Global Finance Shores Up Defences As Ukraine Crisis Slams Shares

Europe's financial sector suffered heavy share price falls on Thursday, with U.S. banks set to follow suit, as it grappled to respond to Russia's invasion of Ukraine.

Among initial measures, Allianz disclosed that it had frozen its Russian government bond exposure, while British lender Lloyds said it was on "heightened alert" for cyberattacks.

Deutsche Bank, meanwhile, said it had contingency plans in place as U.S. and European officials warned of further sanctions on Russia.

Shares of leading banks plunged, with the banking sector down 7.3% in early afternoon, steeper than a 4.7% fall for the Euro Stoxx index.

Banks with significant operations in Russia were particularly hard hit. Austria's Raiffeisen Bank International was down 18.7% while Societe Generale lost 10.8%, though it said its Russian unit Rosbank continued to operate normally.

Shares in UniCredit fell 10.7% and triggered an automatic trading suspension, though the lender said its Russia "exposures are highly covered".

Top U.S. banks, including JPMorgan & Chase, Citigroup, Goldman Sachs, and Morgan Stanley, shed 3-5% in pre-market trade. That was a heavier fall than the broader market, where futures tracking the S&P were down 2.6%.

Russian forces invaded Ukraine by land, air and sea on Thursday, confirming the worst fears of the West with the biggest attack by one state against another in Europe since World War Two.

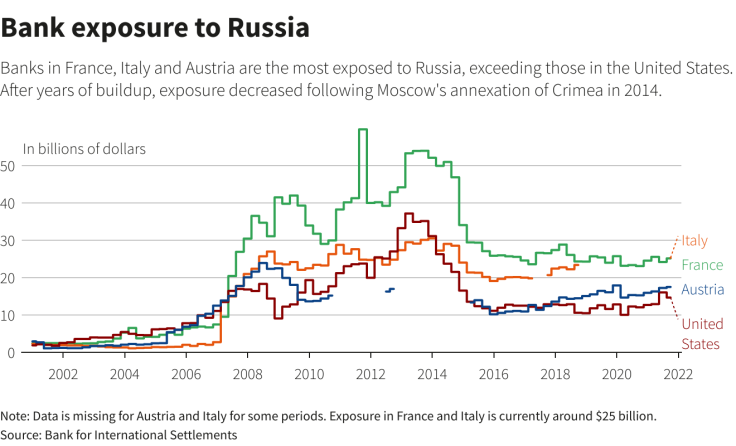

European banks are the world's most exposed to Russia - especially those in France, Italy and Spain, which far outstrip U.S. banks' exposure, data from the Bank for International Settlements shows.

Bank exposure to Russia -

German regulator BaFin said it was keeping a watchful eye on the crisis.

European Union leaders will impose new sanctions on Russia, freezing its assets, halting access of its banks to the European financial market and targeting "Kremlin interests" over its "barbaric attack" on Ukraine, senior officials said on Thursday.

But in what will be a relief to Europe's banks, the European Union is unlikely at this stage to take steps to cut off Russia from the SWIFT global interbank payments system, several EU sources said.

Both Deutsche Bank and Allianz - two of Europe's most important financial businesses and both with operations in Russia - said they were ready to comply with sanctions.

Allianz, one of the world's biggest asset managers, said that the share of Russian government bonds in its portfolio was "currently very low" and that it had recently implemented a freeze on those securities.

Deutsche Bank, like many lenders in recent years, has reduced its presence in Russia as sanctions on the country have expanded.

"We have contingency plans in place," the bank said in a statement. A spokesperson declined to elaborate on the plans but said "risks are well contained".

The lender's shares were down more than 9.8%, the biggest decline among German blue chips.

Lloyds chief executive Charlie Nunn told reporters that it was on "heightened alert ... internally around our cyber risk controls and we've been focused on this for quite a while".

Preparation for potential cyberattacks was discussed in a meeting between the government and banking industry leaders on Wednesday, Nunn added.

Lloyds has been on heightened alert for the past couple of months, Nunn said.

RBI, which this month said it had earmarked 115 million euros ($128.5 million) in provisions for possible sanctions on Russia, said on Thursday, as its shares dropped sharply, that it was "premature to assess" the impact on its business and that its banks in Russia and Ukraine were "well capitalised and self-financing".

Italian heavyweight Intesa Sanpaolo, which has financed major Russian investment projects such as the 'Blue Stream' gas pipeline and the sale of a stake in oil producer Rosneft, fell 8.5%.

While many bankers have played down the importance of Russia to their operations, the country is tightly linked to the European economy.

Russia is the European Union's fifth-largest trading partner, with a 5% share of trade, data shows. U.S. trade with Russia is less than 1% of its total.

Some of the region's top bankers have been more concerned about the potential secondary effects of the crisis.

The boss of HSBC, one of Europe's largest banks, this week said that "wider contagion" for global markets was a concern, even if the bank's direct exposure was limited.

($1 = 0.8951 euros)

© Copyright Thomson Reuters 2024. All rights reserved.