European Growth Failed To 'Lift Off' Amid Brexit, Slowdown: IMF Economist

Europe's economic expansion sputtered this year, disappointing expectations due to the well-known Brexit concerns, but also because of issues within major economies like Germany and Italy, a top IMF economist told AFP.

Gian Maria Milesi-Ferretti, deputy director of the IMF Research Department, said weakening global demand means those export-dependent economies face growing challenges.

"Europe had a very strong 2017 and very strong beginning of 2018 and we were really hoping we would see a liftoff in European growth," he said in an interview.

"This unfortunately has not materialized, we've had a pretty notable slow down."

Even if Britain's divorce from the European Union is finalized with an agreement to smooth the way -- which is the IMF's baseline assumption -- growth "is clearly not spectacular," Milesi-Ferretti said.

After posting GDP growth of 2.4 percent in 2017, the currency union slowed to 1.9 percent last year.

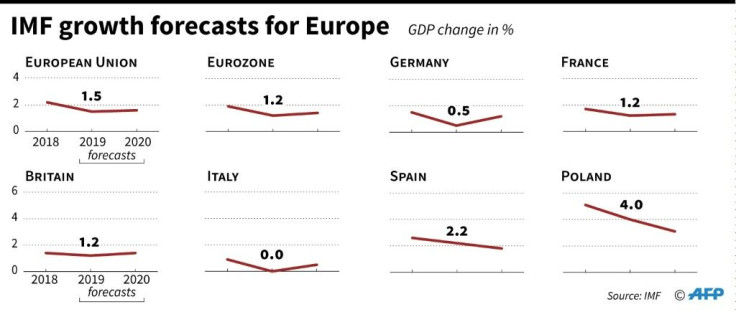

And the IMF's latest World Economic Outlook, released Tuesday, cut the estimates for 2019 to 1.2 percent and to 1.4 percent for 2020 -- with all the members of the currency union seeing slower growth.

Germany is the most disappointing at just 0.5 percent projected for this year -- "which is really low compared to the standards we have gotten accustomed to in previous years," he said -- and Italy's economy is expected to stall with no growth in 2019.

"Clearly, these are countries that can and should do better."

While there are "country-specific factors" holding back a continued expansion, more broadly many of the nations rely on manufacturing, including Germany and Italy, as well as France and Spain, "and when there is a global downturn in manufacturing, these countries are more severely affected."

Don't take the Brexit gamble

Milesi-Ferretti echoed the message of the IMF's economic update that countries like Germany should take advantage of low or even negative interest rates to use government spending with investments in infrastructure and other projects that would boost growth.

"Clearly what Germany has is a better fiscal situation than others," he said.

By using available cash to fund such projects, "you would get both the benefit of supporting economic activity at the moment when activity is weak, and potentially boosting potential output going forward. So we think this is a very good time for those investments to take place."

Brexit remains a large source of the uncertainty weighing on Europe, given the lingering fear Britain will crash out of the union without an agreement, causing a massive hit to both economies in the short term at least.

IMF chief economist Gita Gopinath told reporters on Tuesday that a no-deal Brexit could cut the British economy by three to five percent, "depending on how disruptive the exit is," as well as a "not trivial" hit to the global economy more broadly.

Milesi-Ferretti said it is hard to precisely calculate the immediate damage from shortages at the border or other disruptions.

Though it is possible adequate preparations have been made, "it's still the type of gamble that you really don't want to take."

"So we very much hope that an agreement will be reached and we will not have to cross that bridge and see what type of disruptions will actually materialize."

© Copyright AFP 2024. All rights reserved.