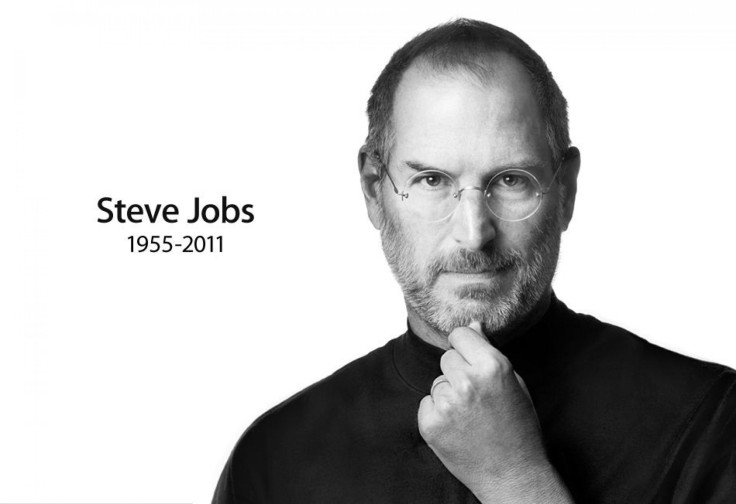

Legacy of Master Innovator Steve Jobs Leaves Apple in Excellent Position

The co-founder and former Chief Executive Officer (CEO) of tech giant Apple Inc., Steven Paul Jobs, died on Wednesday, of a rare form of pancreatic cancer and related health complications.

We are saddened by the passing of Steve Jobs, who has proven to be a technology icon, making technology products that were desirable and easy to use. However, we believe this was widely anticipated and even indicated as much in the past few months. The legacy of Steve Jobs and supply chain capabilities of Tim Cook leave(s) Apple in excellent position, said Scott Sutherland, an analyst at Wedbush Securities.

After founding Apple in 1976, Jobs returned to Apple in 1997 to invigorate the Macintosh product line. Jobs followed that up with the highly successful iPod, the iPhone and the iPad and Sutherland expects Apple TV to follow suit.

At the same time, iTunes and the Apple store came to dominate the online music and mobile application markets. This year, Apple is seeing the realization of iCloud linked to an array of connected devices.

Sutherland believes Jobs was a visionary who made products fun and easy to use, which will be tough to replace. He believes Apple still has a strong pipeline of products tied to the iCloud, which he believes was driven by Jobs. That said, with more products expected and the stickiness of the iCloud solution, he believes Apple is in a good position.

The Wedbush analyst noted the recent and expected launches of Lion OS X, 2 new iPods, the iPhone 4S, iOS 5 and the iCloud. Next year, he expects the 4G iPhone 5 and the iPad 3, along with success in the connected TV market.

Furthermore, Sutherland believes no other ecosystem comes close to the ease of use as Apple's, which will continue to appeal to a large percentage of the masses. With only 228 operators distributing the iPhone and only 68 countries for the iPad, he believes there remains tremendous global expansion opportunities for Apple.

In comparison, Sutherland believes RIM and Nokia distribute through about 600 operators. He believes Cook’s logistics capability will be key as Apple expands globally, furthering the company's strong growth trajectory for years to come.

While there could be some negative near-term knee jerk reaction to this unfortunate news, Sutherland believes the pieces are in place for Apple to greatly exceed expectations for the next couple of years, if not more. He, thus, believes investors should take advantage of any weakness.

As an example, Sutherland highlighted the intra-day decline when Jobs stepped down as CEO, only to see Apple shares finish up slightly for the day. Similarly, while unfortunate, he believes this was widely expected and takes another uncertainty out of the stock.

We believe Apple has solid momentum, a sticky ecosystem, and robust product pipeline to continue to deliver well above consensus results. That said, we believe any weakness should be viewed as a buying opportunity, said Sutherland.

The brokerage reiterated its outperform rating on shares of Apple with a price target of $530.

© Copyright IBTimes 2024. All rights reserved.