Stocks were little changed on Wednesday as European finance ministers appeared ready to prop up struggling banks while reports on the U.S. labor market and services sector came in stronger than expected.

U.S. stocks opened slightly down after the release of mixed U.S. jobs data.

The top after-market NYSE gainers on Tuesday are: Lithia Motors, Ennis, Freeport-McMoran Copper, Dycom Industries and Concho Resources. The top after-market NYSE losers are: Accuride Corp, Lexington Realty Trust, Strategic Hotels, Precision Drilling and HHGregg.

The top after-market NASDAQ Stock Market gainers are: Stamps.com, Westmoreland Coal, GT Advanced Technologies, Interface and Bon-Ton Stores. The top after-market NASDAQ Stock Market losers are: Acme Packet, Westwood One, NN, Cytori Therapeutics and Spreadtrum Communications.

After one hour of “Let’s talk iPhone” it was an utter disappointment to see iPhone 4S and some new iPod, but not the next-generation Apple’s iPhone 5.

Ratings agency Moody’s has downgraded Italian government bonds by three notches to A2 from Aa2 with a negative outlook.

U.S. stocks were saved from bear market territory and it didn't even take that much.

Ford (F), which did not accept U.S. Government assistance, has rebounded after a restructuring, and is well-positioned to capitalize on U.S. job growth, when it returns with gusto. Is now a good time to consider Ford's shares?

U.S. stocks surged in the last hour of trading on a report that European Union officials are coordinating a rescue for European banks.

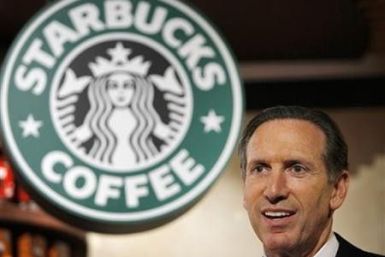

Starbucks CEO Howard Schultz has taken the U.S.’s lack of jobs growth in to his own hands, of sorts. Starbucks and the Opportunity Finance Network have started a new fund to make loans to small businesses and other organizations to spur jobs growth. Every $5 donated will result in $35 in loan money made available.

The stock is up on rumors floating around the market that RIMM has retained an investment banker to ponder strategic options.

Tuesday’s early morning drop has taken the S&P 500 Index down over 20 percent from its May 2 high. Although there is no official definition of a bear market, one commonly accepted metric is falling 20 percent over an extended period.

“Europe was, of course, not particularly successful in the last few months.”

Canadian auto sales fell in September, extending a volatile year with Chrysler's strong performance the lone bright spot among the top manufacturers.

As noted earlier, if Sprint (S) snares Apple’s iPhone 5 this autumn, it could give the cell phone service provider a fighting chance versus AT&T (T) and Verizon (VZ). And that would bode well for Sprint's stock.

U.S stock futures are down on Tuesday as Eurozone debt crisis fears intensified on authorities’ inability to step up and calm the situation.

The top pre-market NASDAQ Stock Market gainers are: SunPower, SodaStream International, Yahoo, Netflix, and LM Ericsson Telephone. The top pre-market NASDAQ Stock Market losers are: Human Genome Sciences, Savient Pharmaceuticals, ATP Oil & Gas, Century Aluminum, and JDS Uniphase.

European finance ministers are considering making banks take bigger losses on Greek debt and have postponed a vital aid payment to Athens until mid-November, setting up a crunch point in the euro zone's sovereign debt crisis.

Sprint Nextel Corp., the third largest wireless and telecommunications network carrier in the U.S., has recently signed a multi-billion dollar deal with California-based Apple Inc. to purchase 30.5 million units of the iPhone 5, over the next four years.

Stock index futures pointed to a lower open on Wall Street on Tuesday, with futures for the S&P 500 down 0.4 percent, Dow Jones futures down 0.5 percent and Nasdaq 100 futures down 0.5 percent at 0841 GMT.

World stocks hit a fresh 15-month low on Tuesday while the dollar neared a nine-month peak on growing doubts over Greece's ability to avert a default that would spark a major banking crisis in Europe and accelerate a global economic slowdown.

Sprint Nextel Corp. reportedly buying 30.5 million iPhones from Apple Inc.

Since July 1, 2002, IBM shares have tripled in value, while Microsoft stock has barely budged.

An aggressive sell-off on Wall Street drove U.S. equity prices to yearly lows, as worries about the developing situation in Europe overshadowed positive reports related to manufacturing and construction indicators.

From its May 2011 high, the index is down about 19 percent, very close to the 20 percent decline required for a bear market.

The Kenyan shilling fell nearly one percent against the dollar on Monday on dollar demand from energy sector importers and the interbank market, while stocks were marginally lower as foreign investors sold on global risk aversion.

Factory activity expanded at a faster pace than expected in September as production and hiring increased, suggesting that manufacturing should help keep the economy out of recession.

Stock index futures pointed to a lower open on Monday as concerns over Greece's teetering finances returned to the forefront and after equities suffered their worst quarter since 2008.

Wedbush Securities sees eBay Inc. (NASDAQ: EBAY) as the best investment in the growth of mobile payments.

The top pre-market NASDAQ Stock Market gainers are: Vermillion, Yahoo, Randgold Resources, Power-One, and S1 Corp. The top pre-market NASDAQ Stock Market losers are: Sangamo Biosciences, Melco Crown Entertainment, Vitesse Semiconductor, Wynn Resorts, and Green Mountain Coffee Roasters.