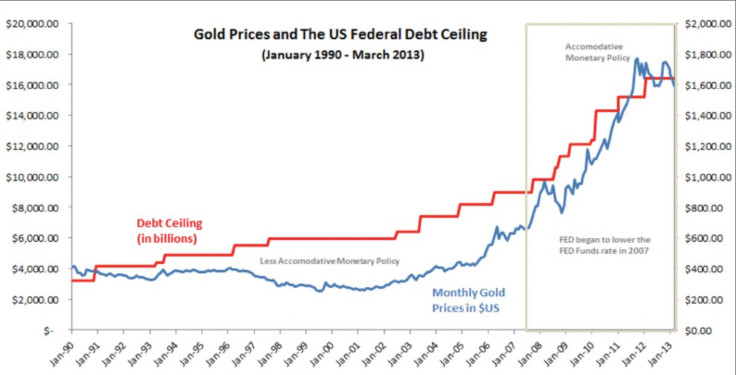

Gold Prices And US Debt Ceiling Levels: A Close But Mysterious Relationship Since 2008

Here’s a quirky chart -- how gold prices have tracked, and potentially followed, the federal government’s debt ceiling over the last 20-odd years.

Former U.S. Mint director Edmund Moy, who led the coin-producing body from 2006 to 2011, told International Business Times that during the financial crisis in 2008 he tasked a team of economists with pinpointing the single factor tracking gold prices most closely, from a quantitative perspective.

On orders from his boss, then Treasury Secretary Hank Paulson, Moy sought better forecasting of gold price and demand, as gold demand spiked at the start of the crisis.

Focusing on the 2008-2009 period, Moy's staff investigated more than 200 potential factors, including the obvious and traditional strong relationships between U.S. interest rates, gold prices and the strength of the U.S. dollar. The outcome of his inquiry surprised, and fascinated, him.

“My Chief Strategist Mike Stojsavljevich concluded that gold prices correlate most accurately with how close our national debt was to hitting the federal debt ceiling,” Moy said. "I was fully expecting them to come back with interest rates. All of a sudden they go 'debt ceiling.' I go 'What? What are you guys drinking?'"

Since the completion of that study, Moy has continued to watch the relationship between gold prices and how close government spending gets to the debt ceiling.

“For the last four years, there’s been this lockstep of gold prices along with the debt ceiling ... Once the debt ceiling is raised, then that will be another trigger for gold to rise again,” Moy said in an interview.

He attributed deviations from that relationship in the summer of 2011 and early 2013, when gold prices spiked and plunged respectively, to gold derivative traders distorting underlying physical demand for gold.

There has been a rough correlation between gold prices and how closely government spending comes to the debt ceiling since 1990, he said. But before 2008 the deviation between gold prices and the national debt ceiling was no stronger than the correlation between gold prices and oil prices or interest rates, Moy said.

It's also unclear if data from before 1990 underpins the correlation convincingly, or if the relationship will be vindicated once the Fed tapers its $85 billion per month bond buying.

“Is it a long term trend? We don’t know yet. We’ll see in 10 years. Time will tell whether this correlation is long term or just Fed policy-related,” said Moy.

© Copyright IBTimes 2024. All rights reserved.