Ethereum: A Victim Of Its Own Success?

It is no understatement to say that Finance 2.0 happened on the back of the Ethereum blockchain. Launched by Vitalik Buterin in 2015, Ethereum represents the second generation of blockchain technology, thanks to smart contracts. Such automated software, ensconced within blockchain's data blocks, is capable of recreating every aspect of traditional finance, from market makers and loans to decentralized exchanges and marketplaces.

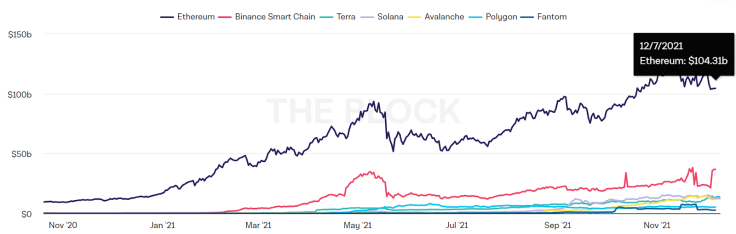

After Ethereum's five-year-long dormancy, it sprang into action during the Summer of 2020, creating a gravitational pull after which nothing remains the same. The timing was perfect. At the height of lockdowns and economic turmoil, people sought an alternative that had a low barrier to entry for investments. Fast forward less than two years, and Ethereum holds $104.3 billion worth of crypto assets locked across 2,894 DApps.

Ethereum is the foundation for dApps

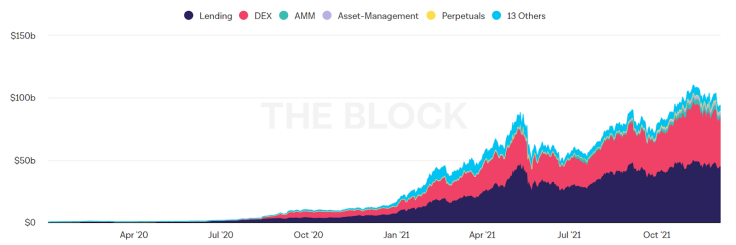

All of the major smart contract use cases now reside on Ethereum. OpenSea dominates the NFT marketplaces with a $13 billion trading volume. Uniswap holds nearly 37% of the market share among decentralized exchanges (DEXs), while Maker, InstaDApp, Aave and Compound together account for $50 billion worth of assets in lending protocols. Although NFTs are on the rise, these two categories, lending and DEXs, make up the bulk of Ethereum's appeal.

Unfortunately, Ethereum did not take this sudden rise in popularity well. From the get-go, Vitalik Buterin envisioned Ethereum as a proof-of-stake blockchain. However, the network was initially launched as a proof-of-work one — just like Bitcoin's — relying on energy hungry miners instead of validators. This made it less scalable, especially after multiple upgrade delays toward Ethereum 2.0, i.e., the proof-of-stake Beacon Chain.

Ethereum's gas fee problem

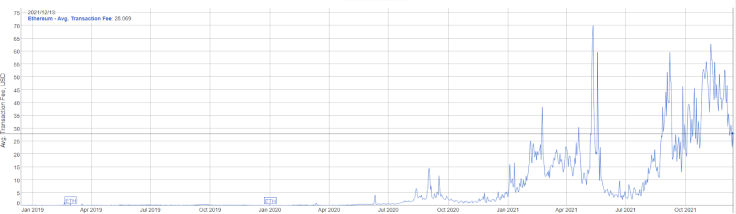

For the end-user, this transitory period has manifested in the form of exceedingly expensive transaction fees. The more users joined Ethereum's network, the more difficult it became to handle the traffic. In turn, the cost of transactions precipitously rose, currently at nearly $30 per transaction.

To understand how severe this problem is, we can compare Ethereum to Solana, one of its closest competitive smart contract platforms, fully proof-of-stake combined with proof-of-history. Solana's average transaction fee is a mere $0.00025, 120x cheaper than Ethereum!

Not for the average retail investor

In practice, let's say you want to swap tokens on a decentralized exchange like Uniswap. The average fee would cost you nearly $50. This leaves many users with funds stuck in the MetaMask wallet, waiting for upcoming upgrades to take place and hopefully deflate ETH gas fees.

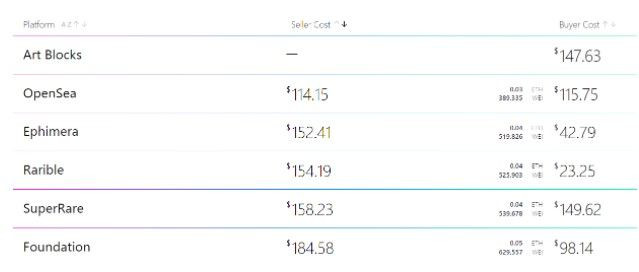

Likewise, if you want to trade NFTs on Ethereum-based marketplaces, the fees are prohibitively high for most retail investors.

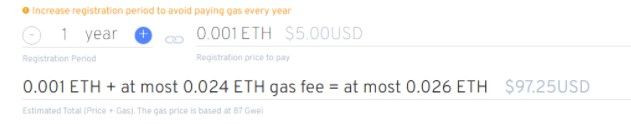

Yes, you've read that correctly. On a good day, a nominal $5 fee for a website name would yield nearly 20x that in ETH gas fees. In the world of traditional finance, such a lopsided ratio pertaining to any service is unheard of. Not only does this problem stifle DeFi adoption, it also prevents one from taking advantage of token airdrops.

Solution for Ethereum moving forward

For the time being, Ethereum transactions are reserved for the wealthy crypto whales and institutional investors. Needless to say, this is precisely the opposite outcome of what decentralized finance was supposed to deliver. There is nothing more unwelcoming than a high barrier to entry.

Sometime in the latter half of 2022, Ethereum should complete its docking with the brand new Beacon Chain, and the fees should drop dramatically. In the meantime, the network has to rely on Layer 2 scalability solutions, such as zkRollups and sidechains. Among them, the most viable one seems to be Arbitrum for the long haul. The gas fee comparison speaks for itself.

Unfortunately, not many investors are so engrossed into blockchain finance to know that such solutions even exist, let alone know how to use them. Fortunately, seeing the writing on the wall, Arbitrum has grown its project portfolio significantly on its Arbitrum One bridge, numbering over 200. After all, there is nothing that spurs demand more than saving money on transactions.

💡Let @bluestwind walk you through how to connect your @MetaMask wallet to the @arbitrum Layer 2 network, bridge your assets, and discover dapps👇https://t.co/ppxpkyYftP

— ConsenSys (@ConsenSys) December 13, 2021

As an optimistic rollup, Arbitrum's super cheap fees are not only attractive, but the protocol offers full compatibility with EVM (Ethereum Virtual Machine). This makes it very easy for Ethereum DApps to migrate to the Arbitrum ecosystem, as has already happened with the most popular ones.

Unfortunately, one big problem will still remain — the interoperability between different Layer 2 networks. Like, say, MATIC or Loopring. Without these bridges, users would have to pay for a token transfer to the main chain (Ethereum) and then to another Layer 2 network. Yet, solutions even in this area are forthcoming. CBridge, Connext and Hermez' Massive Migrations are just some of the candidates that use liquidity to clump transactions together into a single one and then offload them to the main chain.

With that said, Layer 1 blockchains with equal smart contract capabilities — Solana, Avalanche, BSC, Radix, Cardano — all rely on its core scalability instead of Layer 2 scaffolding. This is a feature that will keep drawing in users who prefer simplicity and affordability. In the end, the space for Ethereum to complete its ETH 2.0 upgrade amid such stiff competition is rapidly shrinking.

Rahul owns less than 1 BTC and 40 LRC.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2024. All rights reserved.