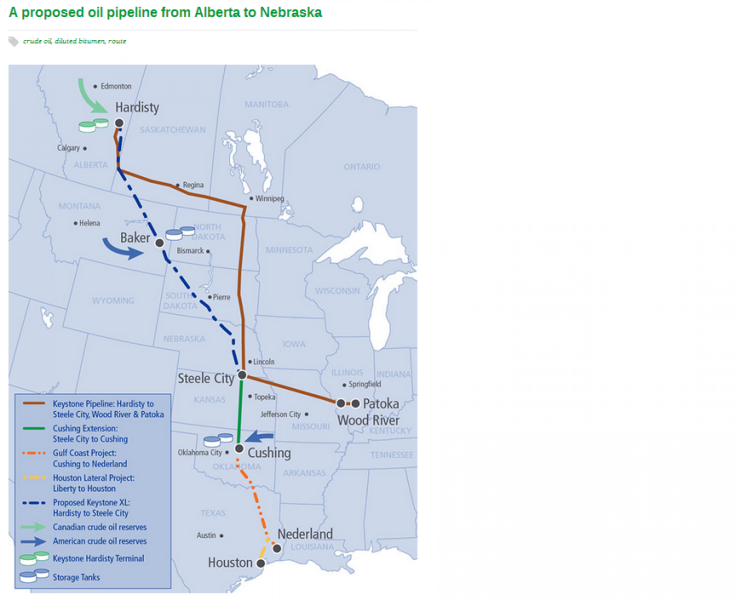

Keystone XL Pipeline: As The Political And Environmental Debate Continues, Economic Reality Will Somehow Get Canadian Crude To US [Photos] [Video] [Map]

The debate between opponents and proponents over whether to approve the controversial Keystone XL pipeline project that would bring Alberta oil sands down to U.S. Gulf Coast refiners, may have been overblown, as market forces will determine the fate of how western Canadian crude gets out, an energy expert told International Business Times Friday.

“Whether Keystone is approved or not, the market has forced people to look at other options,” Katherine Spector, head of commodities strategy at CIBC World Markets, told IBTimes.

The $5.4 billion project is intended to transport two types of crude oil from Alberta, North Dakota and Montana through the nation’s pipeline hub in Cushing, Okla. Many refineries in the U.S. Midwest and in Canada are at capacity, so oil producers are looking to refineries in the South for production.

Pipeline opponents say extracting crude oil from Alberta, known as tar sands, is extremely energy-intensive and will affect climate change, because it requires breaking down a semi-solid form of petroleum so it can flow through a pipeline, something that is not necessary for normal crude oil.

Proponents, on the other hand, say the benefits of the pipeline outweigh the environmental risks because this will reduce America's dependence on oil from hostile, unstable countries in the Middle East and elsewhere.

Spector believes that the Keystone debate has been “painted as a single variable, a be-all, end-all,” especially by environmental groups.

There are those who believe that if Keystone is not built, oil-sand production will stop and sit in Alberta, which is not the case, Spector said.

Spector believes Canadian crude is going to get out one way or the other, because of the current $42 spread between western Canadian select oil and WTI, the U.S. oil benchmark. “If you have that big of a price spread, people are going to get creative,” she said.

Speaking Friday at Columbia University’s ninth annual energy symposium, "Future Now: Energy Progress in the 21st Century," Spector said that rail is just one example of energy producers getting creative.

Moving crude oil on rail is appealing, as it is not tied to a single shipment line for 15 to 20 years, like pipelines, she said.

“With that kind of price differential, there are always other options; it might take a while, it might not be convenient, but you know, there are other options and I think we are seeing examples of that in rail.”

President Barack Obama some time ago delegated the State Department to determine whether the project is in the U.S. national interest, but a recent investigation by the inspector general of the State Department, as well as the government shutdown, have delayed any decisions being taken. It is expected that Obama will announce a decision after February.

© Copyright IBTimes 2024. All rights reserved.