Expert Take: Fireblocks Legal Chief Explains DORA's Positive Impact On Crypto Frameworks

KEY POINTS

- DORA is 'a shift toward establishing greater trust and accountability across the industry': Jason Allegrante of Fireblocks

- While the issue on global regulatory fragmentation remains, DORA has 'harmonization as its end objective': Allegrante

- The scale of DORA's requirements has been 'daunting' for many, especially in line with MiCA compliance

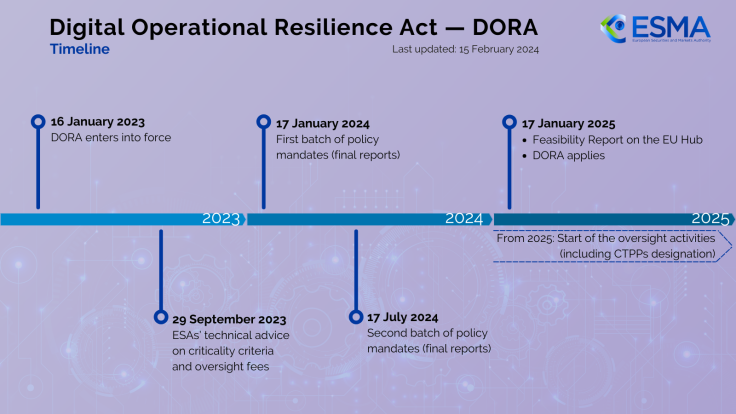

The European Union's Digital Operational Resilience Act (DORA) comes into effect today despite increased industry concerns that market participants aren't prepared for the new requirements, especially with the second phase of the bloc's Markets in Crypto-Assets Regulation (MiCA) having been recently implemented.

There are mixed reactions from industry players, with some confidently prepared for the stringent measures, while others are still rushing toward compliance so they can do business in the region.

In an exclusive with International Business Times, Jason Allegrante, chief legal and compliance officer at Fireblocks, the leading digital infrastructure company, shared his thoughts on DORA and why he believes regulators are right to raise the bar.

DORA an Innovation Blocker or a Catalyst for Trust Building?

When DORA was unveiled by the EU, there were concerns that it might stifle innovative growth in the digital assets space, especially since it covers not just regulated financial institutions but also virtual asset service providers (VASPs).

On the other hand, some industry experts have hailed its potential to trigger positive change, especially in building trust. Allegrante is one of such industry experts who believe in the positive outcomes DORA can bring about.

"DORA's impact is significant because it's not just another compliance requirement – it's a shift toward establishing greater trust and accountability across the industry through standard setting for critical services and service providers," Allegrante said.

He acknowledged that there will be challenges in the short term as businesses adjust to DORA's heightened operational resilience standards, but as time passes by, industry players will understand that it is a "necessary step towards creating a safer and more stable environment for digital assets to thrive."

A Direct Hit for Both Crypto Providers and Financial Institutions

DORA directly covers both financial institutions and digital asset providers, and secondarily, their service providers.

There will be different impacts on each provider, but Allegrante noted that for those directly affected by DORA's requirements, they need to undergo careful reevaluation of their internal systems and even third-party IT providers.

For those who wish to continue to compete in the market for VASP and financial institution business, there may be a need for a major overhaul of product offerings to ensure that they remain competitive.

"The upside to going through this process is potentially significant. The FI [financial institution] and VASP segments handle large transaction volumes and face heightened exposure to cyber risks, making operational resilience critical. Meeting these standards will ultimately strengthen the foundation of their operations and enhance trust among institutional and retail clients," Allegrante said.

The Issue on Regulatory Fragmentation

Aside from a large chunk of the crypto market being unprepared for DORA, there were also early concerns that the EU's regulatory frameworks may fuel more global regulatory fragmentation than encourage a unified approach.

For Allegrante, DORA already addresses one of the industry's core challenges: creating a unified approach to operational resilience, at least within the EU.

He acknowledged the issue on global regulatory fragmentation and noted that the world is still far from achieving the global cohesion needed for global regulatory harmony.

On the other hand, through DORA's consistent standards, the ambiguity around blockchain and crypto business operation is reduced and it also fosters alignment between institutions and regulators, he explained.

"Ultimately, DORA is a kind of standard setting exercise with harmonization as its end objective, and it could serve as a positive model for other regions looking to develop similar frameworks," Allegrante said.

The Case of Racing Against Time

Another major issue that many industry players lamented about since the unveiling of MiCA and DORA was time – to assess compliance, revamp operations as necessary, and adjust overall to the requirements.

Allegrante noted that the timeline for DORA compliance has indeed been challenging for many in the digital asset business, most especially when paired with the parallel rollout of MiCA.

"Even with prior awareness, the scale of what's required is daunting for many," he pointed out, highlighting the woes of many industry players who have been scrambling to meet the January 17 deadline for DORA compliance.

"This underscores the importance of industry collaboration and leveraging external providers to accelerate readiness and avoid unnecessary bottlenecks," Allegrante said.

Still, he believes that DORA sets the precedent for positive change in the long-term. "For the global crypto and blockchain industry, DORA is a strong signal that institutional adoption and regulatory clarity are advancing hand in hand," he noted.

The Role Fireblocks Plays in Crypto Compliance

In the midst of the compliance revolution is Fireblocks, which supports over 1,800 leading organizations with its development platform for managing digital asset operations.

Its enterprise-grade tools not only focus on management but also address critical aspects of operational resilience and cybersecurity, allowing companies in the industry to meet DORA's standards transparently and efficiently.

"By bridging the gap with scalable, out-of-the-box solutions for FIs and VASPs, we aim to support businesses as they transition to this next stage of compliance and security maturity," Allegrante said.

© Copyright IBTimes 2024. All rights reserved.