Asian stock markets declined Wednesday after details from the Federal Reserve's most recent policy meeting suggest that the central bank was backing away from further monetary easing.

Investors re-adjusted their value calculations for risky assets on Tuesday, selling off stocks, bonds and all manner of commodity futures after the Federal Reserve released minutes from the most recent meeting of its rate-setting committee. The minutes strongly suggested that the U.S. central bank was backing away from the possibility of further monetary easing in the short-run, including any kind of quantitative easing.

Steep depreciation of the Japanese currency is likely before long, the Shanghai-based economist predicts. “A financial bubble doesn't burst slowly. When it occurs, it just pops.

Futures on major US stock indices point to a slightly lower opening Tuesday as investors awaited the report on factory orders and minutes of the latest Federal Reserve's Federal Open Market Committee (FOMC).

The top after-market NASDAQ gainers Monday were: Complete Genomics, Affymetrix, MCG Capital Corp, Urban Outfitters, Oncothyreon and Ctrip.com International. The top after-market NASDAQ losers were: Zoltek Companies, Nortek, Cavium, Team, Teva Pharmaceutical Industries and ArthroCare Corp.

Most Asian stock markets advanced Tuesday as better-than-expected readings on US manufacturing and China's services industries data lifted sentiment while stronger yen hurt Japanese shares.

The top aftermarket NYSE gainers Monday were: Annie's, Fortune Brands Home & Security, 3D Systems, Gafisa SA, Frontline and Armstrong World Industries. The top aftermarket NYSE losers were: Rockwood Holdings, Guidewire Software, Flotek Industries, Vocera Communications and ITT Corp.

Stocks and other risky assets rallied Monday after a widely followed U.S. manufacturing index suggested activity in that industrial sector further strengthened in March.

Most Asian stock markets ended with gains Monday as higher-than-expected reading of China’s official Purchasing Managers Index (PMI) boosted sentiment.

The top aftermarket NYSE gainers Friday were: Roundy's, Rouse Properties, Genco Shipping & Trading, Delek US Holdings, USG Corp and MEMC Electronic Materials. The top aftermarket NYSE losers were: Pioneer Natural Resources, Dean Foods, ExactTarget, Drew Industries, Praxair and Drew Industries Inc.

The top after-market NASDAQ gainers Friday were: Metabolix, AXT Inc, Echelon Corp, Ku6 Media Co, Saba Software and Penford Corp. The top after-market NASDAQ losers were: Nortek, TripAdvisor, Groupon, Vera Bradley, Illumina and Amsurg Corp.

Stocks and other risky assets rallied Friday, rounding out the quarter with even more price gains on a day that encapsulated the main developments of the year so far: encouraging news out of Europe, better-than-expected consumer sentiment in the United States, and the perceived and steady pull of inflation.

Futures on major US stock indices point to a higher opening Friday ahead of a wave of economic data including core PCE price index and Chicago PMI.

The top after-market NASDAQ gainers Thursday were: OraSure Technologies, GRAVITY Co, Pacific Biosciences of California, Digital River, Saba Software and Aceto Corp. The top after-market NASDAQ losers were: Xyratex Ltd, VIVUS, American Realty Capital Trust, Savient Pharmaceuticals, Research in Motion and Orexigen Therapeutics.

The top aftermarket NYSE gainers Thursday were: Fortuna Silver Mines, McEwen Mining, E-Commerce China Dangdang, Accretive Health, Collective Brands and Silvercorp Metals Inc. The top aftermarket NYSE losers were: Vocera Communications, Brandywine Realty Trust, Penn Virginia Corp, CPB Inc, Fresh Del Monte Produce and Humana Inc.

Most of the Asian stock markets ended lower Friday as weaker-than-expected U.S. jobless claims and industrial production data in Japan hurt investors sentiment.

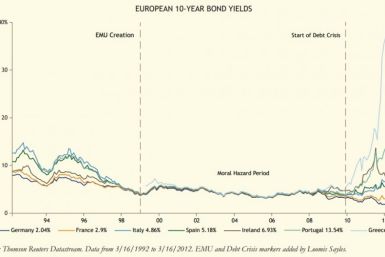

The perception, driven by bonds' performance, that the euro's success would continue unabated was shattered beginning in October 2009, when Greece’s 10-year yields soared to 10.3 percent. Today, U.S. policymakers may be making the same mistake in failing to recognize threats of a coming financial crisis.

Myanmar is eager to rev up its economy with the hard currency that comes with foreign tourists, but officials question just how far to open the doors.

Futures on major US stock indices point to a lower opening on Thursday ahead of economic data including final estimates for fourth quarter GDP and initial jobless claims.

The top after-market NASDAQ gainers Wednesday were: Cleantech Solutions International, Loral Space & Communications, Ultra Clean Holdings, Charming Shoppes, Horizon Pharma and QuickLogic Corp. The top after-market NASDAQ losers were: Central European Distribution, Saba Software, Oncothyreon, Spectrum Pharmaceuticals, Brightcove Inc and Arena Pharmaceuticals.

The top aftermarket NYSE gainers Wednesday were: Collective Brands, Red Hat, Vocera Communications, Guidewire Software, Petroquest Energy and Leapfrog Enterprises. The top aftermarket NYSE losers were: Newcastle Investment, American Greetings, Fortress Investment Group, Western Digital Corp, USG Corp and AVG Technologies NV.

Asian stock markets ended lower for the second day on Thursday as weaker-than-expected US durable goods orders and an unexpected downward revision of Britain's economic growth weighed on the sentiment.

Asian shares eased for a second day in a row Thursday, as investors limited their risk exposures on concerns about growth prospects in the world's two largest economies, the United States and China.

Stocks fell Wednesday as investors were disappointed by a weaker-than-expected reading on durable goods orders, while a plunge in oil prices dragged energy and material shares lower.

The long-term view on gas is bright, and experts say now is the time to invest in the commodity. Gas prices have fallen sharply in recent years, to as low as $2.18 per 1 million BTU this year.

People in Europe drink more alcohol than in any other part of the world, downing the equivalent of 12.5 litres of pure alcohol a year or almost three glasses of wine a day, according to report by the World Health Organisation and the European Commission.

Italy's weak bond auction Tuesday signaled that investors remain concerned about the country and the euro zone region overall.

Window dressing, the practice of stock fund managers buying up top performers as the quarter ends to boost the appearance of success, failed Tuesday to lift the major indexes into positive territory.

Futures on major US stock indices point to a flat opening on Tuesday ahead of reports on home prices and consumer confidence.

The top after-market NASDAQ losers Monday were: Neurocrine Biosciences, Nektar Therapeutics, Apollo Group, ValueVision Media, Gen-Probe, Hi-Tech Pharmacal, Harmonic, Techne Corp, Expedia and Myriad Genetics.