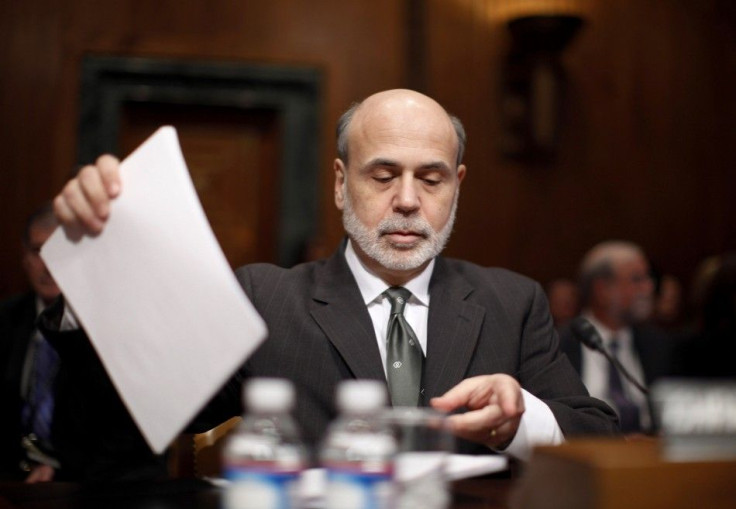

Fed's Bernanke, Before Senate, Is Diplomatic on Fiscal Policy, Aggressive in Monetary Defense

Federal Reserve Chairman Ben Bernanke held his policy prescription cards close to his vest Tuesday morning, skirting around several questions from members of the Senate Banking Committee that seemed designed to pigeonhole the central bank chief into supporting ideologically-charged positions. At the same time, the top U.S. central banker was effusive in his defense of the Federal Reserve's previous actions, sniping back at various U.S. Senators who suggested the bank's expansionary monetary policies were misguided.

To the extent certainty can be provided, that would be helpful to the economy, Bernanke said in response to a question from Sen. Ron Wyden, D-Ore., about how the uncertainty about expiring tax benefits, resetting tax rates and other fiscal stimulus provisions was affecting the markets.

My sense is a strong demonstration by Congress and the administration that they understood these concepts [...] would go a long way, he later added.

Bernanke steadfastly held on to the argument about uncertainty, without blaming any partisan actors, as he was prompted by politicians from both sides of the aisle with leading questions that suggested people in the other party were most at fault for the current fiscal picture.

At one point, when asked if it was worse to provide piecemeal fiscal solutions than no solutions at all, he artfully avoided the controversial core of the question, responding politics is complicated, and sometimes not everything is feasible.

Fed Chair Defends Existing Policy

As diplomatic as the Fed chief was in avoiding the partisan fray, he was equally uncompromising in defending the current policy views of the central bank, including the value of an extended negative interest rate regime and of the bank's asset-purchasing programs.

In response to questions from Senators Kelly Ayotte, R-N.H., and Pat Toomey, R-Penn.,, which took up issue with the Fed's stance on keeping interest rates at historical lows, Bernanke explained the bank was trying to push investors into situations that are appropriately risky.

Going from a situation where people are hunkered down to a slightly riskier position is good for the economy, Bernanke told Sen. Ayotte. In response to Sen. Toomey, who suggested the Fed's policies were bad for savers, he noted savers are also invested in risky equities, such as stocks and corporate bonds, which had benefited from the Fed's policies.

The morning's most cutting encounters occured after several Senators brought up a recent Wall Street Journal column by Charles Schwab, CEO of the namesake brokerage, which suggested the Fed was overplaying its expansionary hand. After Bernanke noted he disagreed with the premise of the article, Sen. Wyden told Bernanke if we asked you in 2006 if you agreed with Noriel Roubini, you'd probably disagreed with that. The Senator then pushed further, asking the Fed chief to detail which predicitons were most likely to be proved wrong.

You just pointed out that it's very hard to forecast, then you're asking me to forecast, Bernanke responded.

© Copyright IBTimes 2024. All rights reserved.