Zero interest rates are a policy of the past for most central banks worldwide, but not for the Bank of Japan.

While the full results of the midterm elections may not be known for days or even weeks, traders and investors raised their bets on stocks on the prospect of a divided legislature.

Equity valuations are heading higher when the Fed is in an interest rate easing cycle. Thus, it's an ideal time to be on the long side of the equity market.

Jobs in the U.S. grew in October, albeit at a slower rate than the previous month, a new BLS report showed.

A technological leap is critical for emerging market economies to overcome two problems they encounter after years of reliance on foreign technology and cheap domestic labor for growth: the middle-income trap and the Lewis point.

The Federal Reserve on Wednesday approved another 0.75 interest rate hike in a bid to stifle unyielding inflation.

Phillips 66, one of the biggest U.S. energy firms, saw its third-quarter revenues grow amid rising oil prices.

According to FRED data from the Federal Reserve Bank of St. Louis, annualized monthly inflation peaked last June at 12.83% and has been falling since then.

According to some estimates, interest rate hikes can take up to 18 months to affect the economy. Thus, the ECB may want to pause and see how the recent interest rate hikes will impact the eurozone economy before its next move.

Two Long Island restaurant owners share their tips for beating inflationary pressure.

Wall Street has bucked the trend of bad news even as the economy starts to slow

U.S. mortgage rates reached the 7% threshold last week, a high not seen since 2002.

The Brotherhood of Railroad Signalmen has rejected a tentative labor deal, raising concerns about whether a rail strike could ensue before the upcoming holiday season.

South Korea's economy has seen slow growth due to rising interest rates and lower exports in the third quarter.

Is it time for traders and investors to go bargain hunting or wait on the sidelines for the worst yet to come?

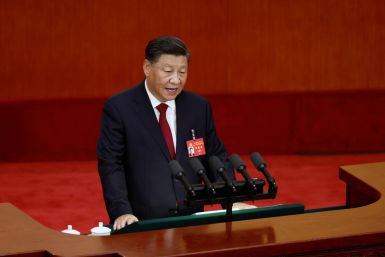

China has delayed the release of GDP and trade data ahead of President Xi Jinping's expected third-term confirmation.

Gas prices have fallen across the US by as much as 30 cents per gallon. Biden Oil Deal and increased supply a contributing factor.

After soaring through much of 2022, rent dipped in September. Here are the 10 cities that saw the biggest drops.

Pakistan appealed to the International Monetary Fund to have its debt rescheduled last week.

The IRS on Tuesday announced new tax rate changes that would save many Americans money in 2023 filing.

Mortgage demand fell to a 25-year low last week, as unrelenting inflation and high interest rates cool demand.

The plan is intended to add enough supply to prevent oil price spikes that could hurt consumers and businesses, while also assuring the nation's drillers the government will swoop into the market as a buyer if prices plunge too low.

Faced with the challenge of unrelenting inflation, the Federal Reserve may raise interest rates again in November.

To have a work-life balance, a well-paying job with low stress is essential. From mathematician to manager, there are options to earn over $100,000 per year.

To catch up with the U.S., China needs much more than a dose of incentives and foreign technology.

Kroger and Albertsons to merge for $24.6B, making it the largest supermarket chain in the United States in a bid to compete against Amazon, Walmart

Singapore tightened monetary policy as expected for the fourth time this year to combat inflation running near a 14-year high, and left the door open for further policy action as it warned of risks to the growth and price outlook.

Japan's solo battle against an overvalued U.S. dollar may feel a little lonelier after it met G7 finance chiefs in Washington this week - and possible yearend market ructions may see its allies regret that.

The European Central Bank is considering entering the maelstrom of volatile world markets to start winding down its massive bond holdings - just as governments scale up spending to respond to an energy crisis likely to induce a recession.

Indian consumers are lapping up everything from cars, houses and television sets to travel and jewellery in the festive season that began last month