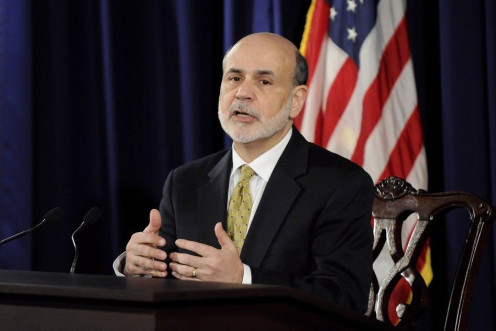

Asian stock markets declined Friday as weak economic reports from Japan and South Korea revived concerns over the global economic growth while investors opted for caution ahead of the long-awaited speech by Federal Reserve Chairman Ben Bernanke at the Jackson Hole symposium later in the day.

U.S. stock index futures point to a higher open Friday ahead of Federal Reserve Chairman Ben Bernanke's speech at the Jackson Hole symposium where he is expected to announce another round of monetary easing.

European markets remained in the tight range Friday as investor confidence continued to be weighed down by fading hopes on the European Central Bank to announce policy measures to boost the euro zone economy and revive growth momentum.

India's economic growth rose in the first quarter of the fiscal year 2012-13 compared to the January-March quarter of the last fiscal, indicating that the country's economy is moderately improving though the soft global demand and the weak domestic policy measures have affected it.

The top after-market NYSE gainers Thursday were SAIC Inc, Domtar Corp, McEwen Mining, Freescale Semiconductor and Crane Co. The top after-market NYSE losers were Accretive Health, Gerdau SA, Quicksilver Resources, American Eagle Outfitters and CoreLogic, Inc.

India's GDP growth likely languished around its lowest in three years in the quarter that ended in June, offering no respite for Prime Minister Manmohan Singh as he struggles to escape from a series of political scandals that have paralysed his economic agenda.

Asian markets fell Friday as investor confidence was weighed down amid increasing concerns about the global economy after data showed a fall in the industrial output of Japan and South Korea.

Market-watchers continued to use words like "anticipation," "expectations," "disappointment" and "excitement" Thursday, less than 24 hours ahead of a speech by Federal Reserve chairman Ben Bernanke that is being hyped up as a make-or-break moment for economic affairs in 2012.

Eric Schmidt, the executive chairman of Google Inc. (Nasdaq: GOOG), sold another 50,000 shares of the company worth around $34.2 million, according to documents filed Wednesday with the Securities and Exchange Commission.

Sears Holdings Corp. (Nasdaq: SHLD), which revolutionized retail in the 20th century with its mail order catalogs. will be removed from the S&P 500 Index at the end of Sept. 4, according to Standard & Poor's, after struggling to lure consumers amid the weak economy.

Caterpillar Inc. (NYSE: CAT), the world's largest maker of construction and mining equipment, is confident that Beijing will step up easing efforts to drive an economic rebound and China's economic growth will probably recover this year.

U.S. consumer spending got off to a fairly firm start in the third quarter, rising by the most in five months and offering hope economic growth could pick up this quarter.

Pandora Media, Tivo Inc, ING Groep, Molycorp, BHP Billiton, Syngenta, Frontline Ltd and First Solar Inc. are among the companies whose shares are moving in pre-market trading Thursday.

China's credit risk is probably much worse than the official non-performing loan (NPL) data suggests, according to Société Générale's China macro strategist Wei Yao.

Asian stock markets declined Thursday as the disappointing Japan retail sales data and the fading hopes for fresh measure by the Fed Reserve weighed on the sentiment.

The U.S. stock index futures point to a lower open Thursday as investors continue to have concerns about the weakening global economy and worsening economic growth momentum.

European markets fell Thursday as investor sentiment was weighed down by concerns of economic and financial instability in Spain worsening the euro zone economy.

The top after-market NYSE gainers Wednesday were Pandora Media, LyondellBasell Industries, GenCorp, ING Group and Turquoise Hill Resources Ltd. The top after-market NYSE losers were Oxford Industries, Rogers Communication, Tim Hortons, Asbury Automotive Group and Bank of Nova Scotia.

Asian markets fell Thursday as investors' concerns about the weakening global economy was revived by the declining Japanese retail sales and disappointing South Korean manufacturers' confidence data.

Asian shares eased and major currencies stayed range-bound Thursday as investors avoided betting on direction before a speech by U.S. Federal Reserve Chairman Ben Bernanke, with focus on whether there will be any hint about further U.S. stimulus.

Citigroup Inc agreed to pay $590 million to settle a shareholder lawsuit accusing it of hiding tens of billions of dollars of toxic mortgage assets, one of the largest settlements stemming from the global financial crisis.

Eric Schmidt, the executive chairman of Google Inc. (Nasdaq: GOOG), has sold 103,193 shares of the company worth around $69.3 million, according to Tuesday filings with the Securities and Exchange Commission.

Ryanair Holdings (Nasdaq: RYAAY), Europe's largest discount airline company by passengers, is asking for some help from rivals in its third attempt to buy Aer Lingus Group Plc (London: AERL).

America's 50 state governments owe a total of $4.19 trillion, including outstanding bonds, unfunded pension commitments and budget gaps. Here's a look at the top five states with the heaviest debt burdens in the country.

The U.S. economy expanded slightly faster than initially thought in the second quarter, but the pace of growth is still too slow to create enough jobs and drive down the unemployment. Economists are forecasting even slower growth in the second half of 2012, which will probably keep expectations of additional monetary stimulus from the Federal Reserve intact.

eBay Inc, Frontline, Harmony Gold Mining, Annies Inc, Nokia Corp, Joy Global, Banco Santander and Zynga Inc. are among the companies whose shares are moving in pre-market trading Wednesday.

Shari Arison is the most powerful woman in Israel and the Middle East, and has a net worth of $3.9 billion to boot. But despite her numerous non-profit organizations and 25% stake in Israel's largest bank, Arison says she doesn't consider herself "a powerful person."

The U.S. stock index futures point to a slightly lower open Wednesday as investors remained cautious waiting for Federal Reserve Chairman Ben Bernanke to announce monetary easing measures at the Jackson Hole symposium later this wee

Asian stock markets ended mixed Wednesday as investors remained in a waiting mode ahead of Federal Reserve Chairman Ben Bernanke’s speech at the Jackson Hole symposium.

Most European markets fell Wednesday as investors remained watchful waiting for the euro zone policymakers to come up with stimulus measures to rejuvenate the faltering economy.