Gautam Adani: The Indian Tycoon Weathering Stock Market Panic

Indian industrialist Gautam Adani is Asia's richest man, with a business empire spanning coal, airports, cement and media now rocked by corporate fraud allegations and a stock market crash.

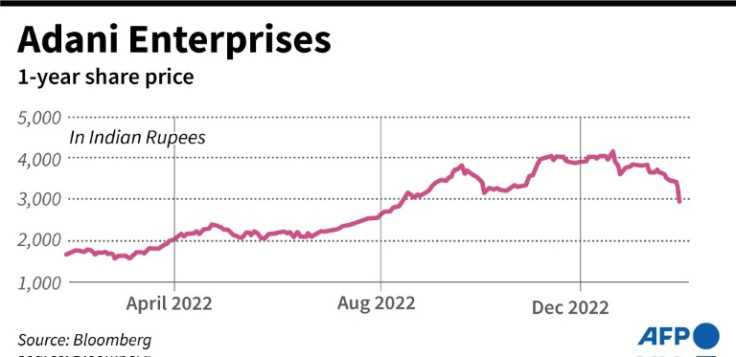

But the billionaire -- who this week lost $25 billion to his net worth and tumbled from third to seventh place on Forbes' global rich list -- is one of the business world's great survivors.

On New Year's Day in 1998, Adani and an associate were reportedly kidnapped by gunmen demanding $1.5 million in ransom, before being later released at an unknown location.

A decade later, he was dining at Mumbai's Taj Mahal Palace hotel when it was besieged by militants, who killed 160 people in one of India's worst terror attacks.

Trapped with hundreds of others, Adani reportedly hid in the basement all night before he was rescued by security personnel early the next morning.

"I saw death at a distance of just 15 feet," he said of the experience after his private aircraft landed in his hometown Ahmedabad later that day.

Adani, now 60, differs from his peers among India's mega-rich, many of whom are known for throwing lavish birthday and wedding celebrations that are later splashed across newspaper gossip pages.

A self-described introvert, he keeps a low profile and rarely speaks to the media, often sending lieutenants to front corporate events.

"I'm not a social person that wants to go to parties," he told the Financial Times in a 2013 interview.

Adani was born in Ahmedabad to a middle-class family but dropped out of school at 16 and moved to financial capital Mumbai to find work in the lucrative gems trade.

After a short stint in his brother's plastics business, he launched the flagship family conglomerate that bears his name in 1988 by branching out into the export trade.

His big break came seven years later with a contract to build and operate a commercial shipping port in his home state of Gujarat.

It grew to become India's largest at a time when most ports were government-owned -- the legacy of a sclerotic economic planning system that impeded growth for decades and was in the process of being dismantled.

Adani in 2009 expanded into coal, a lucrative sector for a country still almost totally dependent on fossil fuels to meet its energy needs. However, the decision brought international attention as he rose rapidly up India's rich list.

His purchase the following year of an untapped coal basin sparked years of "Stop Adani" protests in Australia after dismay at the project's monumental environmental impact.

Similar controversies plagued his coal projects in central India, where forests home to tribal communities were cut down for mining operations.

Adani's $900 million coastal port project in southern Kerala state was the site of violent clashes between police and a local fishing community demanding a halt to construction.

Adani is seen as an acolyte of Hindu nationalist Prime Minister Narendra Modi, a fellow Gujarat native, and has aligned his own business interests with those of "nation building".

He has invested in the government's strategic priorities, in recent years inaugurating a green energy business with ambitious targets.

Last year he launched and completed a hostile takeover of broadcaster NDTV, a television news service considered one of the few media outlets willing to outwardly criticise India's leader.

Adani batted away press freedom fears, but told the Financial Times that journalists should have the "courage" to say "when the government is doing the right thing every day".

The billionaire has also channelled Modi's strident rhetoric when talking about the historical injustices suffered by India during the era of British rule.

"A country, crushed and drained by its colonial rulers, today stands on the cusp of extraordinary growth," he told a business forum in November.

But Adani Group's rapid expansion into capital-intensive businesses has raised alarms, with Fitch subsidiary and market researcher CreditSights warning last year it was "deeply overleveraged".

This week a bombshell report from US investment firm Hindenburg Research claimed the conglomerate had engaged in a "brazen stock manipulation and accounting fraud scheme over the course of decades".

Hindenburg said a pattern of "government leniency towards the group" stretching back decades had left investors, journalists, citizens and politicians unwilling to challenge its conduct "for fear of reprisal".

Adani Group has lost upwards of $45 billion in market cap since the report's release, and its legal chief announced Thursday that it was exploring punitive action against Hindenburg in US and Indian courts.

The issues now facing Adani's empire "strike at the heart" of India's corporate sector and the dominance of family-controlled firms, Global CIO Office chief executive Gary Dugan told Bloomberg on Friday.

"By their very nature they are opaque, and global investors have to take on trust the issues of corporate governance," he said.

© Copyright AFP 2024. All rights reserved.