Google Motorola Mobility $12.5B Deal Good For RIM and Nokia: Top Reasons Why

ANALYSIS

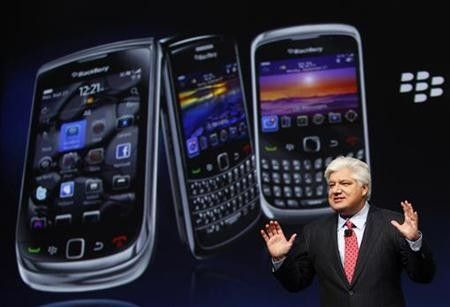

Search giant Google Inc.'s acquisition of Motorola Mobility prima facie looks to shut out Blackberry maker Research in Motion (RIM) and Nokia, which are struggling in the smartphone race -- but instead the deal could make the companies attractive acquisition targets.

Monday's acquisition sends out a warning message to four major hardware-software players in mobile computing industry: Apple-iOS; HP-webOS; Research in Motion-BlackBerry OS; and Nokia-Microsoft's Windows Mobile OS.

With HP focusing more on PCs and tablets, it means Google has to mainly deal with Apple, RIM and Nokia-Microsoft combine.

Google has a long way to go before it can catch up with technology giant Apple, but RIM and Nokia, two companies that have struggled in recent times to produce a popular smartphone, are already feeling Google breathing down their necks.

Both Nokia, which is developing devices for Microsoft’s Windows Phone operating system, and RIM, which is working to launch a new slate of handsets over the next few months as well as a new operating system next year, are struggling to keep up with their rivals in the smartphone race and are fast losing their relevance in mobile computing industry.

While the ouster of Olli-Pekka Kallasvuo from Nokia failed to revive the company, RIM found itself in all kind of mess following the recall of its PlayBook tablet.

However, Monday's announcement of Google's acquisition of Motorola Mobility made the stocks of the two companies jump - Nokia Corp. (NOK) jumped 14 percent to $6.13 while RIM (RIMM) surged nearly 8 percent to $26.53.

Why? There are 2 main reasons:

[1] Patents: Monday's deal made investors feel Nokia and RIM are worth more than what they believed because both are owners of large portfolio of technology patents.

One of the primary reasons Google bought Motorola Mobility was to get hold over the latter's 17,000-odd patents, a move that would help the search giant successfully defend itself against a barrage of patent lawsuits filed by Apple, Microsoft and other rivals that want to stomp on the company's Android operating system.

The mobile computing industry has become a hotbed of patent disputes and any company that buys RIM or Nokia can confidently flex its muscles.

[2] Market Value: Google bought Motorola Mobility for a stunning 63 percent premium and shocked the market because Motorola, though once a pioneer in the cellphone business, wasn't faring any better than RIM or Nokia in recent times.

And, now with Motorola in the bag, Nokia and RIM are ripe takeover targets but now they won't come cheap.

With both companies controlling a treasure trove of patents, if any company has eyes on either, it will need to dig deep into its pockets because both Nokia and RIM will now be eyeing a hefty premium. It means that in case of an acquisition bid, Nokia, whose market value is currently hovering around $23 billion, could be asking as much as $35 billion and RIM, which is currently valued around $14 billion, could be asking for as much as $20 billion.

However, the billion dollar question is - will anyone want to buy them?

Nokia, according to T. Michael Walkley, an analyst with Canaccord Genuity in Minneapolis, stands a good chance of being wooed because other developers of phones running on Google's Android OS may now be more eager to work with the Finnish company.

However, RIM may find it a tougher job if it plans on selling itself. The reason is because its reliance on its proprietary BlackBerry and QNX systems, instead of opening itself up to Android and Windows, has alienated it from consumers, despite its strong presence in the corporate market.

Of course, RIM may draw the attention of technology behemoths that have a strong presence in the corporate sector such as IBM and Cisco, but neither are currently interested in acquiring the smartphone maker.

Another prospective player in the market is Oracle, the database and software services giant which has already sued Google for alleged patent and copyright violations of its Java software in Google's development of Android.

Oracle has the cash muscle (the company's cash and securities exceeded $29 billion on May 31) and has a history of big acquisitions, including Sun, Siebel Systems and PeopleSoft. But will it buy RIM? It's too early to tell.

However, don't bank on RIM being acquired anytime soon despite Monday's nice price bump. The troubled BlackBerry smartphone maker has seen its market share drop significantly, it was recently forced to slash 2,000 jobs, and just last week Sprint announced it was dropping the PlayBook 4 G tablet.

Moreover, RIM would likely be much more expensive than Motorola if it were ever to be acquired and it's unlikely that any company would be willing to pay so much money.

© Copyright IBTimes 2024. All rights reserved.