The continuing sovereign debt crisis in the eurozone and S&P?s downgrade of the U.S. credit rating have increased the safe haven demand for gold and the prices have reached new highs. But investors remain skeptical whether there could be further rally in the price.

Jefferies recently met with Visa Inc. (NYSE: V) management and felt the sessions were upbeat in terms of Visa's competitive positioning, product strategy, post-Durbin initiatives, business model resiliency (regardless of macro climate), and robust, highly visible EPS growth.

The top after-market NYSE gainers on Friday are: Beazer Homes USA, Ralcorp Holdings, Regency Energy Partners, Leapfrog Enterprises and Radian Group. The top after-market NYSE losers are: Stewart Information Services, Stantec, PolyOne Corp, Triumph Group and DSW Inc.

Bund futures dipped Monday following overnight trading that saw equities rebound after a hefty drop last week.

Japan's economy shrank much less than expected in the second quarter as companies made strides in restoring output after the devastating earthquake in March, but a soaring yen and slowing global growth cloud the prospects for a sustained recovery.

Expect Gov. Rick Perry to tout Texas? business-friendly environment now that he?s announced his presidential campaign.

Don?t blame short sellers ? blame the ban on short selling for adding to an already volatile stock market.

China Mobile Ltd , the world's biggest mobile operator, said on Friday it will set up a finance unit with 5 billion yuan ($780 million), in a move that could disappoint shareholders hoping for a dividend hike.

Although they?ve largely avoided enormous layoffs, there?s no reason for Middle Eastern banks to rest on their laurels, says The Islamic Globe.

The Republic of Congo's non-crude revenues rose 25 percent to 500 billion CFA Francs in the first-half of the year, Congo's president Denis Sassou N'Guesso said on Friday, adding the economy needed to ease its reliance on an oil industry poised for decline.

South Africa's rand steadied against the dollar on Friday but faced further losses after a turbulent week in which it hit its weakest levels in more than a year as investors spooked by debt woes in the U.S. and Europe fled to safer havens like the yen.

Record-low borrowing costs in Great Britain are partly behind a small but scrappy real estate boom.

U.S. consumer confidence plunged in August, according to the latest reading. The level is the lowest since 1980.

There?s a chance that S&P could downgrade America?s rating another notch to AA if no serious action is taken on the deficit.

More fake Apple stores spotted in the city of Kunming.

The financier Alex Meruelo is being joined by Meruelo Capital Partners in the purchase of the NBA's Atlanta Hawks.

U.S. July retail sales moved higher, according to the Commerce Department, and stock markets advanced on the report Friday.

MAP Pharmaceuticals Inc. (NASDAQ: MAPP) announced the issuance of a U.S. patent which extends Levadex intellectual property protection to 2028.

The companies whose shares are moving in pre-market trade on Friday are: Nordstrom, J.C. Penney, Prudential Financial, Raytheon, CSX, F5 Networks, Windstream, Carnival Corp, JDS Uniphase, Wynn Resorts and Host Hotels & Resorts.

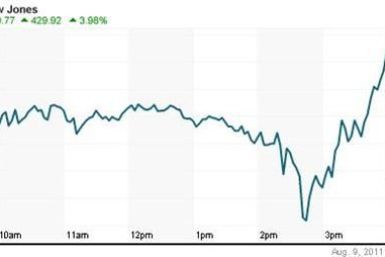

After a week of gyrations that's seen the Dow Jones Industrial Average rise or fall 400 points for four straight days, it's understandable if U.S. investors are bewildered. Given the tumult, what stance should investors adopt now?

The top pre-market NASDAQ Stock Market gainers are: MannKind, NVIDIA, Red Robin Gourmet Burgers, Logitech International, and SodaStream International. The top pre-market NASDAQ Stock Market losers are: Sky-mobi, A123 Systems, Golar LNG, Entegris, and Infosys Technologies.

Housing bonds that are backed by Fannie Mae, Freddie Mac, or Ginnie Mae will all be adjusted.

The top after-market NYSE gainers on Thursday are: Midas, Molycorp, WellCare Helath Plans, Nordstrom, Radian Group, NewJersey Resources, Dillard's and Coca-Cola Enterprises.

The top after-market NYSE Losers on Thursday are: Bally Technologies, Renren, DeVry, Premiere Global Services, Emulex, Humana, Hertz Global Holdings, AMERIGROUP and Transdigm Group.

The top after-market NASDAQ Stock Market gainers are: MannKind, Micromet, NVIDIA, Red Robin Gourmet Burgers, and United Online. The top after-market NASDAQ Stock Market losers are: Body Central, BMC Software, American Superconductor, Southwest Bancorp, and Premier Financial Bancorp.

China's insurance sector has invested 10 billion yuan ($1.6 billion) in mutual funds and local stock markets, focusing mainly on banks and technology shares, following the recent market rout, local media reported on Friday.

South American finance ministers could agree on Friday on ways to strengthen the Latin American Reserve Fund, or FLAR as it is known in Spanish, to protect regional economies from global volatility, Brazilian Finance Minister Guido Mantega said on Thursday.

The Dow Jones industrial average rebounded on Thursday soaring 423.37 points, or 3.95 percent, to 11143.31, after a disappointing 520-point loss on Wednesday, the ninth-largest point drop ever, because of growing fears about the health of Europe's banks and the probabilities of a global economic recession. Meanwhile, the Nasdaq gained 111.63 points, or 4.69 per cent, to 2,492.68.

In the municipal market, the downgrade will likely affect credits directly supported by federal aid and credits that rely on federal support streams for part of total revenues.

The S&P 500 index has not endured such a roller-coaster since in almost three years.