Crude oil prices edge higher in Asian trade Friday, but remained rangebound as renewed concerns over the eurozone debt crisis offset fears over an escalation of violence in Saudi Arabia may threaten crude supply from the Middle East.

Three executives of Japan's Olympus Corp resigned on Thursday ahead of a boardroom showdown with ousted CEO Michael Woodford, as the British whistleblower said he would not be surprised if some criminality were involved in the scandal engulfing the once-venerable firm.

The top after market NYSE Losers on Wednesday were: Quantum Corp, Nabors Industries, MFS Government Markets Income, Daqo New Energy, Weatherford International, Rowan Companies, Halliburton, Exterran Holdings, Diamond Offshore Drilling and Diamond Offshore Drilling.

The top aftermarket NYSE gainers Wednesday were: Xueda Education Group, LyondellBasell Industries, Northstar Realty Finance, Molycorp, Pioneer Natural Resources, Parker Drilling, Safeway, Southwestern Energy, Huntsman Corp and Quicksilver Resources.

The top after-market NASDAQ Stock Market gainers are: Pozen, Andatee China Marine Fuel Services, Power-One, Cirrus Logic, and Spectrum Pharmaceuticals. The top after-market NASDAQ Stock Market losers are: BGC Partners, Jack Henry & Associates, Perion Network, Alaska Communications Systems Group, and Dendreon.

The Austrian banking system is on fire: getting singed not only by the heat of the Eurozone sovereign debt crisis, but also by the immolation of an Eastern European asset bubble the banks had been underwriting for a decade. Stumbling, contradictory guidance from the management of several banks has not helped either. And a stalling Austrian economy is only likely to make things worse

Chinese group Minmetals Resources has extended its $1.3 billion takeover offer for Africa-focused Anvil Mining to December 9, to allow more time to resolve a dispute over contracts with Congo which threatens to scupper the whole deal.

Gold producer and explorer, Goldplat said it expected to make its first shipment from its Kenyan mining project in early 2012, after receiving a mining licence from the government.

Johannesburg stocks fell to their lowest close in a month on Wednesday, as weak Chinese factory data sparked concerns about demand from the world's second-largest economy, hitting miner Assore and luxury good maker Richemont.

South Africa's direct economic exposure to countries at the epicentre of the euro zone debt problems is low, but the risk of increased trade protectionism as a result of the crisis could harm local exports, Deputy President Kgalema Motlanthe said on Wednesday.

Wedbush Securities said UnitedHealth Group Inc. (NYSE: UNH) expects earnings growth in 2012 but flat or declining Commercial and Medicaid earnings; this implies strong Optum and Medicare Advantage growth will drive 2012 earnings growth.

The parent corporations are considering a public float of Nokia Siemens shares in order to dispose of the struggling subsidiary.

The top pre-market NASDAQ Stock Market gainers are: Yahoo, ASML Holding, Brigham Exploration, and First Solar. The top pre-market NASDAQ Stock Market losers are: Diamond Foods, Rambus, Netflix, Groupon, Central European Distribution, and Micron Technology.

Jefferies downgraded its rating on shares of Logica Plc (London Stock Exchange: LOG) to underperform from hold and lowered its price target to 60 pence from 85 pence.

Stock index futures pointed to a weaker open for equities on Wall Street on Thursday, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 down 0.5 to 0.8 percent.

World stocks hit their lowest in six weeks on Wednesday and crude prices fell after and manufacturing in regional heavyweight Germany contracted for a second straight month in November, and at a faster rate, as export demand slumped.

The top after-market NASDAQ Stock Market gainers are: TiVo, Novellus Systems, Casual Male Retail Group, Canadian Solar, and Applied Materials. The top after-market NASDAQ Stock Market losers are: Diamond Foods, Netlist, Gulfport Energy, Sangamo Biosciences, and Expedia.

The collapse in Netflix's valuation is part of a wider wave of grievous losses being felt by shares of companies focused on virtual commerce. After riding a surge of investor enthusiasm to valuation peaks in mid-summer,companies like Netflix and Travelzoo had nowhere to go but down. Short-sellers, chomping at the bit to make bets against the stocks' heady fundamentals, are not exactly helping.

South Africa's state-owned oil company PetroSA said on Tuesday it has received environmental authorisation for its 400,000 barrels-per-day refinery project at the industrial port of Coega.

AngloGold Ashanti, the world's third-largest gold producer, said on Tuesday it expects capital expenditure to double to $1.5 billion dollars by 2013.

Mozambique plans to expand the Quelimane port in the country's Zambezia central province to be able to handle 20 million tonnes of coal per year to meet fast-rising demand from producers setting up in the country, an official said on Tuesday.

Johannesburg stocks rose nearly 1 percent on Tuesday, as investors returned to resource heavyweights African Rainbow Minerals, BHP Billiton and other shares that have been battered down in a recent sharp sell off.

The board of Brazil's Vale has approved a $6 billion expansion of its Moatize coal project in Mozambique to lift output to 22 million tonnes per year from the 11 million tonnes it expects to mine initially, a company official said.

Intel's (INTC) stock has broken out of a four-month range-trading pattern to trade at/near $23.50. Is there more upside ahead with Intel?

Canadian stocks looked set to open slightly higher on Tuesday, in line with stronger commodity prices, though there were signs the respite from worries over U.S. and European government debt could be temporary.

Year-to-date, company shares have plunged about 93 percent.

Wedbush Securities believes Netflix Inc.'s (NASDAQ: NFLX) $400-million concurrent common stock and convertible notes financing were motivated by the company's deteriorating business performance, which in turn triggered liquidity concerns.

The top pre-market NASDAQ Stock Market gainers are: Focus Media Holding, BSD Medical, Brocade Communications Systems, NVIDIA, and E*TRADE Financial. The top pre-market NASDAQ Stock Market losers are: Netflix, Randgold Resources, ASML Holding, Amazon.com, and Shire.

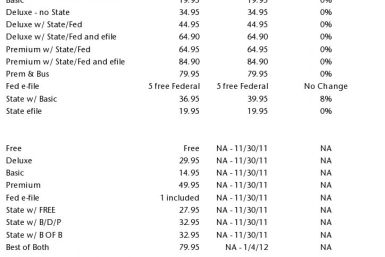

The fight for the 2012 tax season has begun among the companies who provide tax services -- H&R Block Inc. (NYSE: HRB) and Intuit Inc. (INTU).

Stock markets put in gains Tuesday after a heavy session of losses the previous day, though the respite from worries over U.S. and European government debt looked only temporary.