FOMC Decision: Tapering Delayed

The Federal Open Market Committee’s (FOMC’s) decision to hold off on the much expected tapering was of little surprise to us. The 3-month moving average for employment fell to only 148,000 for August. The Federal Reserve wants employment to grow at least 200,000 per month on a sustainable basis before tapering begins in earnest.

The reaction in the financial market was also to be expected with a sharp rally in the Treasury bond market and in the equity markets. The December 2014 euro-dollar forward contract has also rallied measurably over the past week with the yield now dipping to 0.59 percent. The reduction in short-dated euro/dollar interest rates (in part) ratifies the FOMC’s target of 2.0 percent for the Federal Funds rate by the end of 2016.

Unfortunately, investors should not view the rally in the Treasury bond market as a sustainable trend. At some point the market will have to grapple with how high the equilibrium level of interest rates will be for Treasury securities and not whether the Fed will taper. It is our view that the fair value for the 10-year Treasuries is closer to 4.0 percent. Accordingly, investors should take the current rally as an opportunity to reduce duration risk and exposure to negatively convex securities such as mortgages and callable corporate and municipal debt.

While the FOMC’s actions will be dependent on incoming data, investors need to be more sensitive to protecting principal value of fixed income portfolios. The Fed can only control very short- term rates and cannot control long-term market

rates. Animal spirits and investor psychology will be the driving forces responsible for the direction of long-term interest rates.

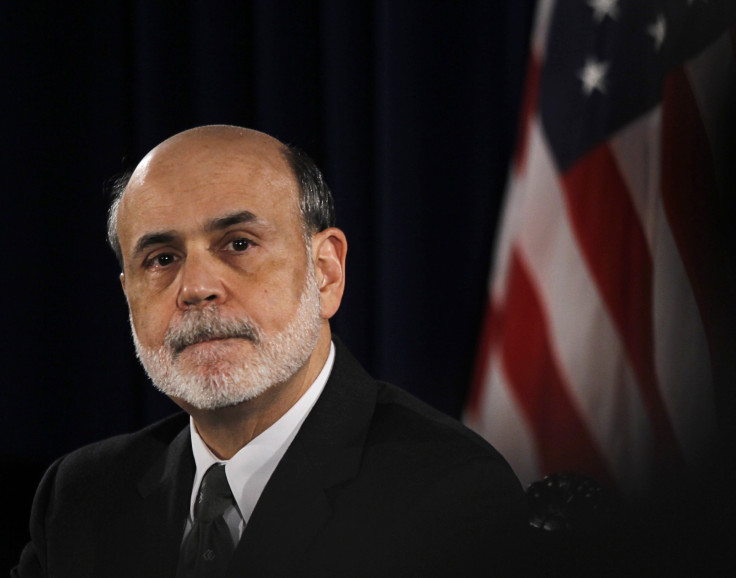

The sharp rally in the equity market needs to be respected, especially given the forward guidance that Fed Chairman Ben Bernanke outlined in his press conference, namely that the Federal Reserve will remain accommodative even when interest rate policy begins to change. In other words, we should not expect (at this time) to have a repeat of the 2004-2006 cycle when the Fed methodically increased interest rates at every FOMC meeting. In the last tightening cycle, the Federal funds rate rose from 1.0 percent in August of 2004 to 5.25 percent in June of 2006.

The next tightening cycle will be considerably choppier and longer -- assuming that Janet Yellen is the next Fed Chairperson. We expect further gains from equities and only limited improvement in the Treasury market. It remains our view that investors from retail to institutional are underweight equities and overweight fixed income. The fact that long- term Treasuries have consistently met with selling pressure suggests that investors believe that the secular low for interest rates has already been set. We have to remember

that the low closing yield for the 10-year Treasury was 1.38 percent on July 24, 2012.

Equities will continue to benefit from a re-allocation of assets and from a long awaited multiple expansion.

Tom Sowanick is Co-President and Chief Investment Officer at Omnivest Group, Princeton, N.J.

© Copyright IBTimes 2024. All rights reserved.