It Is Becoming Easier To Cancel Those Unwanted Subscriptions; Here's How

The government modified existing policy after it received 16,000 comments on the difficulty of canceling.

Consumers no longer have to deal with the hassle of jumping through endless hoops just to cancel a subscription or membership.

Now, thanks to a new federal regulation, businesses must provide shoppers with a clear and simple option to cancel.

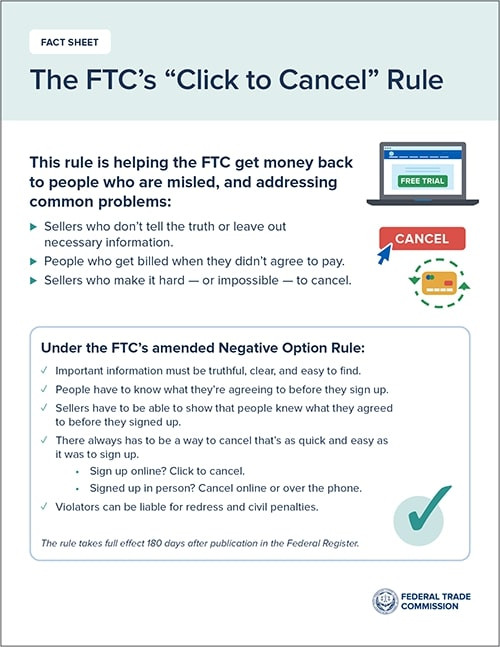

The Federal Trade Commission (FTC) on Wednesday unveiled its "click-to-cancel" rule, which will make it easier for shoppers to end recurring subscriptions and memberships.

"The FTC's rule will end these tricks and traps, saving Americans time and money," Commission Chair Lina M. Khan said. "Nobody should be stuck paying for a service they no longer want."

The rule tackles a few common issues that have risen in the age of the Internet when it comes to ending a subscription or membership online.

Consumers complained to the FTC about businesses that aren't truthful about the duration of their advertised membership or subscription. They also complained of being billed when they didn't agree to pay, and sellers who made it impossible to cancel an agreement.

Now, a change has come. As of March 2023, the FTC has been reviewing its 1973 Negative Option Rule so it can be applicable to modern times.

Under the FTC's amended Negative Option Rule, sellers must post important information clearly and easily. Consumers have to know what they're agreeing to before they sign up and sellers can no longer pull a bait-and-switch, meaning they must be able to show that people knew what they agreed to before signing up.

The 1973 Negative Option Rule is coined from the term negative option billing, a business practice where customers are given goods or services that were not previously ordered. When a customer attempts to cancel it, they have two options -- either paying to continue the service or declining it at the end of the billing cycle.

The FTC chose to add these new modifications after they received 16,000 comments stemming from consumers, federal and state agencies, and trade associations after they announced a notice of the proposed rule.

Aside from helping put money back into the pockets of shoppers, the rule provides a legal framework for individuals who violate it to be subjected to civil penalties.

The rule will go into effect 180 days after it is published in the Federal Register.

© Copyright IBTimes 2024. All rights reserved.