Tom Pugh of Capital Economics in a note to clients. “This decline has taken prices almost all the way to the much lower levels we had been forecasting for the end of the year.”

In addition, Pugh expects demand for grains, especially corn, to be subdued over the next year.

This is mainly due to a fall in demand for corn to produce ethanol. Fuel production now takes up around 40 percent of the U.S. corn crop. The increasing efficiency of vehicles and continued weak economic growth in the U.S. should reduce the amount of gasoline used. And given that U.S. refineries refuse to produce gasoline with more than 10 percent ethanol for fear of damaging vehicle engines, this should reduce demand for ethanol and in turn lower demand for corn.

The Environmental Protection Agency last Friday released a proposal for the first time to ease an annual requirement for ethanol in gasoline, saying that levels mandated in a 2007 law are difficult to meet.

Moreover, cheap sugar, artificial sweeteners and growing health concerns are decreasing demand for high-fructose corn syrup. HFCS makes up a large proportion of “industrial” uses for corn and is easily substituted with other sweeteners by food and drink manufacturers, according to Pugh.

All of these contributed to the decline in corn prices.

While Pugh is not expecting corn prices to plummet again, as they have done over the last year, “we do continue to expect ample supply to pull the price of corn down gradually, to $3.50 by the end of 2014.”

Stock Performance

Analysts at Bank of America Merrill Lynch downgraded Deere from "Buy" to "Neutral" as they have limited faith in a near-term construction equipment recovery. The price target has been lowered to $89 per share.

“Investors should avoid companies that will face negative earnings pressure, such as Deere,” said Lawrence De Maria, an analyst with William Blair.

Deere closed at $83.66 a share Monday. So far this year, the stock has lost 3.1 percent. The company currently pays a quarterly dividend of 51 cents per share, for an annual dividend yield of 2.5 percent.

Year to date, Deere’s competitor, AGCO Corporation (NYSE:AGCO) has gained 17.7 percent.

© Copyright IBTimes 2024. All rights reserved.