Who was the biggest buyer of U.S. commercial real estate in the past 12 months? It wasn't a big private equity firm or luxury developer. Rather, it was the estate of Lehman Brothers, which is still making deals nearly four years after its demise.

Walcott’s accomplishments presents some good news for a country desperately in need of some.

Saks Inc. (NYSE: SKS) and Michael Kors Holdings Ltd. (NYSE: KORS) are both benefitting from wealthy consumers, offsetting global economic turmoil and an uncertain U.S. economy, the companies said Tuesday.

Groupon Inc. (Nasdaq:GRPN) saw shares in the company drop by nearly a quarter of their total value Tuesday -- to all time-lows -- after the Chicago-based daily-deals business reported revenue figures that badly missed analyst expectations.

Retail sales in the U.S. rose in July for the first time in four months and topped economists' forecast as demand rose across the board from cars to building materials, suggesting that the biggest driver of the economy is gaining momentum.

Banco Santander S.A., Mellanox Technologies Ltd, Agrium Inc, Pizza Inn Inc, Newmont Mining Corp, Citigroup Inc, Caterpillar Inc and Groupon Inc are among the companies whose shares are moving in pre-market trading Tuesday.

Amid constant political caterwauling about the demise of American manufacturing, Japanese automakers like Toyota Motor Corporation (NYSE: TM), Honda Motor Co. (NYSE: HMC) and Nissan Motor Co. (Tokyo: 7201) are gradually bringing manufacturing jobs to North America by building new factories and adding extra shifts to meet resurgent demand in the U.S. automotive market.

U.S. stock index futures point to a higher open Tuesday amid hopes that central banks around the world will announce stimulus measures to boost the economy and regain the growth momentum.

Most of the European markets rose Tuesday as investors were hopeful that the ECB will soon announce stimulus measures as the GDP data from Germany and France indicate that the euro zone economy continues to falter.

As India gets ready to celebrate its 66th Independence Day August 15, it appears to be no time to rejoice with its economy faltering as a result of the global economic slowdown and weak governance.

The top after-market Nasdaq gainers Monday were Array BioPharma Inc, Momenta Pharmaceuticals Inc, Aixtron SE, HMS Holdings Corp and Monster Beverage Corporation. The top after-market Nasdaq losers were Envivio, Groupon Inc, Coinstar Inc, Myrexis Inc and Boingo Wireless.

Inflation probably crept up in July as poor monsoon rains drove food prices higher, a Reuters polls showed on Wednesday, giving the RBI less room to cut interest rates to revive a flagging economy.

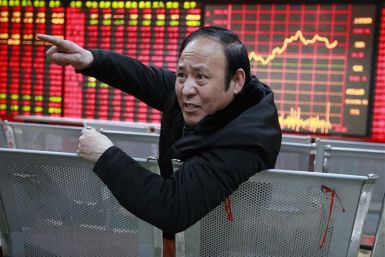

Asian shares steadied Tuesday with investors staying sidelined ahead of more figures from Europe and the United States later in the day, after recent data showed the euro zone's debt woes were eroding business activity globally.

Archstone, the largest private U.S. residential landlord, will benefit from a strong urban portfolio and experienced management team as it prepares to go public for the second time, said analysts.

Gasoline production issues and tensions between Iran and Israel have sent U.S. gasoline prices above $4 per gallon in some cities, and prices likely won't fall until October, according to gasoline analysts.

I have no idea what “Red Hook Summer” is about -- it is about many things, or about nothing (I'm pretty sure Spike Lee doesn't know either).

Focus Media Holding Limited, Research In Motion Limited, Google Inc, Knight Capital Group Inc, CenturyLink Inc, Logitech International SA, Facebook Inc and J.C. Penney Company Inc are among the companies whose shares are moving in pre-market trading Monday.

U.S. stock index futures point to a lower open Monday as investor confidence was dragged down by concerns about the weakening of the global economy following the fragile gross domestic product growth in Japan in the second quarter.

Most of the European markets fell Monday as investors were disappointed to note that the economic growth slowed down in the second quarter in Japan indicating that the global economy continues to falter.

Japan's economic growth slowed down in the April-June quarter compared to the first three months of the year, indicating that the country is losing growth momentum affected by soft global demand and weak consumer spending.

Legendary investor and billionaire George Soros announced that he is engaged and all set to marry his girlfriend of last four years, Tamiko Bolton, during his 82nd birthday celebration on August 11.

India's Oil and Natural Gas Corporation (ONGC) on Saturday announced a big oil discovery in the currently producing D1 oilfield off the West Coast that will boost the state-run firm's declining oil production.

Asian stock markets ended with gains last week as sentiment continued to improve on hopes that the European Central Bank would shortly take policy action to lower the peripheral bond yields of struggling nations such as Italy and Spain.

India's struggling private air carrier Kingfisher Airlines Saturday reported a 147 percent increase in its loss to 6.51 billion rupees for the quarter ending June 30, compared with a loss of 2.64 billion in the same period a year ago.

With South Korea's economy continuing to slowdown, investors feel that the Bank of Korea (BoK) will be under pressure to announce monetary easing measures at the next meeting in September.

Asian markets gained this week on buoyed investor confidence with indications of an improving U.S. economy and the hopes of an announcement of stimulus measures by China to regain the economic growth momentum.

The top after-market NYSE gainers Friday were MasTec, Oasis Petroleum, Matador Resources, Janus Capital Group and Putnam Municipal Opportunities Trust. The top after-market NYSE losers were Imperva, Ocwen Financial Corp, Radioshack Corp, Game Stop Corp and Permian Basin Royalty Trust.

Chinese conglomerate Wanxiang Qianchao Co. (Shanghai: 000559) is offering a $450 million lifeline to struggling battery manufacturer A123 Systems Inc. (Nasdaq: AONE), but the deal is facing right-wing opposition in the U.S.

Major data releases aplenty are on the economic calendar next week. In the U.S., investors will focus on July retail sales, industrial production, and consumer prices. In the euro zone, second-quarter gross domestic product figures across the major economies and the German ZEW index are the main highlights.

The 2012 Editors Poll, released on Friday, solicited data from editors at newspapers, magazines, trade publications and websites. It showed that 61 percent of the editors polled do not believe their publication will increase freelance pay rates in the next 12 months, compared to only 8 percent who thought that an increase is likely.