Intel To Invest $1.5B For 20% Stake In Two Chinese Chipmakers

Intel will invest up to $1.5 billion to buy a 20 percent stake in two low-cost mobile chipmakers, which have ties to the Chinese government, the company announced Thursday. The move is considered to be the Santa Clara, California-based company’s attempt to catch up with industry leaders like Qualcomm.

According to Intel, the company will buy the stake in Spreadtrum Communications and RDA Microelectronics through a deal with Tsinghua Unigroup, a state-owned private equity firm, which owns the two Chinese chip manufacturers. Intel, which has struggled to get a stronger foothold in the smartphone and tablet market, is expected to benefit from the deal by gaining a foothold in the Chinese mobile chip industry, Reuters reported.

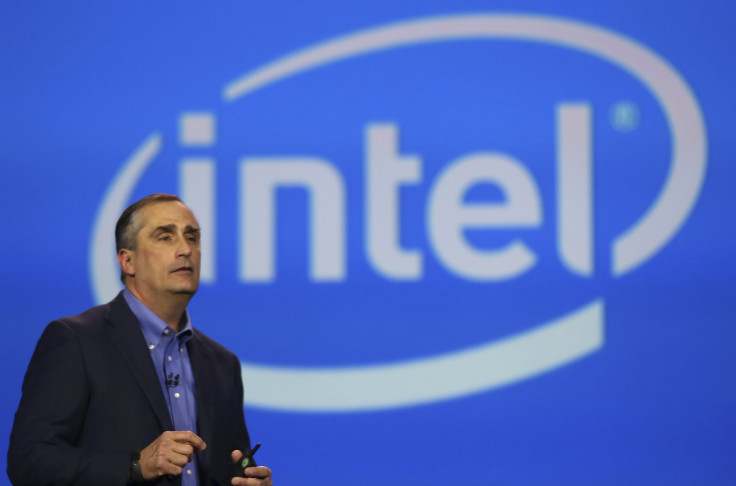

“China is now the largest consumption market for smartphones and has the largest number of internet users in the world,” Brian Krzanich, Intel’s CEO, said in a statement, adding that the partnership will help the company cater to “a wider range of mobile customers in China and the rest of the world.”

Under the terms of the agreement, Spreadtrum and RDA will jointly create and sell a family of Intel Architecture-based chips, while initial products will be available late next year. The deal is yet to get government approval, according to Unigroup.

“It has become a national priority of China to grow its semiconductor industry,” Tsinghua Unigroup Chairman Zhao Weiguo said in the statement. “The strategic collaboration between Tsinghua Unigroup and Intel ranges from design and development to marketing and equity investments, which demonstrate Intel's confidence in the Chinese market and strong commitment to Chinese semiconductor industry.”

After Krzanich took over as Intel’s CEO last year, the company made several deals in an effort to strengthen its presence in the smartphone and tablets space.

“Intel's new CEO has proven to be willing to take on new partnerships and approach new business opportunities that stray from prior conventions,” Suji Da Silva, an analyst at Topeka Capital Markets, tol Reuters. “They should do as much of this as they need to be in markets that are important to them.”

© Copyright IBTimes 2024. All rights reserved.