The top after-market NASDAQ gainers Wednesday were: MannKind Corp, Seanergy Maritime Holdings, Savient Pharmaceuticals, Star Scientific, AVEO Pharmaceuticals and NewLead Holdings. The top after-market NASDAQ losers were: Avid Technology, Apogee Enterprises, Zix Corp, Approach Resources, Bruker Corp and Pacira Pharmaceuticals.

The top aftermarket NYSE gainers Wednesday were: McKesson Corp, YPF SA, Jaguar Mining, EXCO Resources and 3D Systems Corp. The top aftermarket NYSE losers were: Barnes & Noble, Muller Water Products, Cloud Peak Energy, Manning & Napier and Lexington Realty Trust.

Asian stock markets gained Thursday, following a rebound on Wall Street overnight on easing eurozone worries and hopes for a better-than-expected US earnings season after solid start from Alcoa.

Equity investors are advised to remember that dividends and capital gains or losses matter; one can't embrace the fact some stocks pay high dividends while ignoring their risk to capital.

Stocks popped Wednesday on both sides of the Atlantic, one day after their worst loss of the year, on easing euro zone worries and hopes for a better-than-expected earnings season.

The top after-market NASDAQ losers Tuesday were: X-Rite, OPNET Technologies, Premier Exhibitions, Applied Micro Circuits Corp, Shuffle Master, Central European Distribution, JDA Software Group, Amylin Pharmaceuticals, Zix Corp and Gencor Industries Inc.

The top aftermarket NYSE gainers Tuesday were: Owens-Illinois, Och-Ziff Capital Management, Guidewire Software, Alcoa, Koninklijke Philips Electronics and Generac Holdings Inc. The top aftermarket NYSE losers were: Perini Corp, Computer Sciences Corp, Leapfrog Enterprises, QR Energy, Hospitality Properites Trust and Newcastle Investment Corp.

Asian stock markets declined Wednesday, following an overnight slump in Wall Street as surge in Spain’s borrowing costs reignited concern over the eurozone debt crisis.

The top after-market NASDAQ gainers Tuesday were: Mattress Firm Holding Corp, Standard Microsystems Corp, Century Aluminum, Spectrum Pharmaceuticals, NXP Semiconductors, Smith & Wesson Holding Corp, L&L Energy, James River Coal Co, Activision Blizzard and NutriSystem Inc.

Stocks extended their longest and deepest slump of the year on rekindled worries about the euro zone crisis along with nervousness about first-quarter corporate earnings.

The top after-market NASDAQ gainers Tuesday were: Adept Technology, Washington Federal, Affymax, Federal-Mogul Corp, Arena Pharmaceuticals, GRAVITY Co, Orexigen Therapeutics, Tractor Supply and Century Aluminum Co.

Futures on major US stock indices point to a higher opening Tuesday as investors closely watch the start of US corporate earnings.

Most Asian stocks ended lower Tuesday, following a slump in the Wall Street overnight as disappointing March employment report raised concerns about the strength of recovery in the world’s biggest economy.

The top aftermarket NYSE gainers Monday were: C&J Energy Services, Visteon Corp, Centene Corp, Brookdale Senior Living, Hovnanian Enterprises and Alere Inc. The top aftermarket NYSE losers were: FX Alliance, Carnival Corp, Standard Pacific Corp, Vantiv, McClatchy and PPL Corp.

The top after-market NASDAQ losers Monday were: VIVUS, Harmonic, Shutterfly, Finish Line, Ocean Rig UDW, Power-One, Associated Banc, Schnitzer Steel Industries, Vertex Pharmaceuticals and China Real Estate Information Corp.

Asian shares eased Tuesday as investors cautiously awaited Chinese trade data to gauge whether the world's second-largest economy could achieve a soft landing, after a sharp slowdown in U.S. jobs creation clouded prospects for global growth.

The risk-on sentiment ginned up by the kindness of western central banks plus the first quarter's good weather, which pulled forward consumer spending and construction activity, is fading.

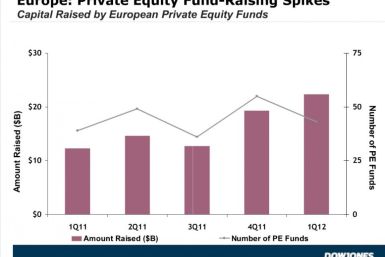

European private equity funds raised 82 percent more capital in the first quarter of 2012 compared to the same period last year, according to Dow Jones LP Source, a research service for the industry.

U.S. stocks fell hard Monday after a surprisingly weak jobs report on Friday left investors hunting for safety rather than big returns.

Futures on major US indices point to a lower opening Monday after US non-farm payrolls data showed that the world's biggest economy added fewer-than-expected jobs in March.

Asian stock markets declined for the fourth day on Monday as weaker-than-expected US employment report raised concerns about the strength of recovery in the world’s biggest economy.

The top after-market NASDAQ gainers Thursday were: NF Energy Saving, Premier Exhibitions, WD-40, Merge Healthcare, MannKind, Crimson Exploration, Foster Wheeler, Caesars Entertainment and Oncothyreon.

The top aftermarket NYSE gainers Thursday were: Parker Drilling, Quicksilver Resources, MEMC Electronic Materials, Penn Virginia Corp, Medifast and McDermott International. The top aftermarket NYSE losers were: Martha Stewart Living Omnimedia, LDK Solar Co, Cooper Companies, InvenSense, Frontline Ltd and Thor Industries.

The top after-market NASDAQ losers Thursday were: Cleantech Solutions International, AsiaInfo-Linkage, Sonus Networks, Affymax, Dendreon Corp, OpenTable, WisdomTree Investments, QLogic Corp and ZELTIQ Aesthetics.

Asian shares eased Friday, when many markets were closed for the Easter holiday, as investors stayed on the sidelines ahead of key U.S. jobs data, avoiding risk after rising yields in weaker euro zone countries refueled concern about Europe.

The head of Traxis Partners still believes U.S. stocks will head higher in coming months, but he's concerned about a near-term pullback as the European debt crisis intensifies and hopes for more Fed bond-buying dim.

Global stocks ended mixed Thursday as solid jobs data and better-than-expected results from retailers failed to offset revived concerns about the euro zone’s fiscal stability.

Spanish borrowing costs Thursday hit their highest levels since before the European Central Bank launched two massive liquidity injections to keep the euro zone's financial system from freezing up.

China has further opened up its domestic share markets for foreign participation, in a bid to ease the tight controls for investments by qualified foreign institutional investors (QFIIs).

Futures on major U.S. indices point to a lower opening Thursday ahead of key weekly jobless claims from the government.