Virus Pushes Germany Into Recession

The coronavirus pandemic has tipped Germany into recession, official data showed Friday, with Europe's top economy suffering its steepest quarterly contraction in more than a decade as lockdown measures began to bite.

The German economy shrank by 2.2 percent in the first three months of 2020, federal statistics agency Destatis said, calling the quarter-on-quarter decline "the worst since the global financial crisis" in 2009.

The agency also revised down its gross domestic product (GDP) figure for the final quarter of 2019, from zero growth initially to a contraction of 0.1 percent.

That means Germany has now experienced two consecutive quarters of decline, meeting the technical definition of a recession.

The worst is yet to come however, with economists warning that the full impact from the coronavirus restrictions will be felt in the second quarter.

Economy Minister Peter Altmaier said last month that Germany was headed for "the worst recession" in its post-war history as the pandemic batters the global economy.

Like many other countries, Germany closed factories, shops and schools from mid-March and asked workers to stay at home to help curb the outbreak.

Disruptions to international travel and trade also weighed on the export powerhouse.

"Private consumption, exports and investments in equipment shrank considerably as a result," the German economy ministry said in a statement.

State spending and the construction industry were the only growth drivers in the first three months of the year.

"Two weeks of lockdown as well as supply chain disruptions... brought the German economy to its knees," said ING-Diba economist Carsten Brzeski.

"For the time being, things will get worse before they get better," he added.

Some experts have forecast the German economy could contract by a whopping 10 percent between April and June.

The German government expects GDP to shrink by a record 6.3 percent in 2020, a bigger contraction than during the 2008-2009 financial crisis.

But there are glimmers of hope on the horizon, with experts saying Germany is well positioned to weather the storm.

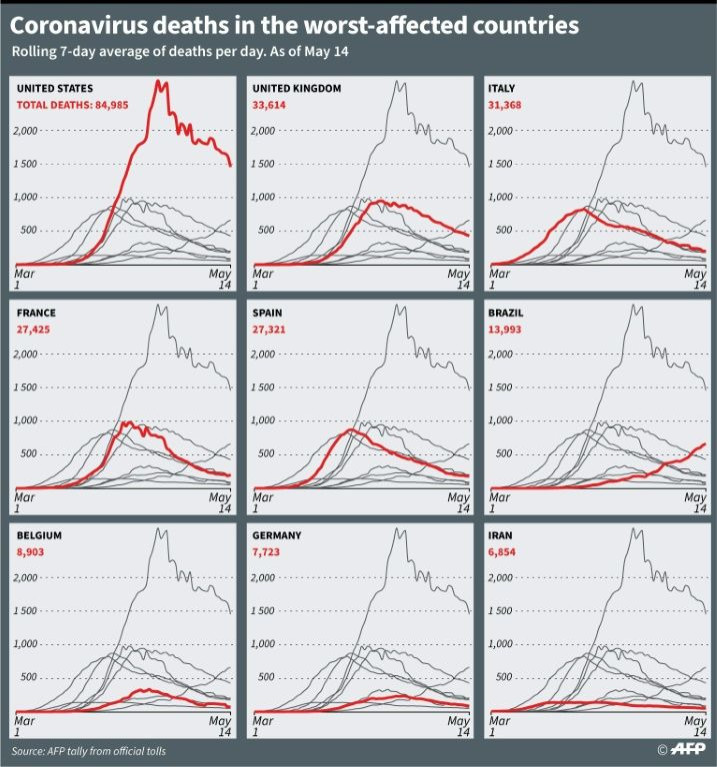

The country's first quarter slump is smaller than steep GDP plunges seen in France, Italy and Spain, which have been hit harder by the virus and imposed far stricter shutdowns.

On average, output in the 19-nation eurozone shrank by 3.8 percent in the first quarter, Eurostat confirmed Friday.

Looking ahead, Berlin predicts the German economy will bounce back in 2021 and grow by 5.2 percent as the virus impact wanes and businesses reopen.

The country began easing social restrictions in early May, allowing shops to reopen while restaurants and tourist businesses are taking the first tentative steps.

Factories too are restarting their production lines.

"The timing of the lifting of the lockdown measures as well as the huge fiscal support by the German government... support the view that the German economy could leave the crisis earlier and stronger than most other countries," Brzeski said.

To help the country through the COVID-19 crisis, Chancellor Angela Merkel's government has ditched its cherished policy of maintaining a balanced budget.

It has launched an ambitious rescue package worth 1.1 trillion euros ($1.2 trillion) that includes state-backed loan guarantees, cash injections and schemes to put millions of workers on reduced hours to avoid layoffs.

Several big-name firms such as sportswear maker Adidas, Condor airline and travel firm TUI have already received hundreds of millions of euros in government-backed loans, while Lufthansa is still negotiating a possible bailout.

But the economy will only rebound if Germany's biggest trading partners are also doing well, warned Jens-Oliver Niklash, an analyst for LBBW bank.

In a sign of more difficult times ahead, carmaker Volkswagen said earlier this week it would suspend production again on some lines that had only just reopened. The demand for cars is simply not there, it said.

© Copyright AFP 2024. All rights reserved.