Most of the Asian markets rose Friday as investor confidence was lifted after German Chancellor Angela Merkel stressed her country's commitment to support measures to alleviate the debt crisis faced by the euro zone.

Shares firmed Friday as German Chancellor Angela Merkel voiced support for the European Central Bank's efforts to contain the euro zone's debt crisis, soothing investor nerves and prompting them to scale back safety bids.

Trading in U.S. stocks has been going on at a snail's pace recently, a fact market-watchers are blaming on policy uncertainty, but could also be the result of investors fed up with the fragmented, unpredictable nature of the market.

18 people are dead in new violence at the Lonmin Platinum Mine in South Africa.

Platinum prices surged after South African authorities Thursday killed an undetermined number of miners protesting at a massive platinum northwest of Johannesburg.

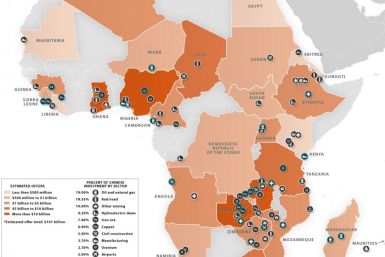

China may have lost out in its mad dash to get the most gold at the London Olympics this summer, but the country is seemingly still running the race for gold where it counts, as it is currently in the process of bidding for a major African gold miner.

Time Warner Inc. (NYSE:TWX), the fourth-largest media conglomerate by market capitalization, and World Wrestling Entertainment Inc.(NYSE:WWE) are hoping an unlikely brand collaboration will create a hit.

Investors rewarded Portugal's efforts to trim its budget gap by sending the credit-default swaps on Portugal to a low of 725 basis points on Thursday, down from 1,515 in January and 1,237 in May, according to Bloomberg. The implied probability of Portugal defaulting on its debt fell to 46 percent from 73 percent.

President Dilma Rousseff said the investment will include the laying of 6,200 miles of train tracks and building or widening 4,660 miles of federal highways.

The number of Americans lining up for new jobless benefits rose slightly more than expected last week, the Labor Department said Thursday, suggesting little improvement in the labor market.

India's leading carmaker Maruti Suzuki will restart production at its Manesar plant August 21, almost a month after the plant was shut down following violence by workers.

Gold prices are set for a 12th consecutive year of gains despite posting the largest quarterly drop since 2008 in the second quarter, a view likely shared by the World Gold Council, and billionaire investors George Soros and John Paulson.

Electronic Arts Inc, Coinstar Inc, Cisco Systems Inc, Netflix Inc, Frontline Ltd, Knight Capital Group Inc, Facebook Inc and Nokia Corp are among the companies whose shares are moving in pre-market trading Thursday.

Demand for gold by central banks and official sector institutions were more than double the level reported a year ago, as emerging market central banks continue to gobble up gold due to concerns about fiat currencies, such as the U.S. dollar and especially the euro, according to World Gold Council data released Thursday.

There comes a time in the life cycle of most commodities when China, home to 1.3 billion people and counting, takes over as the world's biggest consumer. For gold, that moment is drawing near.

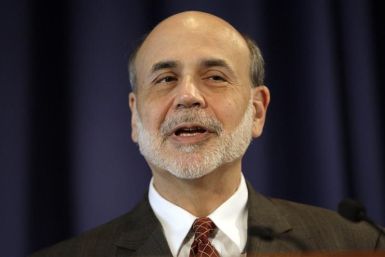

Two years after Federal Reserve Chairman Ben Bernanke announced plans for a massive second round of monetary stimulus at a yearly Fed summit in Jackson Hole, Wyo., market watchers are beginning to take odds on the chances that his speech at this year's Jackson Hole summit could produce a similar announcement.

The Canadian Auto Workers and the Detroit Three, General Motors Company (NYSE: GM), Ford Motor Company (NYSE: F) and Chrysler Group LLC, began preliminary contract negotiations on Tuesday, and the fate of Canadian auto manufacturing may hang on the talks.

An Aeroflot passenger jet carrying 253 people from New York to Moscow Thursday made an emergency landing at Keflavik International Airport in Iceland after a bomb threat.

U.S. stock index futures point to a slightly lower open Thursday ahead of the Labor Department's weekly jobless claims data and Census Bureau's reports on housing starts and building permits.

European markets were mixed Thursday as investors remained cautious waiting for policymakers to announce monetary easing measures which could stop the weakening of the euro zone economy and revive growth momentum.

The Indian rupee fell to a two-week low of 56.00/02 paise against the dollar in the morning trade Thursday, tracking the strengthening of the dollar in the global market. The dollar gained globally, chasing the upbeat U.S. data of retail sales which eased the concerns about the monetary control.

Asian markets were mixed Thursday as investors maintained a watchful mode awaiting monetary easing measures from policymakers around the world to tackle the weakening of the global economic growth.

Asian shares steadied Thursday as investors took to the sidelines, waiting for more clues over the timing and extent of any further stimulus to tackle the euro zone's debt crisis and support global growth.

With the national housing market showing signs of a rebound, analysts are saying shadow inventory might not be such a threat after all.

Mark Thompson, the new CEO of the New York Times Co. (NYSE: NYT), faces numerous challenges at the newspaper -- including skepticism from his new employees.

U.S. homebuilder confidence rose in August to the highest level since February 2007 as more buyers entered the market, according to the National Association of Home Builders/Wells Fargo Housing Market Index.

U.S. industrial output expanded last month at the fastest pace since April and manufacturing notched another solid advance, hinting at underlying resilience in an economy that has struggled to establish momentum.

Consumer prices were flat in July for a second straight month and the year-over-year increase was the smallest since November 2010, giving the Federal Reserve room for further monetary easing to tackle stubbornly high unemployment.

Leaders of a union that operates Colombia's main coal railway met Wednesday to decide how to respond to a unanimous court ruling declaring its three-week strike illegal.

Herbalife Ltd, Nokia Corporation, National-Oilwell Varco Inc, Knight Capital Group Inc, Ellington Financial LLC, ArcelorMittal and MCG Capital Corporation are among the companies whose shares are moving in pre-market trading Wednesday.