The Dow Jones Industrial Average climbed back above 12000, boosted by a major telecommunications deal and a jump in energy stocks as oil prices leapt.

US stocks jumped higher on positive news from Japan and AT&T’s acquisition of T-Mobile.

G7’s coordinated effort to weaken the Japanese yen was a surprise to most. Douglas Borthwick of Connecticut-based Faros Trading, however, anticipated this development.

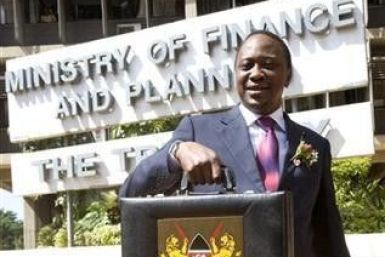

Kenya plans to remove tax incentives in the 2011/12 (July-June) fiscal budget and widen collection to rope in more small businesses to increase revenues, Finance Minister Uhuru Kenyatta said on Monday.

Charles Schwab said it agreed to buy optionsXpress Holdings for about $1 billion in stock to expand in the fast-growing options trading space.

RBC Capital Markets anticipates a dividend increase from SunTrust Banks Inc. (NYSE: STI) to come either in the second quarter or the third quarter of 2011. The brokerage expects the quarterly dividend to go to 8 cents a share (about 20 percent payout).

Existing home sales in the US fell more than expected in February, indicating an uneven recovery in the housing industry. Sales of previously owned homes dropped 9.6 percent to 4.88 million in February compared with an upwardly revised figure of 5.40 million in January, the National Association of Realtors said on Monday.

Citigroup announced a 1-for-10 reverse stock split of its common stock and plans to reinstate a quarterly dividend of $0.01 per common share in the second quarter of 2011.

US stocks advanced in early trade on Monday as sentiment was buoyed after Japan made progress in its battle to control radiation leaks at a crippled plant, and AT&T announced that it will buy T-Mobile USA from German company Deutsche Telekom to create the largest mobile provider in the United States.

The companies whose shares are moving in pre-market trade on Monday are: Tiffany & Co, Hartford Financial, Coach, Joy Global, EMC Corp, General Electric, Nvidia, Sprint Nextel, American Tower and CF Industries Holdings.

The top pre-market NASDAQ stock market gainers are: Curis, TGC Industries, Verigy, Leap Wireless International, and Magic Software Enterprises. The top pre-market NASDAQ stock market losers are: Xenoport, Dish Network, DIRECTV, and Universal Display.

Sprint and Clearwire are now more likely to merge as the cheapest and fastest route for Sprint to have a nationwide 4G network would be via Clearwire.

Though the human tragedy caused by the Japan disaster is incalculable, its economic impact may be less harsh than previously thought. An analyst said on Monday there will be some near-term impact but it will not be sufficient to dent the region’s strong growth prospects this year.

Shares of Celera Corp. (NASDAQ: CRA) touched a new 52-week high of $8.42 on Friday, as it agreed to be acquired by Quest Diagnostics Inc. (NYSE: DGX) for $8 a share or about $344 million in cash, net of $327 million in acquired cash and short-term investments.

US stocks ended higher on Friday as sentiment was buoyed after Libya announced a cease-fire and the Group of Seven (G-7) Finance ministers agreed to intervene in the markets to stabilize the Japanese yen.

U.S. stocks climbed higher Friday, as fears of increased violence in Libya ebbed and currency interventions helped to relieve investor worries over Japan's economy.

A study at the New England Complex Systems Institute has found that increasing co-movement in stocks may precede violent market crashes.

Prices to Buy Gold rose above $1418 per ounce Friday lunchtime in London, reversing this week's earlier 2.4% drop as crude oil fell and world stock markets rose further after news of an immediate cease-fire by the Gaddafi regime in Libya, prompted by the United Nations' no fly zone agreement.

US stocks rally on news of Libya announcement of immediate ceasefire.

Moody's Japan K.K. has downgraded the ratings on Tokyo Electric Power Co., Inc., (TEPCO) including the senior secured rating, to A1 from Aa2, and the long-term issuer rating to A1 from Aa2.

Shares of companies active in Friday's early trade are Nike Inc., Cisco Systems, Lorillard Inc., LDK Solar Co., Celera, Under Armour and Longtop Financial Technologies.

The impact of the devastating earthquake and tsunami in Japan will only have a limited direct economic impact on the eurozone, according to analysts.

Solid state drives (SSD) in 2011 is expected to a near doubling of revenue and hit more than $4 billion, according to new IHS iSuppli research.

US stocks advanced in early trade on Friday after the Group of Seven (G-7) Finance ministers had agreed to intervene in the markets to stabilize the Japanese yen.

Apple may face supply chain disruptions for its newly launched iPad 2 as a 9 magnitude earthquake in Japan impacted several component makers for the tablet, according to a report from IHS.

The companies whose shares are moving in pre-market trade on Friday are: Celera Corp, James River Coal, Star Scientific, Peabody Energy, Johnson Control, Jds Uniphase, Nike, Polypore International, Autonation and Medco Health Solutions.

Apple may face supply chain disruptions for its newly launched iPad 2 as a 9 magnitude earthquake in Japan impacted several component makers for the tablet.

Adam Cole, global head of FX strategy at RBC Capital Markets, expects yen crosses to trade in narrow ranges as factors limit both the upside and the downside.

Crude oil prices rose in Asian trade on Friday, after the United Nations (UN) approved the imposition of a no-fly zone over Libya, raising fresh fears over oil exports from the country.

U.S. stocks rallied on Thursday, bouncing back from three straight days of losses as better-than-expected reports on jobless claims and Consumer Price Index (CPI) buoyed sentiment, and FedEx Corp. boosted its profit forecast.