Various developments across Europe boded ill for future fiscal integration in the Continent, a move many see as the only way to resolve the fundamental issues underlying the current sovereign debt crisis roiling the euro zone.

Fed Chairman Ben Bernanke said Wednesday job growth was better than expected and inflation under control, leaving markets thinking central bank intervention was a long way off. The upshot was a dollar rally that hammered gold, stocks and government bonds.

General Motors Co. said Wednesday that the company has entered into a long-term and broad-scale alliance with French automaker PSA Peugeot Citreon to share vehicle platforms, components and modules and jointly purchase goods and services from suppliers. As part of the agreement, GM will purchase a 7 percent stake in Peugeot.

Gasoline prices across the nation jumped 16 cents since last week and could go higher. Part of the high cost is a tiny city in Oklahoma.

Gas prices in the U.S. are increasing. Is it possible we’ll see a $5 gallon anytime soon? Signs point to yes.

The Dow Jones Industrial Average crossed 13,000 at Tuesday's market close, while the S&P 500 rose above 1,370, but a bullish psychological impact could actually drag down the market in days to come.

U.S. Federal Reserve Chairman Ben Bernanke played killjoy Wednesday morning, delivering a somewhat pessimistic assessment of the nation's economic condition in a semi-annual address to the House of Representatives.

Rising gasoline prices will not threaten soaring new car sales that have the auto industry on pace for an even more impressive recovery year than originally expected, analysts say.

The number of employed Germans declined slightly in February, but a statistical sleight-of-hand means the unemployment rate held steady at 6.8 percent, the lowest level since Germany became the republic that it is today.

Mexico economic growth has been strong in the wake of the Great Recession, thanks in large part to its fiscal and monetary discipline, said Dallas Federal Reserve Bank chief Richard Fischer in a speech in New Mexico.

The Nasdaq Composite Index briefly crossed the 3,000 mark Wednesday for the first time in 12 years, boosted by the European Central Bank's action to increase liquidity in the euro zone financial system and a better-than-expected revision to the U.S. quarterly economic growth.

Factory activity in the Midwest accelerated in February after falling for two consecutive months, fostering hopes that the world's largest economy has gained momentum.

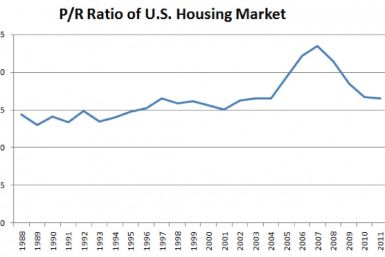

Warren Buffett's real estate forecast for 2012 and beyond is extremely rosy. In some cases, he even recommended buying them over his favored equity investments in a diversified group of leading companies.

The European Central Bank gave the world's financial system a €529.5 ($712) billion Leap Year Day gift, providing financial institutions with that amount in one percent-interest, three-year loans this week, the bank announced Wednesday morning.

Rupert Murdoch's younger son, James, is resigning as executive chairman of U.K.-based newspaper publisher News International, its parent, New York-based News Corp. announced Wednesday.

The U.S. economy grew a bit faster than initially thought in the fourth quarter on slightly firmer consumer and business spending, which could help to allay fears of a sharp slowdown in growth in early 2012.

Automakers will report nearly 1.09 million new cars in February on Thursday, according to two industry forecasts, continuing the ongoing revival of the industry as sales jumped nearly 6 percent from February 2011 and an eye-popping 20 percent from January. That would equal a seasonally adjusted annual rate (SAAR) above 14 million units -- the highest level since early 2008.

The European Central Bank on Wednesday said it distributed €530 billion in cheap, three-year loans to 800 lenders, in the central bank's latest bid to stem the euro zone financial crisis. The new loans are in addition €489 billion in similar lending that the ECB disbursed to more than 500 banks in December.

The top aftermarket NYSE gainers Tuesday were: Lsb Industries Inc, Assured Guaranty, Southwestern Energy, Collective Brands and DeVry Inc. The top aftermarket NYSE losers were: Kodiak Oil & Gas, Ferro Corp, Kayne Anderson MLP Investment, Darden Restaurants and FXCM Inc.

The top after-market NASDAQ losers Tuesday were: TeleTech Holdings, Dreamworks Animation SKG, First Solar, Universal Display Corp, Pacific Sunwear of California, Infosys Ltd, Scientific Games Corp, pSivida Corp, Exterran Partners and Novellus Systems.

European stock markets gained in early trade Wednesday ahead of second 3-year long-term refinancing operation (LTRO) by the European Central Bank.

Standard Chartered Plc said Wednesday it posted an increase in profit of 12 percent last year subsequent to robust revenue growth in both wholesale and consumer banking.

The top after-market NASDAQ gainers Tuesday were: Verisk Analytics, Web.com Group, American Public Education, VIVUS, SodaStream International, Cadence Pharmaceuticals, Pan American Silver, Sun Healthcare Group, PetSmart and Golar LNG Ltd.

India's economic growth slowed to its weakest annual pace in almost three years in the three months to December, as high interest rates and rising input costs constrained investment and manufacturing. GDP rose 6.1 percent in October to December compared with a year earlier, a lower-than-expected increase, figures from the statistics office showed.

International Business Machines Corp. (IBM) has fired more than 1,000 workers in North America this week, according to an advocacy group for the company’s employees.

Market participants are seemingly expecting European banks to take up a massive amount of euro over the next 24 hours, as the European Central Bank offers them a second helping of ultra-low cost loans. The banks themselves, not so much.

Exporting to Brazil could be a hot idea for U.S. companies.

Here's why the Dow closed above 13,000 for the first time since 2008, indicating that the stock market has finally returned to its pre-recession level.

Markets closed higher Tuesday through a choppy session, as indicators gave conflicting signals on the U.S. economy, while Ireland announced it would hold a referendum on Europe's new fiscal treaty. All eyes are now turned to European Central Bank's second liquidity injection set to take place Wednesday.

The Dow closed above 13,000 for the first time since 2008 on Tuesday and the S&P 500 also hit a milestone, as buoyant U.S. consumer confidence data and a sharp drop in oil prices nudged the nearly five-month rally forward.