U.S. stocks plummeted Wednesday in a global stampede toward investments perceived as capable of withstanding a severe European downturn, or worse.

Now that Groupon has finally gone public, raising $700 million through its Nov. 4 IPO, how about some others in the pipeline as well as the king of them all, Facebook?

Stocks tumbled 3 percent on Wednesday, erasing gains for the week so far, as a spike in Italian bond yields fanned worries about contagion in the European debt crisis.

Maidenform Brands, Inc. (NYSE:MFB) badly missed Wall Street estimates for quarterly results released Wednesday, as the company faced sagging demand for the bras that support the bulk of its sales. The company's results, specifically its breakdown of sales growth by retailer type, painted an unflattering picture of a consumer economy weighed down by recessionary pressures.

Fire broke out on Wednesday on the Okordia/Rumuekpe oil pipeline in Nigeria and some production has been shut down, but the blaze has since been put out, a spokesman for operator Royal Dutch Shell said.

Gabon's oil union ONEP has re-launched talks with the government on a dispute over the use of expatriate labour, averting for now the threat of a strike in the sector.

SABMiller's Zimbabwe unit registered a 46 percent increase in earnings in the half-year to September, driven by strong beverage sales growth as the country's economy continues to recover.

South African assets fell on Wednesday when investors were spooked by a ratings outlook downgrade of the domestic economy, which added to market fears over the euro zone debt crisis.

Global markets stampeded Wednesday after the bond market signaled that Europe's third-largest economy can no longer survive without a rescue.

The top pre-market NASDAQ Stock Market gainers are: SodaStream International, Yongye International, KIT digital, Universal Display, and City Telecom HK. The top pre-market NASDAQ Stock Market losers are: Rovi, Blue Nile, STEC, Alaska Communications Systems Group, and China GrenTech.

Toronto's main stock index looked set to open lower on Wednesday, hurt by weaker commodity prices as doubts about Italy's ability to tackle its debt problems persisted even after Prime Minister Silvio Berlusconi pledged to resign.

Malaysia wants economic growth. It wants to catapult itself from a middle-income country to a high-income country.

Germany's wise men panel of economic advisers warned the European Central Bank it risks losing credibility by buying the bonds of heavily-indebted euro zone states, and that monetary and fiscal policy are becoming worryingly blurred.

Canadian miner Timmins Gold Corp (TMM.TO: Quote) swung to a second-quarter profit as it sold more gold at higher prices.

Quebecor Inc's (QBRa.TO: Quote) third-quarter profit fell 69 percent, hurt mainly by a charge related to its move toward a new accounting method and higher costs.

Jefferies said PMC-Sierra Inc.'s (NASDAQ: PMCS) cloud/storage and mobile backhaul overcome wireline weakness.

After swallowing months of cost increases that have eaten into their bottom lines throughout 2011, the nation's largest restaurant chains are positioning themselves to dish out incremental price increases to patrons over the next couple of months.

European stocks were lower at midday Wednesday as mounting concerns over Italy's debt kept investors on edge, following an early rally sparked by Silvio Berlusconi's pledge to step down as Italy's prime minister.

Argentina's biggest energy firm YPF has announced that it had found nearly a billion barrels in unconventional energy resources in Patagonia. YPF is the Argentine unit of Repsol YPF SA, Spain's largest oil group.

Barclays Capital believes that iCloud could be Apple Inc.'s (NASDAQ: AAPL) most important new service since the launch of iTunes in 2003.

The French economy will stagnate in the last quarter of the year, the Bank of France said on Wednesday, the latest sign it is losing momentum as fiscal austerity and Europe's debt crisis depress private sector activity.

The top after-market NASDAQ Stock Market gainers are: Universal Display, EZCORP, HMS Holdings, Smart Balance, and Silicon Graphics International. The top after-market NASDAQ Stock Market losers are: Rovi, Powell Industries, STEC, Blue Nile, and Rubicon Technology.

State Bank of India, the country's top lender, beat estimates with a 12.4 percent rise in quarterly net profit but a rise in non-performing assets disappointed investors.

European shares looked set to follow Asian equities higher Wednesday and the euro steadied after Italian Prime Minister Silvio Berlusconi said he would resign, raising hopes the debt-ridden country would proceed with reforms that may keep Europe's debt crisis from spreading.

The annual inflation rate in China fell to 5.5 percent in October as a result of the government measures to curb rapidly rising prices.

China's annual inflation rate fell sharply in October to 5.5 percent in a further pullback from July's three-year peak, giving Beijing more room to fine tune policy to help an economy feeling the chill of a global slowdown.

The head of the International Monetary Fund warned on Wednesday that Europe's debt crisis risked plunging the global economy into a lost decade and said it was up to rich nations to shoulder the burden of restoring growth and confidence.

China's annual inflation rate eased to 5.5 percent in October, a third straight month of decline from July's three-year peak and Premier Wen Jiabao said prices had fallen further since then.

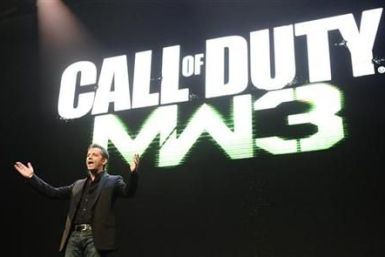

Activision Blizzard, Inc. and Take-Two Interactive both beat Wall Street consensus Tuesday, as the companies each reported better-than-expected sales for the current quarter. However, the similarities between the companies' results end there.

The Kenyan shilling gained against the dollar on Tuesday aided largely by banks selling greenbacks as high interest rates squeezed shillings out of the market, while stocks edged lower in thin volumes.