How Microsoft Gains From Nokia Deal?

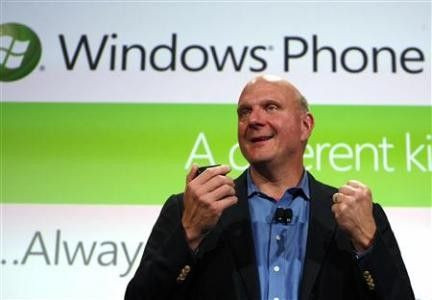

It is official. Nokia (NYSE: NOK) will be adopting Microsoft's Windows Phone 7 (NASDAQ: MSFT) as its new smartphone operating system (OS).

The deal is significant for the Redmond, Washington-based Microsoft, which is trying hard to capture smartphone market share from the likes of iOS and Android.

The near-term goal for Windows Phone 7 seems to be stabilization of recent market share losses for Windows, which over the past 5 years have fallen to range of 2.5 percent to 5 percent from more than 20 percent (source: Nielsen).

Jefferies analyst Katherine Egbert said Nokia as a channel for Windows phones makes a lot of sense for both parties, given Nokia's steep market share losses to Android and Apple and what has been described to her (not by Microsoft) as the Finnish giant's historic blindness to the value of mobile software and applications.

For Nokia, it is getting a decent OS for its smartphones. In return, a partner like Nokia could help bring Windows Phone to a larger range of price points, market segments and geographies.

Credit Suisse analysts said Nokia's move to Windows Phone 7 could significantly improve Microsoft's standing in the smartphone market, increasing the brokerage's unit share estimate from about 8 percent of overall smartphone shipments in fiscal year 2013 to about 23 percent share, which would help the platform attract more application developers.

The deal would also boost Microsoft's margins in the Entertainment & Devices (E&D) division and overall earnings growth, given that the OEM revenue would flow straight down to the bottom line, resulting in a 7 cents increase to the brokerage's current $3.29 earnings per share estimate for fiscal year 2013.

The deal is expected to increase Microsoft's E&D division revenues by $715 million, Credit Suisse analysts wrote.

Credit Suisse also sees Nokia to start ramping shipments of Windows Phone 7 smartphones in the September 2012 quarter and ship 89.4 million units in fiscal year 2013.

... we would view this outcome as an incremental positive in terms of sentiment given investor concerns regarding Microsoft's lack of traction in high growth markets (e.g., Internet search and mobile), Credit Suisse analysts said.

The analysts said the market, in the mid- to long-term, has not only meaningfully undervalued Microsoft's ability to expand operating margins for the next several years, but also the sustainable revenue growth and defensive competitive characteristics of Microsoft's dominant market positions with respect to its client operating system and office productivity suites.

Credit Suisse has an outperform rating and $36 price target on Microsoft stock.

© Copyright IBTimes 2024. All rights reserved.