Goldman Sachs Prepares to Dispute Senate's 'Big Short' Accusation

Goldman Sachs Group, Inc. is marshaling evidence to parry a Senate report that led the Manhattan District Attorney's office to subpoena the bank, the Wall Street Journal reported.

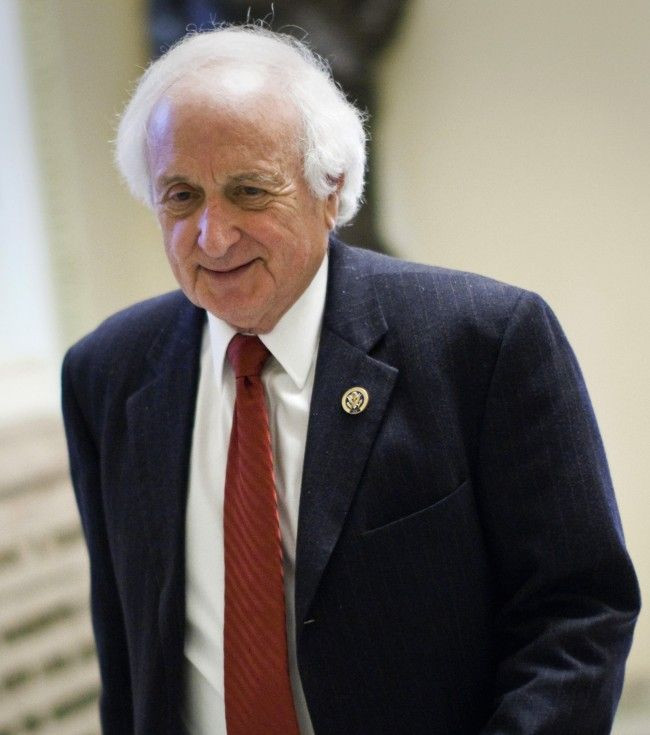

A Senate panel led by Sen. Carl Levin (D-MI) authored a report accusing Goldman Sachs of knowingly selling investors toxic mortgage packages and then enriching itself by successfully betting that those securities would fail. Levin has maintained since the report's release that Goldman officials could be tried for perjury for testifying to Congress that the firm had not bet against the housing market. On Thursday, Bloomberg reported that the Manhattan District Attorney's office had subpoenaed Goldman Sachs for more information.

The steadily intensifying scrutiny led Goldman to undertake a sweeping review of mortgage documents from 2007, an effort that has convinced officials there that the Levin report overlooked healthy investments that would offset the shaky, subprime mortgage deals.

We did not have a massive net short position because our short positions were largely offset by our long positions, and our financial results clearly demonstrate this point, Goldman Sachs spokesman Lucas van Praag said in response to the release of the Levin report.

© Copyright IBTimes 2024. All rights reserved.