Lebanon's Economic Collapse: What Happened?

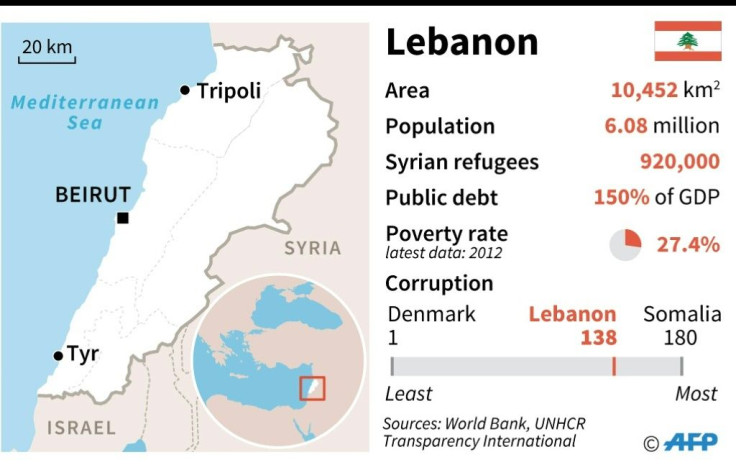

Protest-hit Lebanon has approved an economic rescue plan and requested aid from the International Monetary Fund as it battles its worst financial crisis in decades.

But how did Lebanon become one of the most indebted countries in the world? What's the plan out of this quagmire, and how likely is it to work?

After the 1975-1990 civil war, Lebanon set about rebuilding, launching itself on a path of endless borrowing and ballooning debt.

Successive governments focused on developing an economy built around services and tourism, and fuelled by foreign investment, all dependent on stability.

But they neglected structural reforms, as a political class deeply divided along sectarian lines allowed cronyism and graft.

"The economic crisis is, at its core, a governance crisis emanating from a dysfunctional sectarian system that hindered rational policymaking and permitted a culture of corruption and waste," experts wrote in a January report published by Carnegie Middle East.

Over the years, Lebanon was also rocked by a wave of assassinations, the 2006 war with Israel and then a series of attacks after war broke out in Syria in 2011.

Repeated political deadlocks stalled decision-making, with lawmakers on one occasion failing to elect a new president for more than two years.

The debt grew as spending increased, including to subsidise a loss-making electricity sector dependent on fuel imports and to pay high interest rates on the loans themselves.

The balance of payments deficit also deepened as growth slowed, while an oversized banking sector offered huge interests on deposits.

By late 2019, Lebanon had racked up a debt equivalent to 170 percent of its GDP.

The pound has plummeted from 1,507 to more than 4,000 Lebanese pounds to the dollar on the parallel market in recent weeks, and inflation has soared.

Banks imposed crippling capital controls in the autumn, while deteriorating living conditions sparked mass cross-sectarian protests.

An economic reform plan the cabinet approved on April 30 aims to unlock foreign aid, restructure the debt, and cut back on spending including in the electricity sector.

Lebanon aims to drum up $10 billion in financial support, on top of $11 billion in grants and loans pledged by international donors in 2018.

But the five-year austerity plan includes measures likely to be unpopular such as a freeze on recruitment in the public sector.

It has also been calculated according to an exchange rate of 3,500 pounds to the dollar.

Nasser Yassin, associate professor of policy and planning at the American University in Beirut, said the plan was a good "diagnosis" of the situation but not complete.

"It's an attempt to solve this thorny crisis through financial and accounting tools to obtain foreign aid through the IMF, yet it imposes harsh conditions when it comes to social benefits and austerity measures," he said.

"The poorest levels of society and the middle class are the ones who will pay the price, with high inflation and the contraction of the economy expected."

Up to 45 percent of Lebanon's population already lives in poverty, official estimates show.

Yassin said such a plan to "redesign the state's financial management" could have benefitted from more consultations on how to break away from the old model of a free-market economy to attract foreign capital.

Its implementation is expected to run up against the interests of political parties in the public sector, he added.

Mohammad Faour, a research fellow in banking and finance at University College Dublin, agreed much depended on "how cooperative the political class will be in enacting them in parliament".

"There's always this worry that political bickering will get in the way," he said.

MPs will need to approve many parts of the plan, including accepting foreign aid, restructuring the debt, and imposing new taxes.

President Michel Aoun has invited the leaders of all parliamentary blocs to discuss the plan Wednesday.

The government, formed in January after protests ousted its predecessor, does not enjoy huge popular support.

But it is backed by key political forces including Shiite movement Hezbollah, which has seats in parliament despite the United States -- and now Germany -- labelling it as "terrorist".

"It will be a hard slog, but Lebanon can get back on its feet with a solid reform plan that is front-loaded with international support," Faour said.

"But the main concern is whether internal politics will permit the implementation of a credible plan."

© Copyright AFP 2024. All rights reserved.