Inside Biden's Budget: Taxing The Rich And Expanding Social Programs

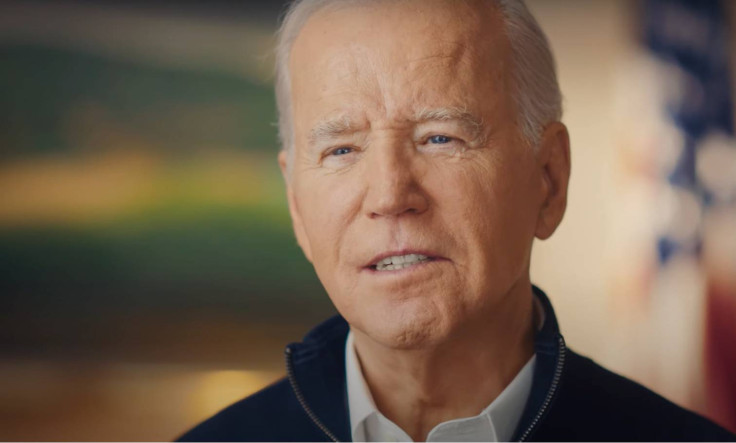

President Joe Biden's proposed budget plan for fiscal year 2025, set to be released Monday, reflects his administration's priorities and vision for the country's economic future. The plan, which aims to address various aspects of the economy, including tax reform, healthcare, and government spending, comes at a critical time as the nation navigates through economic challenges and political divisions.

One of the central elements of Biden's budget proposal is tax reform, particularly targeting billionaires and corporations. The plan seeks to reduce the federal deficit by $3 trillion over the next decade, primarily by imposing a minimum 25% tax rate on the unrealized income of the wealthiest households and reshaping the corporate tax code. Additionally, Biden aims to strengthen Medicare and Social Security by granting Medicare the authority to negotiate prices on prescription drugs and seeking savings in various sectors such as housing and health insurance.

The budget proposal also includes measures to support families, such as increasing the child tax credit and providing tax credits for homebuyers. Moreover, Biden plans to make permanent certain provisions of the Affordable Care Act and cap drug costs for all Americans, not just those with Medicare. These initiatives align with Biden's broader economic agenda, emphasizing fairness and support for working families.

However, Biden's budget faces significant challenges in Congress, where partisan divisions have stalled progress on key legislative priorities. With Republicans likely to oppose many of the proposed tax increases and spending initiatives, the budget's passage is uncertain. Moreover, the ongoing negotiations over the current fiscal year's budget further complicate the process, highlighting the political gridlock that has characterized Washington in recent years.

Despite these obstacles, Biden sees his budget proposal as an opportunity to shape the narrative of the upcoming election cycle. By presenting a clear vision for the country's economic future, Biden aims to contrast his approach with that of his potential opponent, former President Donald Trump. Biden's focus on tax fairness and support for middle-class families reflects his commitment to addressing economic inequality and promoting economic growth that benefits all Americans.

"Republicans will cut Social Security and give more tax cuts to the wealthy," Biden stated at his State of the Union address Thursday. "I will protect and strengthen Social Security and make the wealthy pay their fair share!"

Last week, President Biden declared a "Strike Force on Unfair and Illegal Pricing," a collaborative initiative led by both the Federal Trade Commission and the Department of Justice. The objective of this task force is to exert pressure on companies to reduce prices deemed unfair or illegal.

Meanwhile, Trump has signaled his own economic priorities, including calls for increased tariffs and tax cuts, as well as efforts to reduce government regulations. "I think taxes could be cut, I think other things could happen to more than adjust that. But I'm a big believer in tariffs," Trump noted, saying they help American industries when they are "being taken advantage of" by China and other nations.

When asked about Medicare, Social Security and Medicare programs and the nation's spending and deficits, Trump said, "There is a lot you can do in terms of entitlements in terms of cutting and in terms of also the theft and the bad management."

The contrasting visions of Biden and Trump underscore the broader ideological divide in American politics and the challenges facing policymakers as they seek to address complex economic issues. With the 2024 election looming, the debate over economic policy is likely to intensify, shaping the political landscape for years to come.

© Copyright IBTimes 2024. All rights reserved.