Earnings Preview: Oracle Corporation (ORCL), FedEx Corporation (FDX), Walgreen Company (WAG), NIKE Inc (NKE), General Mills Inc (GIS)

Next week, investors will hear from a handful of U.S. companies reporting their earnings results, which may offer clues on whether the economy is strong enough to withstand an imminent stimulus reduction by the Federal Reserve.

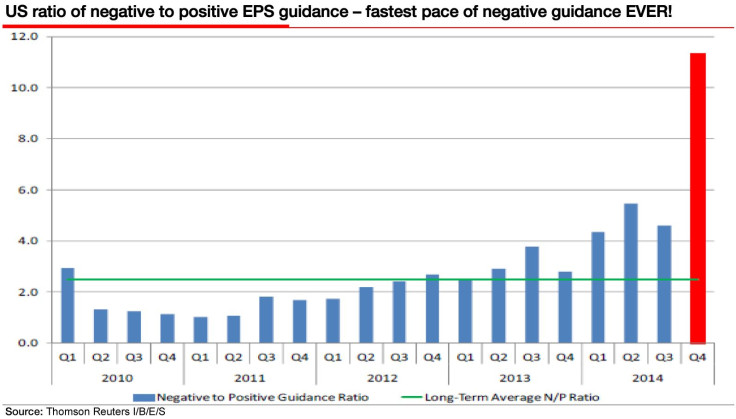

The rate of negative guidance has rocketed in recent weeks to unprecedented highs, said Societe Generale equity strategist Albert Edwards, citing data from Thomson Reuters.

So far, S&P 500 (INDEXSP:.INX) companies have issued negative guidance 103 times and positive guidance only nine times. The resulting 11.4 negative-to-positive guidance ratio is the most negative on record by a wide margin. The highest negative-to-positive ratio prior to this quarter was 6.8, in the first quarter of 2001.

Currently, analysts expect earnings to grow 7.8 percent over the four quarters of 2012. This estimate is down from the 10.9 percent estimate at the beginning of the quarter. Given the 0.4 percent expected revenue growth, it may be difficult to achieve profit increases of the magnitude currently expected.

We ran a screen and produced a list of 13 notable companies set to report earnings between Dec. 16-20. We have highlighted their expected reporting dates and times, along with analysts’ earnings-per-share (fully reported) and revenue estimates from Reuters, as well as the stocks’ year-to-date performances.

Tuesday After Markets Close, or AMC:

Jabil Circuit, Inc. (NYSE:JBL) is a provider of worldwide electronic manufacturing services and solutions. The company has a market capitalization of $3.94 billion. It is expected to report FY 2014 first-quarter EPS of 55 cents on revenue of $4.50 billion, compared with a profit of 61 cents a share on revenue of $4.64 billion a year earlier. Jabil Circuit is trading at around $19.38 a share. So far this year, the stock has gained 0.5 percent.

Wednesday Before Markets Open, or BMO:

General Mills Inc. (NYSE:GIS) is a manufacturer and marketer of branded consumer foods sold through retail stores. The company has a market capitalization of $32.19 billion. It is expected to report FY 2014 second-quarter EPS of 89 cents on revenue of $4.95 billion, compared with a profit of 86 cents per share on revenue of $4.88 billion in the year-ago period. General Mills is trading around $50.71 per share. So far this year, the stock has gained 25.6 percent.

FedEx Corporation (NYSE:FDX) is a holding company that provides a portfolio of transportation, online commerce and business services under the FedEx brand. The company has a market capitalization of $43.29 billion. It is expected to report FY 2014 second-quarter EPS of $1.63 on revenue of $11.43 billion, compared with a profit of $1.39 a share on revenue of $11.11 billion a year earlier. FedEx is trading at around $136.39 a share. So far this year, the stock has gained 49.1 percent.

Wednesday AMC:

Oracle Corporation (NASDAQ:ORCL) is an enterprise software company with a market cap of $156.71 billion. It is expected to report FY 2014 second-quarter EPS of 53 cents on revenue of $9.20 billion, compared with a profit of 53 cents a share on revenue of $9.11 billion a year earlier. Oracle is trading at around $33.71 a share. So far this year, the stock has appreciated 1.3 percent.

Thursday BMO:

Accenture Plc (NYSE:ACN) is a management consulting, technology services and outsourcing company. Accenture has a market capitalization of $50.38 billion. It is expected to report FY 2014 first-quarter EPS of $1.08 on revenue of $7.25 billion, compared with a profit of $1.06 per share on revenue of $7.22 billion in the year-ago period. Accenture is trading at around $74.40 per share. So far this year, the stock has gained 11.9 percent.

Darden Restaurants Inc. (NYSE:DRI) is a company owned and full-service restaurant company. The company has a market capitalization of $6.70 billion. It is expected to report FY 2014 second-quarter EPS of 21 cents on revenue of $2.08 billion, compared with a profit of 26 cents a share on revenue of $1.96 billion a year earlier. Darden Restaurants is trading at around $51.37 a share. So far this year, the stock has gained 13.9 percent.

ConAgra Foods Inc. (NYSE:CAG) is a food company with a market cap of $13.53 billion. It is expected to report FY 2014 second-quarter EPS of 55 cents on revenue of $4.61 billion, compared with a profit of 51 cents a share on revenue of $3.74 billion in the year-ago period. ConAgra is trading at around $32.04 a share. So far this year, the stock has lost 8.7 percent.

Rite Aid Corporation (NYSE:RAD) a retail drugstore chain in the U.S. The company has a market cap of $5.12 billion. It is expected to report FY 2014 third-quarter EPS of 4 cents on revenue of $6.32 billion, compared with a profit of 7 cents a share on revenue of $6.24 billion a year earlier. Rite Aid is trading at around $5.60 a share. So far this year, the stock has gained 311.0 percent.

Thursday AMC:

NIKE Inc. (NYSE:NKE) is a seller of athletic footwear and athletic apparel worldwide. The company has a market cap of $68.46 billion. It is expected to report FY 2014 second-quarter EPS of 57 cents on revenue of $6.44 billion, compared with a profit of 42 cents a share on revenue of $5.96 billion in the year-ago period. Nike is trading at around $76.65 a share. So far this year, the stock has appreciated 48.6 percent.

Red Hat Inc. (NYSE:RHT) is engaged in providing open-source software solutions to enterprises. The company has a market cap of $8.83 billion. It is expected to report FY 2014 third-quarter EPS of 21 cents on revenue of $383.13 million, compared with a profit of 18 cents a share on revenue of $343.6 million a year earlier. Red Hat is trading at around $46.57 a share. So far this year, the stock has lost 12.1 percent.

Tibco Software Inc. (NASDAQ:TIBX) is a provider of middleware and infrastructure software. The company has a market capitalization of $3.84 billion. It is expected to report FY 2013 fourth-quarter EPS of 27 cents on revenue of $312.23 million, compared with a profit of 29 cents per share on revenue of $296.53 million in the year-ago period. Tibco Software is trading at around $23.58 per share. So far this year, the stock has gained 7.3 percent.

Friday BMO:

CarMax, Inc. (NYSE:KMX) is a retailer of used cars. The company has a market capitalization of $11.41 billion. It is expected to report FY 2014 third-quarter EPS of 47 cents on revenue of $2.89 billion, compared with a profit of 41 cents a share on revenue of $2.60 billion a year earlier. CarMax is trading at around $51.08 a share. So far this year, the stock has gained 36.0 percent.

Walgreen Company (NYSE:WAG), together with its subsidiaries, operates drugstore chains in the U.S. The company has a market capitalization of $54.65 billion. It is expected to report FY 2013 first-quarter EPS of 59 cents on revenue of $18.34 billion, compared with a profit of 43 cents per share on revenue of $17.32 billion in the year-ago period. Walgreen is trading at around $57.57 per share. So far this year, the stock has gained 55.5 percent.

© Copyright IBTimes 2024. All rights reserved.