Asian stock markets mostly declined Monday as fears of a further global slowdown and economic headwinds from the euro zone continued to weigh on the sentiment.

European markets fell Monday as investors remained concerned about the debt crisis lingering over the euro zone.

Crude oil futures advanced Monday as U.S. companies shut down nearly a quarter of oil and natural gas production in the Gulf of Mexico because of the intensifying weather caused by Tropical Storm Debby.

Most Asian markets fell Monday as investor sentiment continued to be dragged down by concerns over the looming debt crisis in the euro zone.

Five years into the most significant global financial crisis since the 1930s, the world's leaders have formulated neither the fiscal policies nor the monetary policies required to deal with it, according to the Bank for International Settlements' 82nd Annual Report, which was released Sunday.

The market sentiment is likely to remain subdued in the coming week as increasing expectations of a further global slowdown and economic headwinds from the euro zone will continue to weigh.

An inch of time is an inch of gold, but you can't buy that inch of time with an inch of gold. Does this Chinese proverb ring true in the case of Indians who invest in gold for a 'good time' tomorrow? Or is the craze for the yellow metal ruining the country's economy?

The top after-market NYSE gainers Friday were: Teva Pharmaceutical, Lloyds Banking Group, Thompson Creek Metals Company, St. Jude Medical and Flotek Industries. The top after-market NYSE losers were: Hovnanian Enterprises, MGIC Investment Corp, Astrazeneca Plc, Tejon Ranch and 3D Systems Corp.

Most Asian markets fell this week as investors were worried after the U.S. Federal Reserve refused to announce a further round of quantitative easing and the HSBC Flash Purchasing Managers Index (PMI) indicated that China's manufacturing activity was faltering.

The Amazon.com Inc. launch of AmazonSupply in April indicates the shift to online from offline commerce continues apace among industrial consumers, which increasingly prefer to buy goods electronically.

A list of winners and losers in the world of business and economics for the week of June 17.

While coal has powered the 19th-century Industrial Revolution, heated homes and generated electricity, the era of King Coal has come to an end.

Walgreen Co. (NYSE: WAG), the largest U.S. drugstore operator, is facing challenges it has never seen in its 111-year history, and this week it responded to those challenges with a high-stakes strategic move.

Forget the currency crisis: On Thursday, the Euro that counts is the soccer championship, pitting Germany versus Greece in the quarterfinals. Rarely in history have sport, politics and economics mixed so deeply.

The European Central Bank said Friday it was easing the collateral rules on certain asset-backed securities currently pledged by banks as backing for ECB loans. Specifically, the bank will accept lower-quality securities as collateral for loans made to banks without demanding higher cash collateral, as had been the case in the past.

Suicide now ranks as the second leading cause of death among Indian youth.

Harvest Natural Resources, Sony Corp., Morgan Stanley, Banco Santander, Deutsche Bank, Jack in the Box, Statoil and IHS Inc. are among the companies whose shares are moving in pre-market trading Friday.

South Asian taxi drivers not only have a very hard and thankless profession, but they are caught in a vortex of prejudice in which they are both the victim and perpetrators of racism and discrimination.

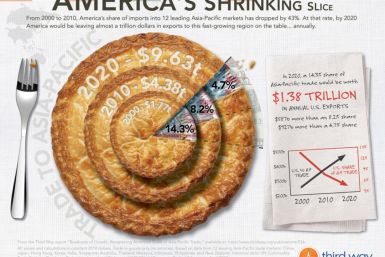

Four years ago, for every five shipping containers that Asia sent to the U.S., America sent back only two, resulting in gluts of empty containers at U.S. West Coast ports and a widening trade deficit with countries like China and Japan.

U.S. stock index futures point to a higher open Friday, but investors are expected to remain watchful amid weak data across the globe following the downgrading of 15 global banks by ratings agency Moody's on Thursday.

Asian stock markets declined Friday, following a slump in the Wall Street overnight, as weak manufacturing reports from Europe, China and the U.S. dampened hopes for a global economic recovery.

European markets fell Friday as concerns about the economic slowdown were revived after data from the euro zone was disappointing and 15 global banks were downgraded by Moody's Investor Service.

Crude oil prices slightly advanced in Asian trading Friday, after plunging to their lowest level in eight months in the previous session.

The top after-market Nasdaq gainers Thursday were Metabolix, Inc, Interval Leisure Group, Inc, Crosstex Energy, Inc, BioMimetic Therapeutics, Inc and Gevo, Inc. The top after-market Nasdaq losers were: Verisk Analytics, Inc, James River Coal Company, Amyris, Inc, Incyte Corporation and Netlist, Inc.

Most Asian markets fell Friday due to investor concerns following indications of a faltering U.S. economy and the downgrading of global banks by Moody's Investor Service.

The top after-market NYSE gainers Thursday were: Harvest Natural Resources, McEwen Mining, BRF-Brasil Foods, AVX Corp and Parker Drilling. The top after-market NYSE losers were: Ryder System, Associated Estates Realty, Main Street Capital, Renren and Wesco Aircraft Holdings.

Asian shares fell Friday and the safe-haven dollar hovered near its highest in a week-and-a-half after weak manufacturing data from the United States, Europe and China heightened fears over the outlook for global growth.

Moody's Investors Service downgraded 15 global financial institutions Thursday, including five of the largest U.S. banks, nine major European banks and the Royal Bank of Canada (NYSE: RY), a move that could tighten borrowing and require the companies to post billions of additional collateral.

Markets are losing the power to ride high after positive political developments, a worrying trend that might rain chaos on the best laid plans of central bankers and politicians looking to buy time to solve the financial crisis in Europe with grandiose statements.

Spain's banks would need between 51 billion and 62 billion euros ($64-78 billion) in extra capital to weather a serious downturn of the economy and new losses on their books, two independent audits of the sector showed on Thursday.