Elizabeth Warren, The Candidate Who Keeps Wall Street Up At Night

With plans to raise taxes on the rich, break up tech giants and tighten regulation on banks and other corporations, Elizabeth Warren is making Wall Street increasingly nervous.

A recent poll showed the Massachusetts senator leading the race to become the Democratic candidate for the US presidential election in 2020.

Among her most vocal -- and colorful -- critics, American billionaire investor Leon Cooperman predicts the stock market will plunge 25 percent if Warren is elected.

"I believe in a progressive income tax and the rich paying more. But this is the... American dream she is shitting on," he told Politico last week.

She wasted no time in hitting back on Twitter: "Leon, you were able to succeed because of the opportunities this country gave you. Now why don't you pitch in a bit more so everyone else has a chance at the American dream, too?"

The 70-year-old progressive candidate built her reputation through years of defending consumers from bad behavior by banks.

Dubbed one of the "New Sheriffs of Wall Street" in 2010 by Time magazine for her role in regulating banks that caused the 2008 financial crisis, Warren has made reining in the financial system a central feature of her presidential campaign.

"Wall Street is generally concerned about Warren. She's advocated a program which entails significant spending, but she hasn't been detailed or helpful on telling us how she's going to finance that spending," said financial advisor Hugh Johnson.

Those costly measures include her campaign promises such as universal health insurance and canceling some college loan debt, and market players worry about the tax increases that may be needed to pay for them.

"An increase in corporate taxes means a drop in their income," said Gregori Volokhine, portfolio manager for Meeschaert Financial Services. And just as is the case with individuals, "Wall Street fears that will cause a decline in consumption."

Warren is focused on taxing the super-rich, with what she calls the "Ultra-Millionaire Tax," which imposes an additional levy of two percent a year on wealth over $50 million -- which would apply to the richest 75,000 households -- and three percent on $1 billion or more.

In the crosshairs

French economist Gabriel Zucman, whose work inspired the plan, estimates that this wealth tax would bring in $2.75 trillion over 10 years.

While critics say Warren's economic program will dig a deep fiscal hole, supporters note that President Donald Trump has exploded the budget deficit, which in the latest fiscal year was just shy of $1 trillion -- $400 billion more than when he took office, before he signed a massive corporate tax cut and even with a healthy growing economy.

A former Harvard law professor, Warren is pushing for stricter oversight of powerful industries.

"There's a broad swath of sectors that would come under pressure initially if she won the nomination," said Quincy Krosby of Prudential.

The candidate also has a plan to break up large banks that she says pose a danger to the economy, and dismantle some Silicon Valley tech giants.

Facebook founder Mark Zuckerberg said he was ready to "go to war" with a Warren administration, according to comments leaked to the public in early October.

The oil industry is also in the crosshairs: Warren has pledged to ban hydraulic fracturing -- "fracking" -- which is used to extract shale gas that has helped make the United States less dependent on foreign oil, but is controversial due to serious concerns about the environmental impact.

Major drug makers too would face new limits, as the candidate has promised to require big pharma to lower many drug prices.

Veer to the middle?

Shaken by her tough stances, Wall Street has grasped at any signs that things might not turn out so bad.

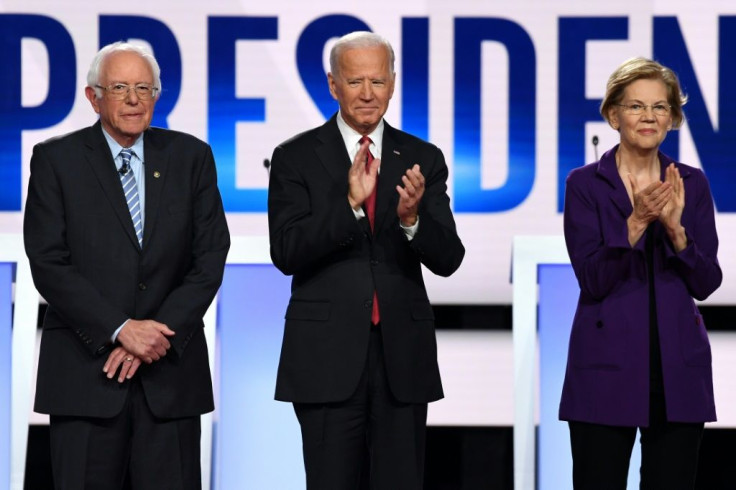

For one, Warren, a former Republican, has described herself as "capitalist to my bones," unlike rival Bernie Sanders, a self-described democratic socialist, and may temper some of her rhetoric if she is picked to face off against Trump.

"Very often in order to win the election, you have to veer towards the middle," Krosby said, although she is skeptical Warren will change much.

Stock market players also bet on the fact it will be nearly impossible for a Warren administration to get congressional approval for many of her policies, since Republicans are likely to retain control of the Senate and likely would probably block any reform they deem too radical.

A President Warren would then be obliged to find a way to compromise.

"The stock market has some reason to be reassured, but if you take her program literally, there are a lot of reasons to panic," Volokhine said.

© Copyright AFP 2024. All rights reserved.